MasterCard 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

84

In the event that MasterCard effects a payment on behalf of a failed customer, MasterCard may seek an assignment of the underlying

receivables of the failed customer. Customers may be charged for the amount of any settlement loss incurred during these ordinary

course activities of the Company.

The Company’s global risk management policies and procedures are aimed at managing the settlement exposure. These risk

management procedures include interaction with the bank regulators of countries in which it operates, requiring customers to make

adjustments to settlement processes, and requiring collateral from customers. MasterCard requires certain customers that are not

in compliance with the Company’s risk standards in effect at the time of review to post collateral, typically in the form of cash,

letters of credit, or guarantees. This requirement is based on management’s review of the individual risk circumstances for each

customer that is out of compliance. In addition to these amounts, MasterCard holds collateral to cover variability and future growth

in customer programs. The Company may also hold collateral to pay merchants in the event of an acquirer failure. Although the

Company is not contractually obligated under its rules to effect such payments to merchants, the Company may elect to do so to

protect brand integrity. MasterCard monitors its credit risk portfolio on a regular basis and the adequacy of collateral on hand.

Additionally, from time to time, the Company reviews its risk management methodology and standards. As such, the amounts of

estimated settlement exposure are revised as necessary.

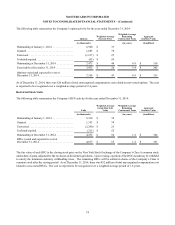

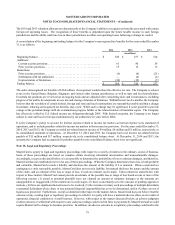

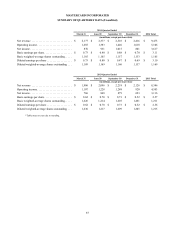

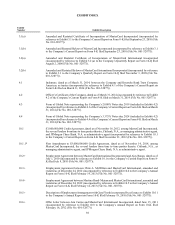

The Company’s estimated settlement exposure from MasterCard, Cirrus and Maestro branded transactions was as follows:

December 31,

2014 December 31,

2013

(in millions)

Gross settlement exposure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 41,729 $ 40,657

Collateral held for settlement exposure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,415)(3,167)

Net uncollateralized settlement exposure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 38,314 $ 37,490

General economic and political conditions in countries in which MasterCard operates affect the Company’s settlement risk. Many

of the Company’s financial institution customers have been directly and adversely impacted by political instability and uncertain

economic conditions. These conditions present increased risk that the Company may have to perform under its settlement guarantee.

This risk could increase if political, economic and financial market conditions deteriorate further. The Company’s global risk

management policies and procedures are revised and enhanced from time to time. Historically, the Company has experienced a

low level of losses from financial institution failures.

MasterCard also provides guarantees to customers and certain other counterparties indemnifying them from losses stemming from

failures of third parties to perform duties. This includes guarantees of MasterCard-branded travelers cheques issued, but not yet

cashed of $465 million and $503 million at December 31, 2014 and 2013, respectively, of which $370 million and $403 million

at December 31, 2014 and 2013, respectively, is mitigated by collateral arrangements. In addition, the Company enters into business

agreements in the ordinary course of business under which the Company agrees to indemnify third parties against damages, losses

and expenses incurred in connection with legal and other proceedings arising from relationships or transactions with the Company.

Certain indemnifications do not provide a stated maximum exposure. As the extent of the Company’s obligations under these

agreements depends entirely upon the occurrence of future events, the Company’s potential future liability under these agreements

is not determinable. Historically, payments made by the Company under these types of contractual arrangements have not been

material.

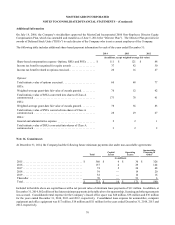

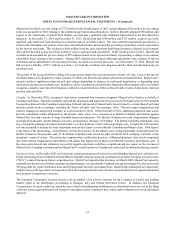

Note 20. Foreign Exchange Risk Management

The Company enters into foreign currency forward contracts to manage risk associated with anticipated receipts and disbursements

which are either transacted in a non-functional currency or valued based on a currency other than its functional currency. The

Company may also enter into foreign currency derivative contracts to offset possible changes in value due to foreign exchange

fluctuations of earnings, assets and liabilities denominated in currencies other than the functional currency of the entity. The

objective of these activities is to reduce the Company’s exposure to gains and losses resulting from fluctuations of foreign currencies

against its functional currencies.

The Company does not designate foreign currency derivatives as hedging instruments pursuant to the accounting guidance for

derivative instruments and hedging activities. The Company records the change in the estimated fair value of the outstanding

derivatives at the end of the reporting period on its consolidated balance sheet and consolidated statement of operations.