NetFlix 2013 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2013 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

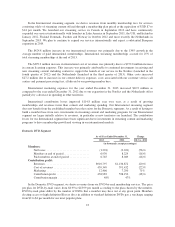

Other Data:

As of / Year Ended December 31,

2013 2012 2011 2010 2009

(in thousands)

Net consolidated streaming member additions during

period ...................................... 11,083 9,738 — — —

Total consolidated streaming members .............. 44,350 33,267 23,529 — —

Prior to certain changes to our pricing and plan structure in 2011, we did not separately track streaming

memberships.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

We are the world’s leading Internet television network with more than 44 million streaming members in

over 40 countries enjoying more than one billion hours of TV shows and movies per month, including original

series. Our members can watch as much as they want, anytime, anywhere, on nearly any Internet-connected

screen. Members can play, pause and resume watching, all without commercials or commitments. Additionally,

in the United States (“U.S.”), our members can receive DVDs delivered quickly to their homes.

We are a pioneer in the Internet delivery of TV shows and movies, launching our streaming service in 2007.

Since this launch, we have developed an ecosystem for Internet-connected devices and have licensed increasing

amounts of content that enable consumers to enjoy TV shows and movies directly on their TVs, computers and

mobile devices. As a result of these efforts, we have experienced growing consumer acceptance of and interest in

the delivery of TV shows and movies directly over the Internet. Historically, our acquisition of new members has

been seasonal with the first and fourth quarters representing our strongest net member additions and our second

quarter representing the lowest net member additions in a calendar year.

Our core strategy is to grow our streaming subscription business domestically and internationally. We are

continuously improving our members’ experience—expanding our streaming content, with a focus on

programming an overall mix of content that delights our customers, enhancing our user interface and extending

our streaming service to even more Internet-connected devices while staying within the parameters of our

consolidated net income (loss) and operating segment contribution profit (loss) targets.

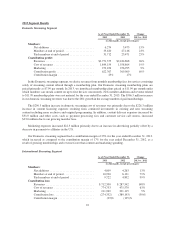

Results of Operations

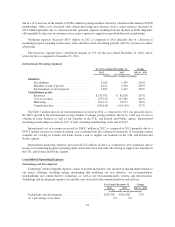

The following represents our consolidated performance highlights:

Year Ended December 31, Change

2013 2012 2011 2013 vs. 2012 2012 vs. 2011

(in thousands)

Revenues ............................ $4,374,562 $3,609,282 $3,204,577 21% 13%

Operating income ..................... 228,347 49,992 376,068 357% (87)%

Net income .......................... 112,403 17,152 226,126 555% (92)%

Free cash flow (1) ..................... (16,300) (58,151) 186,550 72% NM

(1) See “Liquidity and Capital Resources” for a definition of “free cash flow” and a reconciliation of “free cash

flow” to “net cash provided by operating activities.”

Consolidated revenues for 2013 increased as compared to prior years due to growth in international and

domestic streaming memberships. Operating income and net income increased as compared to prior year by

$178.4 million and $95.3 million, respectively, due to the increase in revenue, partially offset by an increase in

the cost of revenues due to continued investments in existing and new streaming content.

20