MasterCard 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

54

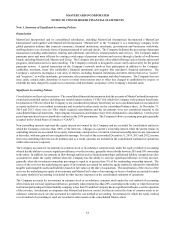

The impairment test for indefinite-lived intangible assets consists of a qualitative assessment to evaluate all relevant events and

circumstances that could affect the significant inputs used to determine the fair value of indefinite-lived intangible assets. If the

qualitative assessment indicates that it is more likely than not that indefinite-lived intangible assets are impaired, then a quantitative

assessment is required. Based on the qualitative assessment performed in 2014, it was determined that the Company’s indefinite-

lived intangible asset was not impaired.

Litigation - The Company is a party to certain legal and regulatory proceedings with respect to a variety of matters. The Company

evaluates the likelihood of an unfavorable outcome of all legal or regulatory proceedings to which it is a party and accrues a loss

contingency when the loss is probable and reasonably estimable. These judgments are subjective based on the status of the legal

or regulatory proceedings, the merits of its defenses and consultation with in-house and external legal counsel. Legal costs are

expensed as incurred and recorded in general and administrative expenses.

Settlement and other risk management - MasterCard’s rules guarantee the settlement of many of the MasterCard, Cirrus and

Maestro-branded transactions between its issuers and acquirers. Settlement exposure is the outstanding settlement risk to customers

under MasterCard’s rules due to the difference in timing between the payment transaction date and subsequent settlement. While

the term and amount of the guarantee are unlimited, the duration of settlement exposure is short term and typically limited to a

few days. In the event that MasterCard effects a payment on behalf of a failed customer, MasterCard may seek an assignment of

the underlying receivables of the failed customer. Customers may be charged for the amount of any settlement loss incurred during

the ordinary course activities of the Company.

The Company also enters into agreements in the ordinary course of business under which the Company agrees to indemnify third

parties against damages, losses and expenses incurred in connection with legal and other proceedings arising from relationships

or transactions with the Company. As the extent of the Company’s obligations under these agreements depends entirely upon the

occurrence of future events, the Company’s potential future liability under these agreements is not determinable. The Company

accounts for each of its guarantees by recording the guarantee at its fair value at the inception or modification date through earnings.

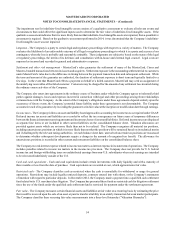

Income taxes - The Company follows an asset and liability based approach in accounting for income taxes as required under GAAP.

Deferred income tax assets and liabilities are recorded to reflect the tax consequences on future years of temporary differences

between the financial statement carrying amounts and income tax bases of assets and liabilities. Deferred income taxes are displayed

as separate line items or are included in other current liabilities on the consolidated balance sheet. Valuation allowances are

provided against assets which are not more likely than not to be realized. The Company recognizes all material tax positions,

including uncertain tax positions in which it is more likely than not that the position will be sustained based on its technical merits

and if challenged by the relevant taxing authorities. At each balance sheet date, unresolved uncertain tax positions are reassessed

to determine whether subsequent developments require a change in the amount of recognized tax benefit. The allowance for

uncertain tax positions is recorded in other current and noncurrent liabilities on the consolidated balance sheet.

The Company records interest expense related to income tax matters as interest expense in its statement of operations. The Company

includes penalties related to income tax matters in the income tax provision. The Company does not provide for U.S. federal

income tax and foreign withholding taxes on undistributed earnings from non-U.S. subsidiaries when such earnings are intended

to be reinvested indefinitely outside of the U.S.

Cash and cash equivalents - Cash and cash equivalents include certain investments with daily liquidity and with a maturity of

three months or less from the date of purchase. Cash equivalents are recorded at cost, which approximates fair value.

Restricted cash - The Company classifies cash as restricted when the cash is unavailable for withdrawal or usage for general

operations. Restrictions may include legally restricted deposits, contracts entered into with others, or the Company’s statements

of intention with regard to particular deposits. In December 2012, the Company made a payment into a qualified cash settlement

fund related to its U.S. merchant class litigation. The Company has presented these funds as restricted cash for litigation settlement

since the use of the funds under the qualified cash settlement fund is restricted for payment under the settlement agreement.

Fair value - The Company measures certain financial assets and liabilities at fair value on a recurring basis by estimating the price

that would be received upon the sale of an asset or paid to transfer a liability in an orderly transaction between market participants.

The Company classifies these recurring fair value measurements into a three-level hierarchy (“Valuation Hierarchy”).