MasterCard 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

57

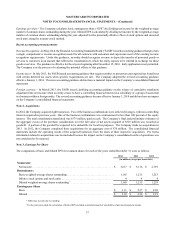

Earnings per share - The Company calculates basic earnings per share (“EPS”) by dividing net income by the weighted-average

number of common shares outstanding during the year. Diluted EPS is calculated by dividing net income by the weighted-average

number of common shares outstanding during the year, adjusted for the potentially dilutive effect of stock options and unvested

stock units using the treasury stock method.

Recent accounting pronouncements

Revenue Recognition - In May 2014, the Financial Accounting Standards Board (“FASB”) issued accounting guidance that provides

a single, comprehensive revenue recognition model for all contracts with customers and supersedes most of the existing revenue

recognition requirements. Under this guidance, an entity should recognize revenue to depict the transfer of promised goods or

services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those

goods or services. The guidance is effective for fiscal years beginning after December 15, 2016. Early application is not permitted.

The Company is in the process of evaluating the potential effects of this guidance.

Income taxes - In July 2013, the FASB issued accounting guidance that requires entities to present an unrecognized tax benefit net

with certain deferred tax assets when specific requirements are met. The Company adopted the revised accounting guidance

effective January 1, 2014. This new accounting guidance did not have a material impact on the Company’s consolidated financial

statements.

Foreign currency - In March 2013, the FASB issued clarifying accounting guidance on the release of cumulative translation

adjustment into net income when an entity ceases to have a controlling financial interest in a subsidiary or a group of assets that

is a business within a foreign entity. The revised accounting guidance became effective January 1, 2014 and did not have an impact

on the Company’s consolidated financial statements.

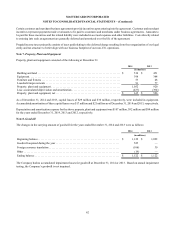

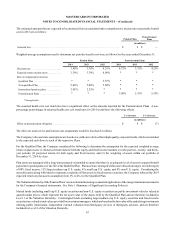

Note 2. Acquisitions

In 2014, the Company acquired eight businesses. Two of the business combinations were achieved in stages, with non-controlling

interests acquired in previous years. One of the business combinations was a transaction for less than 100 percent of the equity

interest. The total consideration transferred was $575 million, paid in cash. The Company’s final and preliminary estimates of

the aggregate excess of the purchase consideration over the fair value of net assets acquired of $525 million was recorded as

goodwill. A portion of the goodwill is expected to be deductible for local tax purposes. The Company made no acquisitions in

2013. In 2012, the Company completed three acquisitions for an aggregate cost of $70 million. The consolidated financial

statements include the operating results of the acquired businesses from the dates of their respective acquisition. Pro forma

information related to acquisitions was not included because the impact on the Company’s consolidated results of operations was

not considered to be material.

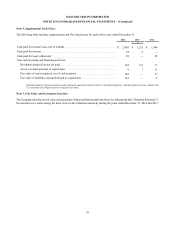

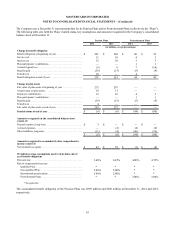

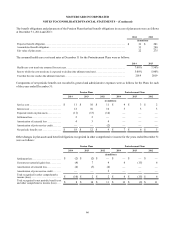

Note 3. Earnings Per Share

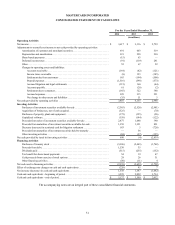

The components of basic and diluted EPS for common shares for each of the years ended December 31 were as follows:

2014 2013 2012

(in millions, except per share data)

Numerator:

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,617 $ 3,116 $ 2,759

Denominator:

Basic weighted-average shares outstanding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,165 1,211 1,253

Dilutive stock options and stock units . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 4 4

Diluted weighted-average shares outstanding 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,169 1,215 1,258

Earnings per Share

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3.11 $ 2.57 $ 2.20

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3.10 $ 2.56 $ 2.19

* Table may not sum due to rounding.

1 For the years presented, the calculation of diluted EPS excluded a minimal amount of anti-dilutive share-based payment awards.