NetFlix 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

amortization period is extended by a year. Current estimates of viewing patterns indicate that viewing in the first

few months is significantly higher, relative to the remaining amortization period, than previously estimated. As a

result, in the third quarter of 2013, the Company began amortizing this type of content on an accelerated basis over

the amortization period. The effect of this change in estimate was an $18.9 million decrease in contribution profit

for the Domestic streaming segment and a $6.1 million increase in contribution loss for the International streaming

segment for the year ended December 31, 2013. The effect of this change in estimate was a decrease in operating

income and net income of $25.0 million and $15.4 million, respectively for the year ended December 31, 2013. The

effect to basic earnings per share and diluted earnings per share was a decrease of $0.27 and $0.25, respectively, for

the year ended December 31, 2013. The effect of this change in estimate relates primarily to titles that first

premiered on Netflix in the first and second quarters of 2013.

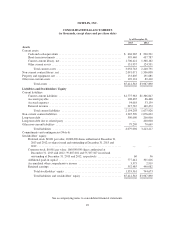

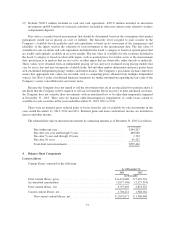

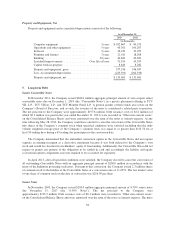

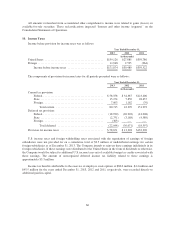

3. Short-term Investments

The Company’s investment policy is consistent with the definition of available-for-sale securities. The

Company does not buy and hold securities principally for the purpose of selling them in the near future. The

Company’s policy is focused on the preservation of capital, liquidity and return. From time to time, the Company

may sell certain securities but the objectives are generally not to generate profits on short-term differences in

price. The following tables summarize, by major security type, the Company’s assets that are measured at fair

value on a recurring basis and are categorized using the fair value hierarchy.

December 31, 2013

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

(in thousands)

Cash .................................. $ 483,959 $ — $ — $ 483,959

Level 1 securities:

Money market funds ................. 126,208 — — 126,208

Level 2 securities:

Corporate debt securities .............. 316,465 1,245 (654) 317,056

Government securities ................ 143,812 287 (18) 144,081

Asset and mortgage-backed securities . . . 93,118 229 (418) 92,929

Certificate of deposits ................ 23,425 — — 23,425

Agency securities ................... 17,951 — (2) 17,949

Total (1) ............................... $1,204,938 $1,761 $(1,092) $1,205,607

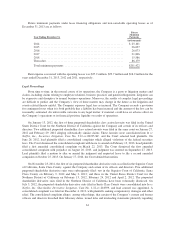

December 31, 2012

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

(in thousands)

Cash .................................. $ 284,661 $ — $ — $ 284,661

Level 1 securities:

Money market funds ................. 10,500 — — 10,500

Level 2 securities:

Corporate debt securities .............. 150,322 1,605 (32) 151,895

Government securities ................ 166,643 285 — 166,928

Asset and mortgage-backed securities . . . 138,340 750 (125) 138,965

Total (2) ............................... $ 750,466 $2,640 $ (157) $ 752,949

(1) Includes $605.0 million that is included in cash and cash equivalents, $595.4 million included in short-term

investments and $5.2 million of restricted cash that is included in other non-current assets related to workers

compensation deposits.

56