MasterCard 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

73

Note 15. Share-Based Payment and Other Benefits

In May 2006, the Company implemented the MasterCard Incorporated 2006 Long-Term Incentive Plan, which was amended and

restated as of June 5, 2012 (the “LTIP”). The LTIP is a shareholder-approved omnibus plan that permits the grant of various types

of equity awards to employees.

The Company has granted non-qualified stock options (“Options”), restricted stock units (“RSUs”) and performance stock units

(“PSUs”) under the LTIP. The options, which expire ten years from the date of grant, generally vest ratably over four years from

the date of grant. The RSUs and PSUs generally vest after three years. The Company uses the straight-line method of attribution

for expensing equity awards. Compensation expense is recorded net of estimated forfeitures. Estimates are adjusted as appropriate.

Upon termination of employment, a participant’s unvested awards are forfeited. However, when a participant terminates

employment due to disability or retirement more than six months after receiving the award, the participant retains all of their

awards without providing additional service to the Company. Retirement eligibility is dependent upon age and years of service.

Compensation expense is recognized over the shorter of the vesting periods stated in the LTIP or the date the individual becomes

eligible to retire but not less than six months.

There are approximately 116 million shares of Class A common stock authorized for equity awards under the LTIP. Although the

LTIP permits the issuance of shares of Class B common stock, no such shares have been authorized for issuance. Shares issued

as a result of option exercises and the conversions of RSUs and PSUs were funded primarily with the issuance of new shares of

Class A common stock.

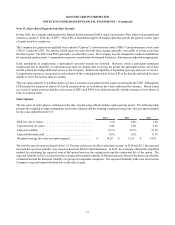

Stock Options

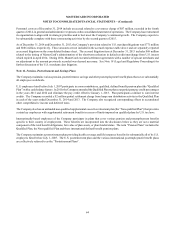

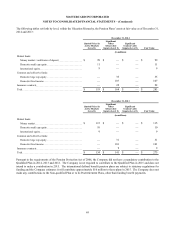

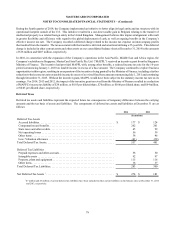

The fair value of each option is estimated on the date of grant using a Black-Scholes option pricing model. The following table

presents the weighted-average assumptions used in the valuation and the resulting weighted-average fair value per option granted

for the years ended December 31:

2014 2013 2012

Risk-free rate of return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.5% 0.8% 1.2%

Expected term (in years). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.00 5.00 6.25

Expected volatility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19.1% 27.1% 35.2%

Expected dividend yield . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.6% 0.5% 0.3%

Weighted-average fair value per option granted. . . . . . . . . . . . . . . . . $ 14.29 $ 12.33 $ 14.85

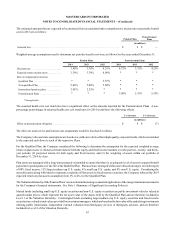

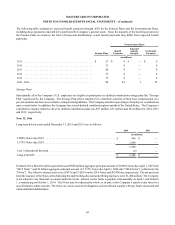

The risk-free rate of return was based on the U.S. Treasury yield curve in effect on the date of grant. In 2014 and 2013, the expected

term and the expected volatility were based on historical MasterCard information. In 2012, the Company utilized the simplified

method for calculating the expected term of the option based on the vesting terms and the contractual life of the option. The

expected volatility in 2012 was based on the average of the implied volatility of MasterCard and a blend of the historical volatility

of MasterCard and the historical volatility of a group of comparable companies. The expected dividend yields were based on the

Company’s expected annual dividend rate on the date of grant.