MasterCard 2014 Annual Report Download - page 84

Download and view the complete annual report

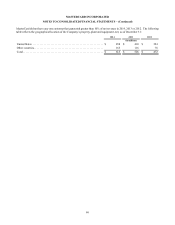

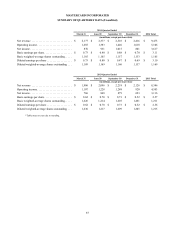

Please find page 84 of the 2014 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

82

In April 2013, the European Commission announced that it has opened proceedings to investigate: (1) MasterCard’s interregional

interchange fees that apply when a card issued outside the EEA is used at a merchant location in the EEA, (2) central acquiring

rules, which apply when a merchant uses the services of an acquirer established in another country and (3) other business rules

and practices (including the “honor all cards” rule).

Additional Litigations in Europe. In the United Kingdom, beginning in May 2012, a number of retailers filed claims against

MasterCard seeking damages for alleged anti-competitive conduct with respect to MasterCard’s cross-border interchange fees and

its U.K. and Ireland domestic interchange fees. More than 20 different retailers have filed claims or notice of claims. An additional

13 potential claimant retailers have agreed to delay filing their claims in exchange for MasterCard agreeing to suspend the running

of the time limitations on their damages claims. Although the claimants have not quantified the full extent of their compensatory

and punitive damages, their purported damages exceed $2 billion. MasterCard has submitted statements of defense to the retailers’

claims disputing liability and damages. Courts in two of the actions will address preliminary issues before addressing issues

concerning any liability and damages. The court in one of the other actions has scheduled a trial for January 2016. Similarly, in

Belgium, a retailer filed claims in December 2012 for unspecified damages with respect to MasterCard’s cross-border and domestic

interchange fees paid in Belgium, Greece and Luxembourg.

Additional Interchange Proceedings. In February 2007, the Office for Fair Trading of the United Kingdom (the “OFT”) commenced

an investigation of MasterCard’s current U.K. default credit card interchange fees and so-called “immediate debit” cards to

determine whether such fees contravene U.K. and European Union competition law. The OFT informed MasterCard that it did

not intend to issue a Statement of Objections or otherwise commence formal proceedings prior to the completion of the appeal to

the ECJ of the December 2007 cross-border interchange fee decision. In November 2014, the Competition and Markets Authority

(the successor to the OFT) announced that it had decided not to progress its investigation of MasterCard’s domestic interchange

fees in light of the European Commission’s proposed interchange fee regulation.

Regulatory authorities in a number of other jurisdictions around the world, including Hungary, Italy and Poland, have commenced

competition-related proceedings or inquiries into interchange fees and acceptance practices. In some of these jurisdictions, fines

have been or could be assessed against MasterCard. These matters could have a negative impact on MasterCard’s business in the

specific country where the regulatory authority is located but would not be expected to have a material impact on MasterCard’s

overall revenue.

Private Litigations Related to 1998 Department of Justice Antitrust Litigation

In April 2005, a complaint was filed in California state court on behalf of a putative class of consumers under California unfair

competition law (Section 17200) and the Cartwright Act (the “Attridge action”). The claims in this action seek to leverage a 1998

action by the U.S. Department of Justice against MasterCard International, Visa U.S.A., Inc. and Visa International Corp. In that

action, a federal district court concluded that both MasterCard’s Competitive Programs Policy and a Visa bylaw provision that

prohibited financial institutions participating in the respective associations from issuing competing proprietary payment cards

(such as American Express or Discover) constituted unlawful restraints of trade under the federal antitrust laws. The state court

in the Attridge action granted the defendants’ motion to dismiss the plaintiffs’ state antitrust claims but denied the defendants’

motion to dismiss the plaintiffs’ Section 17200 unfair competition claims. In September 2009, MasterCard executed a settlement

agreement that received final approval by the court in the California consumer actions in August 2010 (see “Consumer Litigations

Related to 2003 U.S. Merchant Settlement”). The agreement includes a release that the parties believe encompasses the claims

asserted in the Attridge action. In January 2012, the Appellate Court reversed the trial court’s settlement approval and remanded

the matter to the trial court for further proceedings. In April 2013, the trial court granted final approval of a revised settlement

agreement, to which the plaintiff from the Attridge action and three other objectors appealed. In October 2014, the appeals court

affirmed the trial court’s approval order and the California Supreme Court subsequently denied the objectors’ request to appeal

that ruling.