NetFlix 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

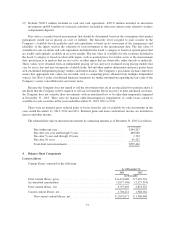

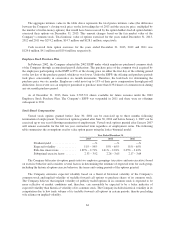

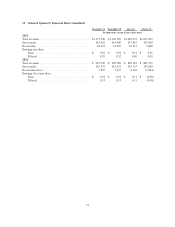

A reconciliation of the provision for income taxes, with the amount computed by applying the statutory

federal income tax rate to income before income taxes is as follows:

Year Ended December 31,

2013 2012 2011

(in thousands)

Expected tax expense at U.S. federal statutory rate of 35% ...... $59,878 $10,667 $125,833

State income taxes, net of Federal income tax effect ........... 8,053 2,914 15,042

R&D tax credit ........................................ (13,841) (1,803) (8,365)

Other ................................................ 4,581 1,550 886

Provision for income taxes ............................... $58,671 $13,328 $133,396

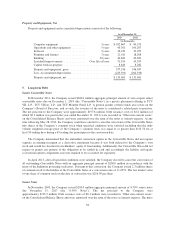

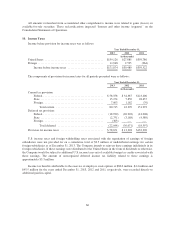

The components of deferred tax assets and liabilities were as follows:

As of December 31,

2013 2012

(in thousands)

Deferred tax assets (liabilities):

Stock-based compensation ............................. $69,201 $ 66,827

Accruals and reserves ................................. 13,022 11,155

Depreciation and amortization .......................... (11,159) (18,356)

R&D credits ........................................ 19,196 8,480

Other .............................................. 824 (244)

Total deferred tax assets ................................... 91,084 67,862

Valuation allowance .................................. (481) —

Net deferred tax assets .................................... $90,603 $ 67,862

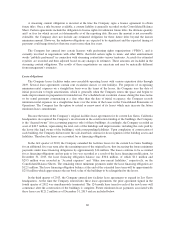

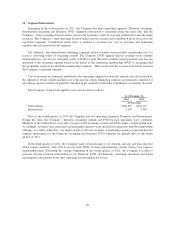

Deferred tax assets include $21.5 million and $11.0 million classified as “Other current assets” and $69.1

million and $56.9 million classified as “Other non-current assets” in the Consolidated Balance Sheets as of

December 31, 2013 and 2012, respectively. In evaluating its ability to realize the net deferred tax assets, the

Company considered all available positive and negative evidence, including its past operating results and the

forecast of future market growth, forecasted earnings, future taxable income, and prudent and feasible tax

planning strategies. As of December 31, 2013 and 2012, it was considered more likely than not that substantially

all deferred tax assets would be realized, and no significant valuation allowance was recorded.

As of December 31, 2013, our federal R&D tax credit and state tax credit carryforwards for tax return

purposes were $16.3 million and $29.7 million, respectively. The federal R&D tax credit carryforwards expire in

2033. State tax credit carryforwards of $0.9 million expire in 2023 and the remaining tax credit carryforwards of

$28.8 million can be carried forward indefinitely.

On January 2, 2013, the American Taxpayer Relief Act of 2012 (H.R. 8) was signed into law which

retroactively extends the Federal research and development credit from January 1, 2012 through December 31,

2013. As a result, the Company recognized the retroactive benefit of the Federal research and development credit

of approximately $3.1 million as a discrete item in the first quarter of 2013, the period in which the legislation

was enacted.

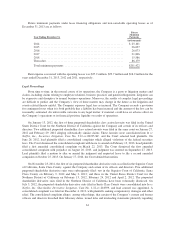

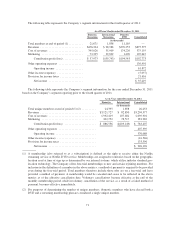

The Company classifies unrecognized tax benefits that are not expected to result in payment or receipt of

cash within one year as “Other non-current liabilities” in the Consolidated Balance Sheets. As of December 31,

2013, the total amount of gross unrecognized tax benefits was $68.2 million, of which $57.0 million, if

67