NetFlix 2013 Annual Report Download - page 62

Download and view the complete annual report

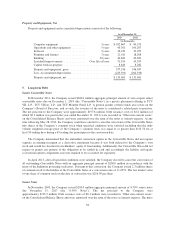

Please find page 62 of the 2013 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.A streaming content obligation is incurred at the time the Company signs a license agreement to obtain

future titles. Once a title becomes available, a content liability is generally recorded on the Consolidated Balance

Sheet. Certain agreements include the obligation to license rights for unknown future titles, the ultimate quantity

and / or fees for which are not yet determinable as of the reporting date. Because the amount is not reasonably

estimable, the Company does not include any estimated obligation for these future titles beyond the known

minimum amount. However, the unknown obligations are expected to be significant and the expected timing of

payments could range from less than one year to more than five years.

The Company has entered into certain licenses with performing rights organizations (“PROs”), and is

currently involved in negotiations with other PROs, that hold certain rights to music and other entertainment

works “publicly performed” in connection with streaming content into various territories. Accruals for estimated

royalties are recorded and then adjusted based on any changes in estimates. These amounts are included in the

streaming content obligations. The results of these negotiations are uncertain and may be materially different

from management’s estimates.

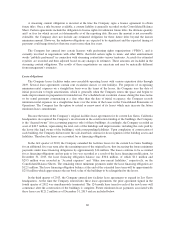

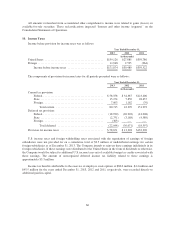

Lease obligations

The Company leases facilities under non-cancelable operating leases with various expiration dates through

2019. Several lease agreements contain rent escalation clauses or rent holidays. For purposes of recognizing

minimum rental expenses on a straight-line basis over the terms of the leases, the Company uses the date of

initial possession to begin amortization, which is generally when the Company enters the space and begins to

make improvements in preparation for intended use. For scheduled rent escalation clauses during the lease terms

or for rental payments commencing at a date other than the date of initial occupancy, the Company records

minimum rental expenses on a straight-line basis over the terms of the leases in the Consolidated Statements of

Operations. The Company has the option to extend or renew most of its leases which may increase the future

minimum lease commitments.

Because the terms of the Company’s original facilities lease agreements for its current Los Gatos, California

headquarters site required the Company’s involvement in the construction funding of the buildings, the Company

is the “deemed owner” (for accounting purposes only) of these buildings. Accordingly, the Company recorded an

asset of $40.7 million, representing the total costs of the buildings and improvements, including the costs paid by

the lessor (the legal owner of the buildings), with corresponding liabilities. Upon completion of construction of

each building, the Company did not meet the sale-leaseback criteria for de-recognition of the building assets and

liabilities. Therefore the leases are accounted for as financing obligations.

In the first quarter of 2010, the Company extended the facilities leases for the current Los Gatos buildings

for an additional five year term after the remaining term of the original lease, thus increasing the future minimum

payments under lease financing obligations by approximately $14 million. The leases continue to be accounted

for as financing obligations and no gain or loss was recorded as a result of the lease financing modification. At

December 31, 2013, the lease financing obligation balance was $30.6 million, of which $1.1 million and

$29.5 million were recorded in “Accrued expenses” and “Other non-current liabilities,” respectively, on the

Consolidated Balance Sheets. The remaining future minimum payments under the lease financing obligation are

$12.1 million. The lease financing obligation balance at the end of the extended lease term will be approximately

$25.8 million which approximates the net book value of the buildings to be relinquished to the lessor.

In the third quarter of 2013, the Company entered into facilities lease agreements to expand its Los Gatos

headquarters. At the time the Company entered into these lease agreements, the prior agreement signed in the

fourth quarter of 2012 was simultaneously terminated. The 124 month lease term for each of the new leases will

commence after the construction of the buildings is complete. Future minimum lease payments associated with

these leases are $121.2 million as of December 31, 2013 and are included below.

60