MasterCard 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

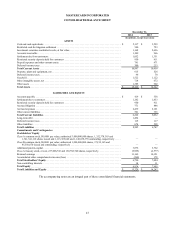

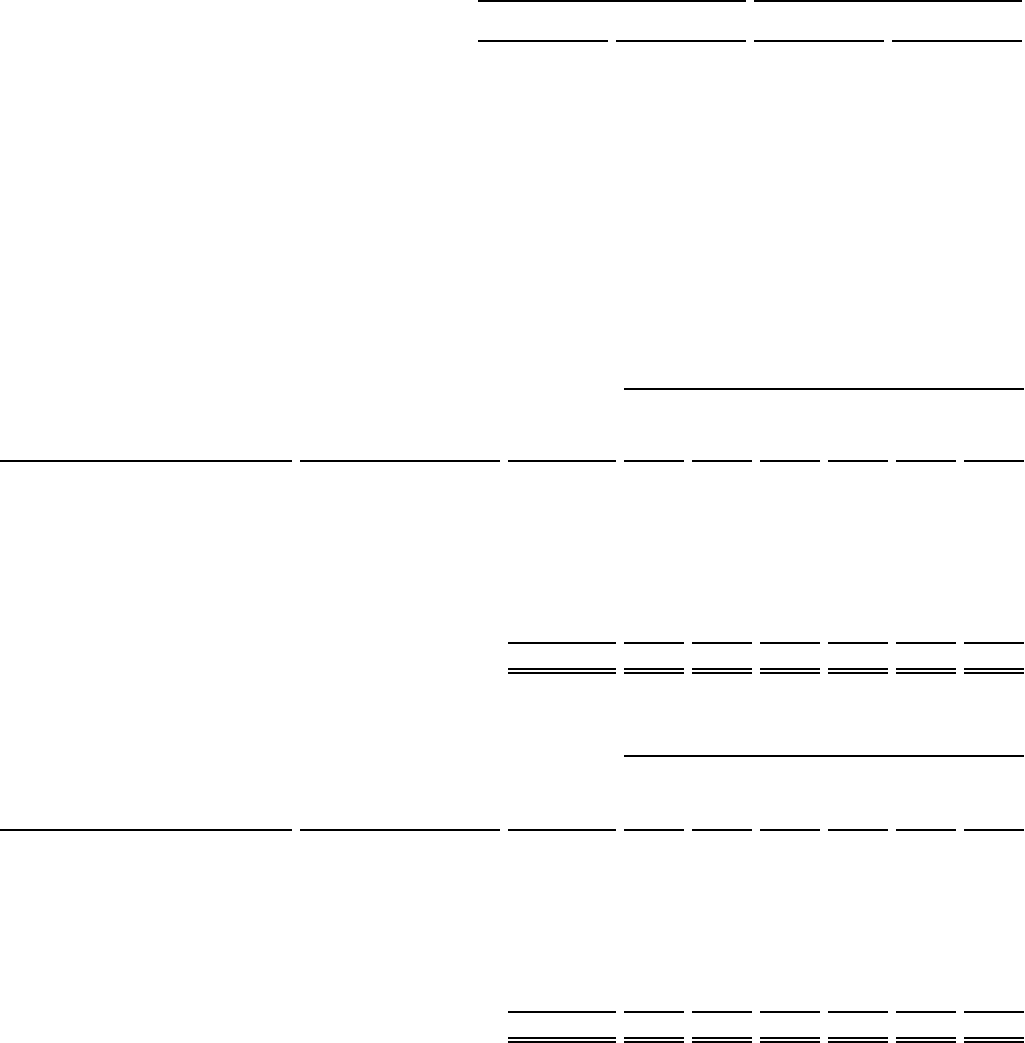

As of December 31, 2014, all forward contracts to purchase and sell foreign currency had been entered into with customers of

MasterCard. MasterCard’s derivative contracts are summarized below:

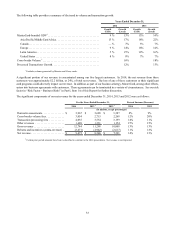

December 31, 2014 December 31, 2013

Notional Estimated Fair

Value Notional Estimated Fair

Value

(in millions)

Commitments to purchase foreign currency . . . . . . . . . . . . $ 47 $ 4 $ 23 $ (1)

Commitments to sell foreign currency . . . . . . . . . . . . . . . . 614 27 1,722 1

Our settlement activities are subject to foreign exchange risk resulting from foreign exchange rate fluctuations. This risk is typically

limited to the one business day between setting the foreign exchange rates and clearing the financial transactions.

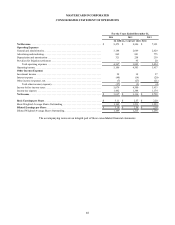

Interest Rate Risk

Our interest rate sensitive assets are our investments in debt securities, which we generally hold as available-for-sale investments.

Our general policy is to invest in high quality securities, while providing adequate liquidity and maintaining diversification to

avoid significant exposure. The fair value and maturity distribution of the Company’s available for sale investments for debt

securities as of December 31 was as follows:

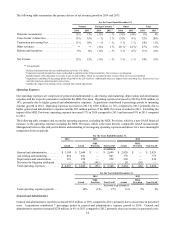

Maturity

Fair Market

Value at

December 31,

2014 2015 2016 2017 2018 2019

2020

and

there-

after

Financial Instrument Summary Terms

(in millions)

Municipal securities . . . . . . . . . . . . . . . Fixed / Variable Interest $ 135 $ 82 $ 48 $ 2 $ — $ — $ 3

Corporate securities . . . . . . . . . . . . . . . Fixed / Variable Interest 618 325 211 82 — — —

U.S. government and agency

securities. . . . . . . . . . . . . . . . . . . . . Fixed / Variable Interest 199 132 52 2 — — 13

Asset-backed securities . . . . . . . . . . . . Fixed / Variable Interest 178 4 59 75 28 7 5

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . Fixed / Variable Interest 25 15 5 1 — — 4

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,155 $ 558 $ 375 $ 162 $ 28 $ 7 $ 25

Maturity

Financial Instrument Summary Terms

Fair Market

Value at

December 31,

2013 2014 2015 2016 2017 2018

2019

and

there-

after

(in millions)

Municipal securities . . . . . . . . . . . . . . . Fixed / Variable Interest $ 267 $ 200 $ 57 $ 10 $ — $ — $ —

Corporate securities . . . . . . . . . . . . . . . Fixed / Variable Interest 1,426 646 464 290 9 15 2

U.S. government and agency

securities. . . . . . . . . . . . . . . . . . . . . Fixed / Variable Interest 560 376 122 31 12 9 10

Asset-backed securities . . . . . . . . . . . . Fixed / Variable Interest 364 307 49 8 — — —

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . Fixed / Variable Interest 90 33 37 7 2 — 11

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,707 $1,562 $ 729 $ 346 $ 23 $ 24 $ 23

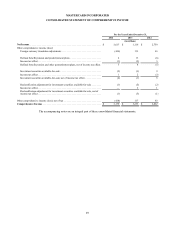

At December 31, 2014, we have a credit facility which provides liquidity for general corporate purposes, including providing

liquidity in the event of one or more settlement failures by the Company’s customers. This credit facility has variable rates, which

are applied to the borrowing based on terms and conditions set forth in the agreement. See Note 12 (Debt) to the consolidated

financial statements in Part II, Item 8 of this Report for additional information on the Company’s current and prior credit facilities.

We had no borrowings under the current or prior credit facilities at December 31, 2014 and 2013.

Equity Price Risk

The Company did not have significant equity price risk as of December 31, 2014 and 2013.