NetFlix 2013 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2013 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

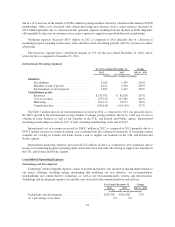

In the International streaming segment, we derive revenues from monthly membership fees for services

consisting solely of streaming content offered through a membership plan priced at the equivalent of USD $7 to

$14 per month. We launched our streaming service in Canada in September 2010 and have continuously

expanded our services internationally with launches in Latin America in September 2011, the U.K. and Ireland in

January 2012, Finland, Denmark, Sweden and Norway in October 2012 and most recently the Netherlands in

September 2013. We plan to continue to expand our services internationally and expect a substantial European

expansion in 2014.

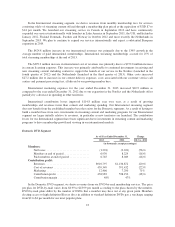

The $424.8 million increase in our international revenues was primarily due to the 134% growth in the

average number of paid international memberships. International streaming memberships account for 25% of

total streaming memberships at the end of 2013.

The $299.2 million increase in international cost of revenues was primarily due to a $272.0 million increase

in content licensing expenses. This increase was primarily attributable to continued investments in existing and

new streaming content including content to support the launch of our service in the Nordics (launched in the

fourth quarter of 2012) and the Netherlands (launched in the third quarter of 2013). Other costs increased

$27.2 million due to increases in our content delivery expenses, costs associated with our customer service call

centers and payment processing fees, all driven by our growing member base.

International marketing expenses for the year ended December 31, 2013 increased $10.9 million as

compared to the year ended December 31, 2012 due to our expansion in the Nordics and the Netherlands offset

partially by a decrease in spending in other territories.

International contribution losses improved $114.8 million year over year, as a result of growing

memberships and revenues faster than content and marketing spending. Our International streaming segment

does not benefit from the established member base that exists for the Domestic segments. As a result of having to

build a member base from zero, investments in streaming content and marketing programs for our International

segment are larger initially relative to revenues, in particular as new territories are launched. The contribution

losses for our International segment have been significant due to investments in streaming content and marketing

programs to drive membership growth and viewing in our international markets.

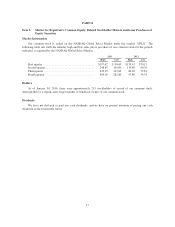

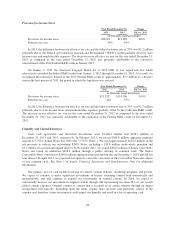

Domestic DVD Segment

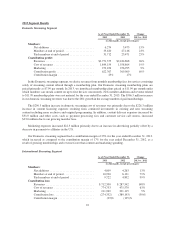

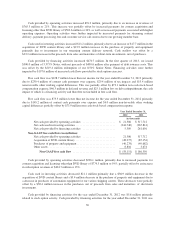

As of /Year Ended December 31, Change

2013 2012 2013 vs. 2012

(in thousands, except percentages)

Members:

Net losses .............................. (1,294) (2,941) (56)%

Members at end of period .................. 6,930 8,224 (16)%

Paid members at end of period .............. 6,765 8,049 (16)%

Contribution profit:

Revenues ............................... $910,797 $1,136,872 (20)%

Cost of revenues ......................... 459,349 591,432 (22)%

Marketing .............................. 12,466 7,290 71%

Contribution profit ....................... 438,982 538,150 (18)%

Contribution margin ...................... 48% 47%

In the Domestic DVD segment, we derive revenues from our DVD-by-mail membership services. The price

per plan for DVD-by-mail varies from $4.99 to $43.99 per month according to the plan chosen by the member.

DVD-by-mail plans differ by the number of DVDs that a member may have out at any given point. Members

electing access to high definition Blu-ray discs in addition to standard definition DVDs pay a surcharge ranging

from $2 to $4 per month for our most popular plans.

23