MasterCard 2014 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2014 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

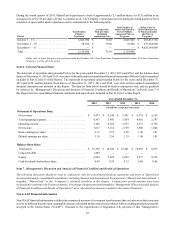

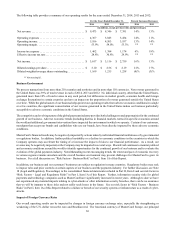

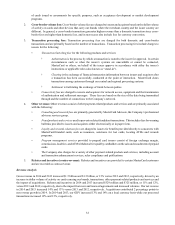

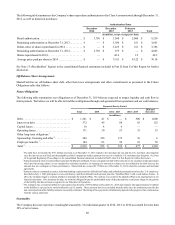

The following table provides a summary of our operating results for the years ended December 31, 2014, 2013 and 2012:

For the Years Ended December 31, Percent Increase (Decrease)

2014 2013 2012 2014 2013

(in millions, except per share data and percentages)

Net revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 9,473 $ 8,346 $ 7,391 14% 13%

Operating expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,367 3,843 3,454 14% 11%

Operating income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,106 4,503 3,937 13% 14%

Operating margin . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53.9% 54.0% 53.3% ** **

Income tax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,462 1,384 1,174 6% 18%

Effective income tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28.8% 30.8% 29.9% ** **

Net income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,617 $ 3,116 $ 2,759 16% 13%

Diluted earnings per share . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3.10 $ 2.56 $ 2.19 21% 17%

Diluted weighted-average shares outstanding . . . . . . . . . . . . 1,169 1,215 1,258 (4)% (3)%

** Not meaningful.

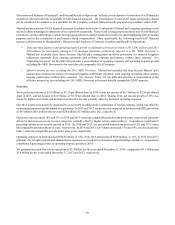

Business Environment

We process transactions from more than 210 countries and territories and in more than 150 currencies. Net revenue generated in

the United States was 39% of total revenue in each of 2014, 2013 and 2012. No individual country, other than the United States,

generated more than 10% of total revenue in any such period, but differences in market growth, economic health and foreign

exchange fluctuations in certain countries can have an impact on the proportion of revenue generated outside the United States

over time. While the global nature of our business helps protect our operating results from adverse economic conditions in a single

or a few countries, the significant concentration of our revenue generated in the United States makes our business particularly

susceptible to adverse economic conditions in the United States.

The competitive and evolving nature of the global payments industry provides both challenges to and opportunities for the continued

growth of our business. Adverse economic trends (including distress in financial markets, turmoil in specific economies around

the world and additional government intervention) have impacted the environment in which we operate. Certain of our customers,

merchants that accept our brands and cardholders who use our brands, have been directly impacted by these adverse economic

conditions.

MasterCard’s financial results may be negatively impacted by actions taken by individual financial institutions or by governmental

or regulatory bodies. In addition, further political instability or a decline in economic conditions in the countries in which the

Company operates may accelerate the timing of or increase the impact of risks to our financial performance. As a result, our

revenue may be negatively impacted, or the Company may be impacted in several ways. MasterCard continues to monitor political

and economic conditions around the world to identify opportunities for the continued growth of our business and to evaluate the

evolution of the global payments industry. Notwithstanding recent encouraging trends, the extent and pace of economic recovery

in various regions remains uncertain and the overall business environment may present challenges for MasterCard to grow its

business. For a full discussion see “Risk Factors - Business Risk” in Part I, Item 1A of this Report.

In addition, our business and our customers’ businesses are subject to regulation in many countries. Regulatory bodies may seek

to impose rules and price controls on certain aspects of our business and the payments industry. For further discussion, see Note

18 (Legal and Regulatory Proceedings) to the consolidated financial statements included in Part II, Item 8 and our risk factor in

“Risk Factors - Legal and Regulatory Risks” in Part I, Item 1A of this Report. Further, information security risks for global

payments and technology companies such as MasterCard have significantly increased in recent years. Although to date we have

not experienced any material impacts relating to cyber-attacks or other information security breaches, there can be no assurance

that we will be immune to these risks and not suffer such losses in the future. See our risk factor in “Risk Factors - Business

Risks” in Part I, Item 1A of this Report related to a failure or breach of our security systems or infrastructure as a result of cyber-

attacks.

Impact of Foreign Currency Rates

Our overall operating results can be impacted by changes in foreign currency exchange rates, especially the strengthening or

weakening of the U.S. dollar versus the euro and Brazilian real. The functional currency of MasterCard Europe, our principal