NetFlix 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

not the tax position will be sustained on examination by the taxing authorities, based on the technical merits of

the position. The tax benefits recognized in the financial statements from such positions are then measured based

on the largest benefit that has a greater than 50% likelihood of being realized upon settlement. The Company

recognizes interest and penalties related to uncertain tax positions in income tax expense. See Note 10 to the

consolidated financial statements for further information regarding income taxes.

Foreign Currency

The Company translates the assets and liabilities of its non-U.S. dollar functional currency subsidiaries into

U.S. dollars using exchange rates in effect at the end of each period. Revenues and expenses for these

subsidiaries are translated using rates that approximate those in effect during the period. Gains and losses from

these translations are recognized in cumulative translation adjustment included in “Accumulated other

comprehensive income” in stockholders’ equity on the Consolidated Balance Sheets.

The Company remeasures monetary assets and liabilities that are not denominated in the functional currency

at exchange rates in effect at the end of each period. Gains and losses from these remeasurements are recognized

in interest and other income (expense). Foreign currency transactions resulted in losses of $8.4 million and

$4.0 million for the years ended December 31, 2013 and 2012, respectively. The gains (losses) from foreign

currency transactions were immaterial for the year ended December 31, 2011.

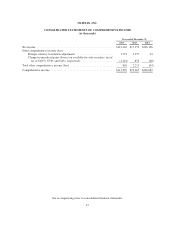

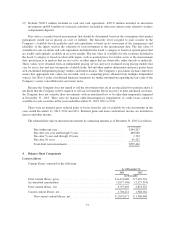

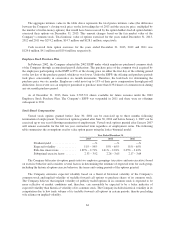

Earnings Per Share

Basic earnings per share is computed using the weighted-average number of outstanding shares of common

stock during the period. Diluted earnings per share is computed using the weighted-average number of

outstanding shares of common stock and, when dilutive, potential common shares outstanding during the period.

Potential common shares consist of shares issuable upon the assumed conversion of the Company’s Convertible

Notes (prior to the conversion of such notes) and incremental shares issuable upon the assumed exercise of stock

options. The computation of earnings per share is as follows:

Year ended December 31,

2013 2012 2011

(in thousands, except per share data)

Basic earnings per share:

Net income ....................................... $112,403 $17,152 $226,126

Shares used in computation: ..........................

Weighted-average common shares outstanding ....... 58,198 55,521 52,847

Basic earnings per share ............................. $ 1.93 $ 0.31 $ 4.28

Diluted earnings per share:

Net income ....................................... $112,403 $17,152 $226,126

Convertible Notes interest expense, net of tax ............ 49 195 17

Numerator for diluted earnings per share ................ 112,452 17,347 226,143

Shares used in computation:

Weighted-average common shares outstanding ....... 58,198 55,521 52,847

Convertible Notes shares ........................ 715 2,331 217

Employee stock options ......................... 1,848 1,052 1,305

Weighted-average number of shares ............... 60,761 58,904 54,369

Diluted earnings per share ............................... $ 1.85 $ 0.29 $ 4.16

54