MasterCard 2014 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2014 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

63

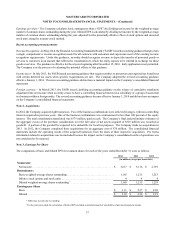

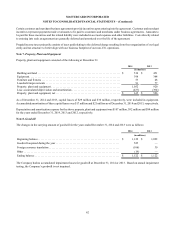

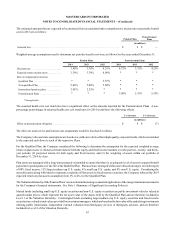

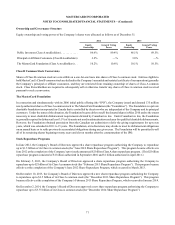

Note 9. Other Intangible Assets

The following table sets forth net intangible assets, other than goodwill, at December 31:

2014 2013

Gross

Carrying

Amount Accumulated

Amortization Net Carrying

Amount

Gross

Carrying

Amount Accumulated

Amortization Net Carrying

Amount

(in millions)

Amortized intangible assets:

Capitalized software . . . . . . . $ 839 $ (496) $ 343 $ 699 $ (404) $ 295

Trademarks and tradenames . 48 (38) 10 49 (38) 11

Customer relationships . . . . . 292 (115) 177 237 (84) 153

Other . . . . . . . . . . . . . . . . . . . 20 (14) 6 20 (8) 12

Total. . . . . . . . . . . . . . . . . . . . . . 1,199 (663) 536 1,005 (534) 471

Unamortized intangible assets:

Customer relationships . . . . . 178 — 178 201 — 201

Total. . . . . . . . . . . . . . . . . . . . . . $ 1,377 $ (663) $ 714 $ 1,206 $ (534) $ 672

The increase in the net carrying amount of amortized intangible assets in 2014 was primarily related to our acquired businesses.

The increase in the net carrying amount of amortized intangible assets in 2013 was primarily related to additions in internally

developed software and purchased software. Certain intangible assets, including amortizable and unamortizable customer

relationships and trademarks and tradenames, are denominated in foreign currencies. As such, the change in intangible assets

includes a component attributable to foreign currency translation.

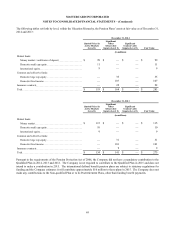

Amortization and impairment expense on the assets above amounted to $214 million, $166 million and $149 million in 2014, 2013

and 2012, respectively. The following table sets forth the estimated future amortization expense on amortizable intangible assets

on the balance sheet at December 31, 2014 for the years ending December 31:

(in millions)

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 216

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 159

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 92

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

2019 and thereafter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

$ 536

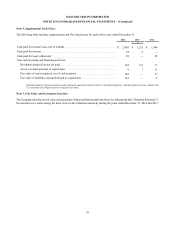

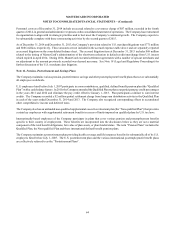

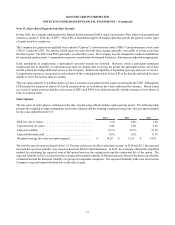

Note 10. Accrued Expenses and Accrued Litigation

Accrued expenses consisted of the following at December 31:

2014 2013

(in millions)

Customer and merchant incentives. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,433 $ 1,286

Personnel costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 531 413

Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 154 149

Income and other taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 105 95

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 216 158

Total accrued expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,439 $ 2,101