MasterCard 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

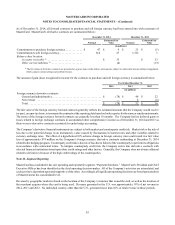

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

81

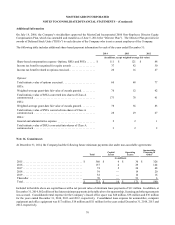

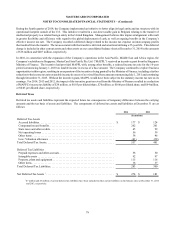

MasterCard recorded a pre-tax charge of $770 million in the fourth quarter of 2011 and an additional $20 million pre-tax charge

in the second quarter of 2012 relating to the settlement agreements described above. In 2012, MasterCard paid $790 million with

respect to the settlements, of which $726 million was paid into a qualified cash settlement fund related to the merchant class

litigation. At December 31, 2014 and December 31, 2013, MasterCard had $540 million and $723 million, respectively, in the

qualified cash settlement fund classified as restricted cash on its balance sheet. The class settlement agreement provided for a

return to the defendants of a portion of the class cash settlement fund, based upon the percentage of purchase volume represented

by the opt-out merchants. This resulted in $164 million from the cash settlement fund being returned to MasterCard in January

2014 and reclassified at that time from restricted cash to cash and cash equivalents. In the fourth quarter of 2013, MasterCard

recorded an incremental net pre-tax charge of $95 million related to the opt-out merchants, representing a change in its estimate

of probable losses relating to these matters. During 2014, MasterCard executed settlement agreements with a number of opt-out

merchants and no adjustment to the amount previously recorded was deemed necessary. As of December 31, 2014, MasterCard

had accrued a liability of $771 million as a reserve for both the merchant class litigation and the filed and anticipated opt-out

merchant cases.

The portion of the accrued liability relating to the opt-out merchants does not represent an estimate of a loss, if any, if the opt-out

merchant matters were litigated to a final outcome, in which case MasterCard cannot estimate the potential liability. MasterCard’s

estimate involves significant judgment and may change depending on progress in settlement negotiations or depending upon

decisions in any opt-out merchant cases. In addition, in the event that the merchant class litigation settlement approval is overturned

on appeal, a negative outcome in the litigation could have a material adverse effect on MasterCard’s results of operations, financial

position and cash flows.

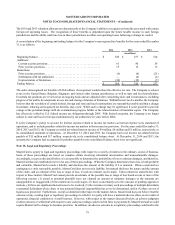

Canada. In December 2010, a proposed class action complaint was commenced against MasterCard in Quebec on behalf of

Canadian merchants. That suit essentially repeated the allegations and arguments of a previously filed application by the Canadian

Competition Bureau to the Canadian Competition Tribunal (dismissed in MasterCard’s favor) related to certain MasterCard rules

related to point-of-sale acceptance, including the “honor all cards” and “no surcharge” rules. The suit sought compensatory and

punitive damages in unspecified amounts, as well as injunctive relief. In the first half of 2011, additional purported class action

lawsuits containing similar allegations to the Quebec class action were commenced in British Columbia and Ontario against

MasterCard, Visa and a number of large Canadian financial institutions. The British Columbia suit seeks compensatory damages

in unspecified amounts, and the Ontario suit seeks compensatory damages of $5 billion. The British Columbia and Ontario suits

also seek punitive damages in unspecified amounts, as well as injunctive relief, interest and legal costs. In April 2012, the Quebec

suit was amended to include the same defendants and similar claims as in the British Columbia and Ontario suits. With respect

to the status of the proceedings: (1) the Quebec suit has been stayed, (2) the Ontario suit is being temporarily suspended while the

British Columbia suit proceeds, and (3) the British Columbia court issued an order in March 2014 certifying a number of the

merchants’ causes of action. The parties have appealed the certification decision. Additional proposed class action complaints

have been filed in Saskatchewan and Alberta with claims that largely mirror those in the British Columbia and Ontario suits. If

the class action lawsuits are ultimately successful, negative decisions could have a significant adverse impact on the revenue of

MasterCard’s Canadian customers and on MasterCard’s overall business in Canada and could result in substantial damage awards.

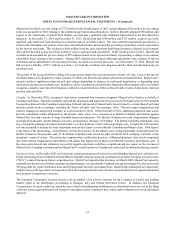

European Union. In December 2007, the European Commission announced a decision concluding that MasterCard’s default cross-

border interchange fees for MasterCard and Maestro branded consumer payment card transactions in the European Economic Area

(“EEA”) violated European Union competition law. MasterCard appealed that decision. In March 2009, MasterCard agreed to

establish new default cross-border consumer card interchange fees such that the weighted average interchange fee does not exceed

30 basis points for credit card transactions and 20 basis points for debit card transactions. MasterCard continued to act consistently

with the terms of the agreement. In September 2014, the European Union Court of Justice rejected MasterCard’s appeal and upheld

the European Commission’s decision.

The European Commission decision increases the possibility of an adverse outcome for the Company in related and pending

matters (such as the interchange proceedings in Hungary, Italy and Poland referenced below). In addition, the European

Commission’s decision could lead, and in the case of the United Kingdom and Belgium (as described below) has led, to the filing

of private actions against MasterCard Europe by merchants and/or consumers that could result in MasterCard owing substantial

damages.