MasterCard 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7

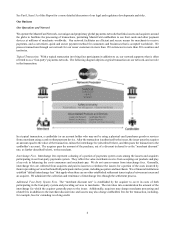

Our Network Architecture and Information Security. The MasterCard Network features a globally integrated structure that provides

scale for our issuers, enabling them to expand into regional and global markets. It features an intelligent architecture that enables

the network to adapt to the needs of each transaction by blending two distinct processing structures:

• a distributed (peer-to-peer) processing structure for transactions that require fast, reliable processing to ensure they are

processed close to where the transaction occurred; and

• a centralized (hub-and-spoke) processing structure for transactions that require value-added processing, such as real-

time access to transaction data for fraud scoring or rewards at the point-of-sale, to ensure advanced processing products

and services are applied to the transaction.

Our network’s architecture enables us to connect all parties regardless of where or how the transaction is occurring. It has 24-hour

a day availability and world-class response time. The network incorporates multiple layers of protection, both for continuity

purposes and to address information security challenges. We engage in multiple efforts to mitigate such challenges, including

regularly testing our systems to address potential vulnerabilities.

Participation Standards. We establish, apply and enforce standards surrounding participation in the MasterCard payments system.

We grant licenses that provide issuers and acquirers that meet specified criteria with certain rights, including access to the network

and usage of cards and payment devices carrying our brands. As a condition of our licenses, issuers and acquirers agree to comply

with our standards surrounding participation and brand usage and acceptance. We monitor areas of risk exposure and enforce our

standards to combat fraudulent, illegal and brand-damaging activity. Issuers and acquirers are also required to report instances of

fraud to us in a timely manner so that we can monitor trends and initiate action when appropriate.

Customer Risk Management. We guarantee the settlement of many of the transactions between our issuers and acquirers to ensure

the integrity of our network. We refer to this as our settlement exposure. We do not, however, guarantee payments to merchants

by their acquirer, or the availability of unspent prepaid cardholder account balances. As a guarantor of certain obligations of

principal customers, we are exposed to customer credit risk arising from the potential financial failure of any principal customers

of MasterCard, Maestro and Cirrus, and affiliate debit licensees. Principal customers participate directly in MasterCard programs

and are responsible for the settlement and other activities of their sponsored affiliate customers. To minimize the contingent risk

to MasterCard of a failure of a customer to meet its settlement obligations, we monitor the financial health of, economic and

political operating environments of, and compliance with our standards by, our customers. We employ various strategies to mitigate

these risks.

Processing

Transaction Switching - Authorization, Clearing and Settlement. Through the MasterCard Network, we enable the routing of a

transaction to the issuer for its approval, facilitate the exchange of financial transaction information between issuers and acquirers

after a successfully-conducted transaction, and help to settle the transaction by facilitating the exchange of funds between parties

via settlement banks chosen by us and the customer.

Cross-Border and Domestic Processing. The MasterCard Network processes transactions throughout the world when the merchant

country and issuer country are different (cross-border transactions), providing cardholders with the ability to use, and merchants

to accept, MasterCard cards and other payment devices across multiple country borders. We also provide domestic (or intra-

country) transaction processing services to customers in every region of the world, which allow issuers to facilitate payment

transactions between cardholders and merchants within a particular country. We process approximately half of all transactions

using MasterCard-branded cards, including most cross-border transactions. We process the majority of MasterCard-branded

domestic transactions in the United States, United Kingdom, Canada, Brazil and a select number of other countries. Outside of

these countries, most domestic transaction activity on our products is processed without our involvement.

Extended Processing. We extend our processing capabilities in the payments value chain in various regions and across the globe

with an expanded suite of offerings including:

• Issuer and acquirer solutions designed to provide medium to large customers with a complete processing solution to

help them create differentiated products and services and allow quick deployment of payments portfolios across banking

channels.

• Payment gateways that offer a single interface to provide e-commerce merchants with the ability to process secure

payments and offer value-added solutions, including outsourced electronic payments, fraud prevention and alternative

payment options.