NetFlix 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$261.7 million, which consisted primarily of $199.9 million of proceeds from the public offering of common

stock and $198.1 million of proceeds from the issuance of debt. These proceeds were offset by $199.7 million of

stock repurchases.

Free cash flow was $39.6 million lower than net income for the year ended December 31, 2011 primarily

due to $147.7 million of content cash payments over expense partially offset by $61.6 million non-cash stock-

based compensation expense and $46.5 million favorable other working capital differences.

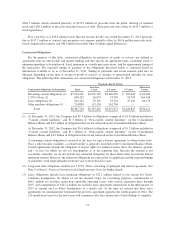

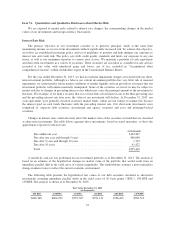

Contractual Obligations

For the purpose of this table, contractual obligations for purchases of goods or services are defined as

agreements that are enforceable and legally binding and that specify all significant terms, including: fixed or

minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate timing of

the transaction. The expected timing of payment of the obligations discussed below is estimated based on

information available to us as of December 31, 2013. Timing of payments and actual amounts paid may be

different depending on the time of receipt of goods or services or changes to agreed-upon amounts for some

obligations. The following table summarizes our contractual obligations at December 31, 2013:

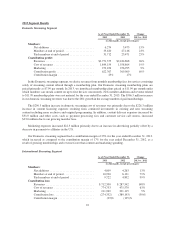

Payments due by Period

Contractual obligations (in thousands): Total

Less than

1 year 1-3 years 3-5 years

More than

5 years

Streaming content obligations (1) $7,252,161 $2,972,325 $3,266,907 $ 929,645 $ 83,284

5.375% Notes (2) ............ 699,323 26,875 53,750 53,750 564,948

Lease obligations (3) ......... 201,422 25,101 52,710 37,432 86,179

Other purchase obligations (4) . . 214,838 113,134 101,704 — —

Total .................. $8,367,744 $3,137,435 $3,475,071 $1,020,827 $734,411

(1) At December 31, 2013, the Company had $7.3 billion of obligations comprised of $1.8 billion included in

“Current content liabilities” and $1.3 billion of “Non-current content liabilities” on the Consolidated

Balance Sheets and $4.2 billion of obligations that are not reflected on the Consolidated Balance Sheet.

At December 31, 2012, the Company had $5.6 billion of obligations comprised of $1.3 billion included in

“Current content liabilities” and $1.1 billion of “Non-current content liabilities” on the Consolidated

Balance Sheets and $3.2 billion of obligations that are not reflected on the Consolidated Balance Sheet.

A streaming content obligation is incurred at the time we sign a license agreement to obtain future titles.

Once a title becomes available, a content liability is generally recorded on the Consolidated Balance Sheet.

Certain agreements include the obligation to license rights for unknown future titles, the ultimate quantity

and / or fees for which are not yet determinable as of the reporting date. Because the amount is not

reasonably estimable, we do not include any estimated obligation for these future titles beyond the known

minimum amount. However, the unknown obligations are expected to be significant and the expected timing

of payments could range primarily from one year to more than five years.

(2) Long-term debt obligations include our 5.375% Notes consisting of principal and interest payments. See

Note 5 of Item 8, Financial Statements and Supplementary Data for further details.

(3) Lease obligations include lease financing obligations of $12.1 million related to our current Los Gatos,

California headquarters for which we are the deemed owner for accounting purposes, commitments of

$68.1 million for facilities under non-cancelable operating leases with various expiration dates through

2019, and commitments of $121.2 million for facilities lease agreements entered into in the third quarter of

2013 to expand our Los Gatos headquarters to a nearby site. At the time we entered into these lease

agreements we simultaneously terminated the previous agreement signed in the fourth quarter of 2012. The

124 month lease terms for the new leases will commence after the construction of the buildings is complete.

31