MasterCard 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

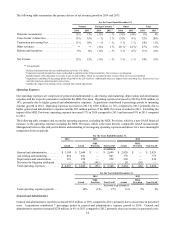

Depreciation and Amortization

Depreciation and amortization expenses increased $63 million, or 24%, in 2014 and $28 million, or 12%, in 2013. The increase

in depreciation and amortization expense in 2014 was primarily due to higher amortization of capitalized software costs and

acquisition-related intangible assets. The increase in 2013 was primarily due to higher amortization of capitalized software costs.

Provision for Litigation Settlement

As of December 31, 2014, the accrued litigation related to the MDL Provision was $771 million versus $886 million as of

December 31, 2013. The accrued litigation item includes $68 million as of December 31, 2013 related to the timing of MasterCard’s

administration of the short-term reduction in default credit interchange from U.S. issuers, which expired in April 2014. During

2014, MasterCard executed settlement agreements with a number of opt-out merchants and no adjustments to the amount reserved

was deemed necessary. In the fourth quarter of 2013, MasterCard recorded an incremental net pre-tax charge of $95 million related

to the opt-out merchants. See Note 18 (Legal and Regulatory Proceedings) to the consolidated financial statements included in

Part II, Item 8 of this Report for further discussion.

Other Income (Expense)

Other income (expense) is comprised primarily of investment income, interest expense, our share of income (losses) from equity

method investments and other gains and losses. Total other expense increased $24 million in 2014 compared to 2013, primarily

due to higher interest expense related to our debt issuance in March 2014. Total other expense decreased $1 million in 2013

compared to 2012 primarily related to an adjustment in interest expense due to the reversal of tax reserves, partially offset by

increased expenses from investments in joint ventures.

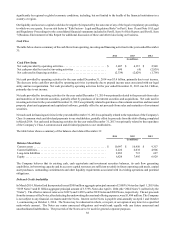

Income Taxes

The effective income tax rates for the years ended December 31, 2014, 2013 and 2012 were 28.8%, 30.8% and 29.9%, respectively.

The effective tax rate for 2014 was lower than the effective tax rate for 2013 primarily due to the recognition of a larger repatriation

benefit and an increase in the Company’s domestic production activity deduction in the U.S. related to the Company’s authorization

revenue, partially offset by an unfavorable mix of taxable earnings in 2014. The effective tax rate for 2013 was higher than the

effective tax rate for 2012 primarily due to the recognition of a discrete benefit relating to additional export incentives in 2012

and a lower benefit related to foreign repatriations in 2013, partially offset by a more favorable mix of earnings in 2013.

During the fourth quarter of 2014, we implemented an initiative to better align our legal entity and tax structure with our operational

footprint outside of the U.S. This initiative resulted in a one-time taxable gain in Belgium relating to the transfer of intellectual

property to a related foreign entity in the United Kingdom. We believe this improved alignment will result in greater flexibility

and efficiency with regard to the global deployment of cash, as well as ongoing benefits in our effective income tax rate. See Note

17 (Income Taxes) to the consolidated financial statements included in Part II, Item 8 of this Report for further discussion.

The provision for income taxes differs from the amount of income tax determined by applying the U.S. federal statutory income

tax rate of 35% to pretax income for the years ended December 31, as a result of the following:

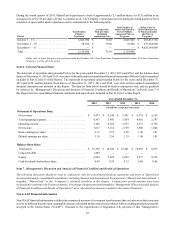

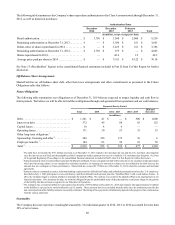

For the Years Ended December 31,

2014 2013 2012

Amount Percent Amount Percent Amount Percent

(in millions, except percentages)

Income before income taxes . . . . . . . . . . . . . . . $ 5,079 $ 4,500 $ 3,933

Federal statutory tax . . . . . . . . . . . . . . . . . . . . . 1,778 35.0 % 1,575 35.0 % 1,376 35.0 %

State tax effect, net of federal benefit . . . . . . . . 29 0.6 % 19 0.4 % 23 0.6 %

Foreign tax effect. . . . . . . . . . . . . . . . . . . . . . . . (108) (2.1)% (208) (4.6)% (175) (4.4)%

Foreign repatriation . . . . . . . . . . . . . . . . . . . . . . (177) (3.5)% (14) (0.3)% (27) (0.7)%

Other, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (60) (1.2)% 12 0.3 % (23) (0.6)%

Income tax expense . . . . . . . . . . . . . . . . . . . . . . $ 1,462 28.8 % $ 1,384 30.8 % $ 1,174 29.9 %