MasterCard 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

83

Consumer Litigations Related to 2003 U.S. Merchant Settlement

Individual or multiple complaints have been brought in 19 states and the District of Columbia alleging state unfair competition,

consumer protection and common law claims against MasterCard International (and Visa) on behalf of putative classes of consumers.

The claims in these actions largely mirror the allegations made in several class action suits brought by a number of U.S. merchants

against MasterCard International and Visa U.S.A., Inc., which were settled in 2003, and assert that merchants, faced with excessive

interchange fees, have passed these overhead charges to consumers in the form of higher prices on goods and services sold.

MasterCard has successfully resolved the cases in all of the jurisdictions except California, where there continue to be outstanding

cases. As discussed above under “Private Litigations Related to 1998 Department of Justice Antitrust Litigation,” in September

2009, the parties to the California state court actions executed a settlement agreement that received final approval from the California

state trial court in August 2010, subsequent to which MasterCard made a required payment of $6 million. As noted above in more

detail, the plaintiff from the Attridge action and three other objectors filed appeals of the trial court’s final approval in April 2013

of a revised settlement. In October 2014, the appeals court affirmed the trial court’s approval order and the California Supreme

Court subsequently denied the objectors’ request to appeal that ruling.

ATM Non-Discrimination Rule Surcharge Complaints

In October 2011, a trade association of independent Automated Teller Machine (“ATM”) operators and 13 independent ATM

operators filed a complaint styled as a class action lawsuit in the U.S. District Court for the District of Columbia against both

MasterCard and Visa (the “ATM Operators Complaint”). Plaintiffs seek to represent a class of non-bank operators of ATM terminals

that operate ATM terminals in the United States with the discretion to determine the price of the ATM access fee for the terminals

they operate. Plaintiffs allege that MasterCard and Visa have violated Section 1 of the Sherman Act by imposing rules that require

ATM operators to charge non-discriminatory ATM surcharges for transactions processed over MasterCard’s and Visa’s respective

networks that are not greater than the surcharge for transactions over other networks accepted at the same ATM. Plaintiffs seek

both injunctive and monetary relief equal to treble the damages they claim to have sustained as a result of the alleged violations

and their costs of suit, including attorneys’ fees. Plaintiffs have not quantified their damages although they allege that they expect

damages to be in the tens of millions of dollars.

Subsequently, multiple related complaints were filed in the U.S. District Court for the District of Columbia alleging both federal

antitrust and multiple state unfair competition, consumer protection and common law claims against MasterCard and Visa on

behalf of putative classes of users of ATM services (the “ATM Consumer Complaints”). The claims in these actions largely mirror

the allegations made in the ATM Operators Complaint described above, although these complaints seek damages on behalf of

consumers of ATM services who pay allegedly inflated ATM fees at both bank and non-bank ATM operators as a result of the

defendants’ ATM rules. Plaintiffs seek both injunctive and monetary relief equal to treble the damages they claim to have sustained

as a result of the alleged violations and their costs of suit, including attorneys’ fees. Plaintiffs have not quantified their damages

although they allege that they expect damages to be in the tens of millions of dollars.

In January 2012, the plaintiffs in the ATM Operators Complaint and the ATM Consumer Complaints filed amended class action

complaints that largely mirror their prior complaints. In February 2013, the district court granted MasterCard’s motion to dismiss

the complaints for failure to state a claim. The plaintiffs’ motion seeking approval to amend their complaints was denied by the

district court in December 2013. The plaintiffs have appealed the dismissal of both their complaints and their motion to amend

their complaints.

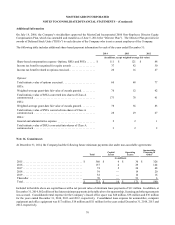

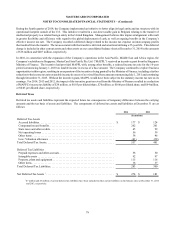

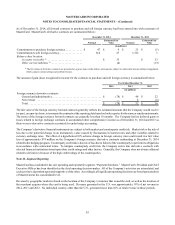

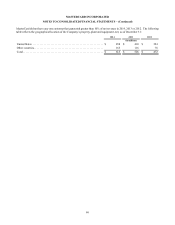

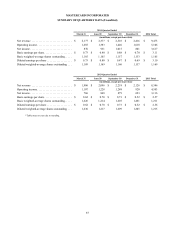

Note 19. Settlement and Other Risk Management

MasterCard’s rules guarantee the settlement of many of the MasterCard, Cirrus and Maestro branded transactions between its

issuers and acquirers (“settlement risk”). Settlement exposure is the outstanding settlement risk to customers under MasterCard’s

rules due to the difference in timing between the payment transaction date and subsequent settlement. While the term and amount

of the guarantee are unlimited, the duration of settlement exposure is short term and typically limited to a few days. Gross settlement

exposure is estimated using the average daily card volume during the quarter multiplied by the estimated number of days to settle.

The Company has global risk management policies and procedures, which include risk standards, to provide a framework for

managing the Company’s settlement risk. Customer-reported transaction data and the transaction clearing data underlying the

settlement exposure calculation may be revised in subsequent reporting periods.