MasterCard 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

85

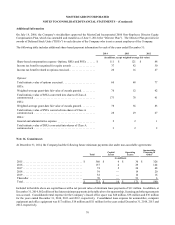

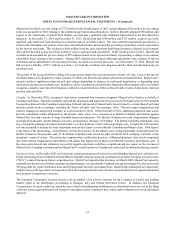

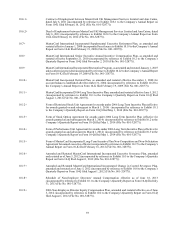

As of December 31, 2014, all forward contracts to purchase and sell foreign currency had been entered into with customers of

MasterCard. MasterCard’s derivative contracts are summarized below:

December 31, 2014 December 31, 2013

Notional Estimated Fair

Value Notional Estimated Fair

Value

(in millions)

Commitments to purchase foreign currency . . . . . . . . . . . . $ 47 $ 4 $ 23 $ (1)

Commitments to sell foreign currency. . . . . . . . . . . . . . . . . 614 27 1,722 1

Balance sheet location:

Accounts receivable *. . . . . . . . . . . . . . . . . . . . . . . . . . $ 35 $ 13

Other current liabilities *. . . . . . . . . . . . . . . . . . . . . . . (4) (13)

* The fair values of derivative contracts are presented on a gross basis on the balance sheet and are subject to enforceable master netting arrangements,

which contain various netting and setoff provisions.

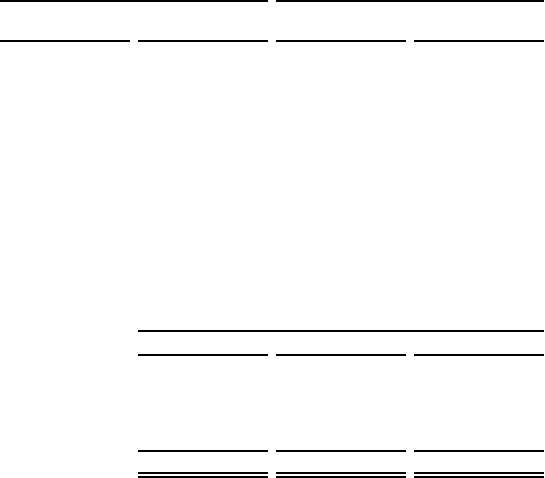

The amount of gain (loss) recognized in income for the contracts to purchase and sell foreign currency is summarized below:

Year Ended December 31,

2014 2013 2012

(in millions)

Foreign currency derivative contracts

General and administrative. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (78) $ 48 $ 22

Net revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 4 (6)

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (78) $ 52 $ 16

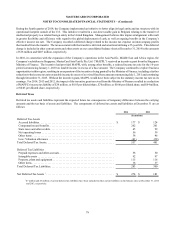

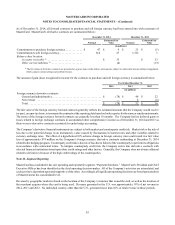

The fair value of the foreign currency forward contracts generally reflects the estimated amounts that the Company would receive

(or pay), on a pre-tax basis, to terminate the contracts at the reporting date based on broker quotes for the same or similar instruments.

The terms of the foreign currency forward contracts are generally less than 18 months. The Company had no deferred gains or

losses related to foreign exchange contracts in accumulated other comprehensive income as of December 31, 2014 and 2013 as

there were no derivative contracts accounted for under hedge accounting.

The Company’s derivative financial instruments are subject to both market and counterparty credit risk. Market risk is the risk of

loss due to the potential change in an instrument’s value caused by fluctuations in interest rates and other variables related to

currency exchange rates. The effect of a hypothetical 10% adverse change in foreign currency rates could result in a fair value

loss of approximately $74 million on the Company’s foreign currency derivative contracts outstanding at December 31, 2014

related to the hedging program. Counterparty credit risk is the risk of loss due to failure of the counterparty to perform its obligations

in accordance with contractual terms. To mitigate counterparty credit risk, the Company enters into derivative contracts with

selected financial institutions based upon their credit ratings and other factors. Generally, the Company does not obtain collateral

related to derivatives because of the high credit ratings of the counterparties.

Note 21. Segment Reporting

MasterCard has concluded it has one operating and reportable segment, “Payment Solutions.” MasterCard’s President and Chief

Executive Officer has been identified as the chief operating decision-maker. All of the Company’s activities are interrelated, and

each activity is dependent upon and supportive of the other. Accordingly, all significant operating decisions are based upon analysis

of MasterCard at the consolidated level.

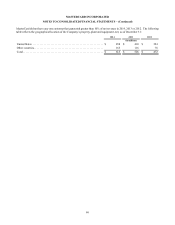

Revenue by geographic market is based on the location of the Company’s customer that issued the card, as well as the location of

the merchant acquirer where the card is being used. Revenue generated in the U.S. was approximately 39% of net revenue in

2014, 2013 and 2012. No individual country, other than the U.S., generated more than 10% of total revenue in those periods.