MasterCard 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

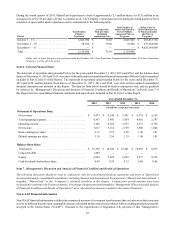

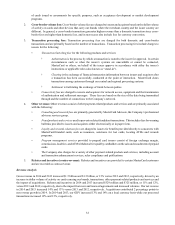

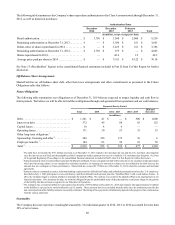

The Company’s GAAP effective tax rates for 2013 was affected by the tax benefits related to the MDL Provision as illustrated in

the table below. The effective tax rate was 29.9% in 2012 including and excluding the portion of the MDL Provision recorded in

2012.

GAAP to Non-GAAP effective tax rate

reconciliation

For the Year Ended December 31, 2013

Actual MDL

Provision Non-GAAP

(in millions, except percentages)

Income before income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,500 $ 95 $ 4,595

Income tax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,384) (34) (1,418)

Net income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,116 $ 61 $ 3,177

Effective tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30.8% 30.9%

During 2014, the Company’s unrecognized tax benefits related to tax positions taken during the current and prior periods increased

by $44 million. The increase in the Company’s unrecognized tax benefits for 2014 was primarily due to judgments related to

current year tax positions. As of December 31, 2014, the Company’s unrecognized tax benefits related to positions taken during

the current and prior period were $364 million, all of which would reduce the Company’s effective tax rate if recognized.

In 2010, in connection with the expansion of the Company’s operations in the Asia Pacific, Middle East and Africa region, the

Company’s subsidiary in Singapore, MasterCard Asia Pacific Pte. Ltd. (“MAPPL”), received an incentive grant from the Singapore

Ministry of Finance. See Note 17 (Income Taxes) to the consolidated financial statements included in Part II, Item 8 of this Report

for further discussion.

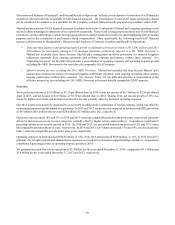

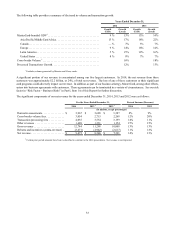

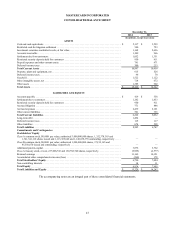

Liquidity and Capital Resources

We need liquidity and access to capital to fund our global operations, credit and settlement exposure, capital expenditures,

investments in our business and current and potential obligations. The Company generates the cash required to meet these needs

through operations. The following table summarizes the cash, cash equivalents, time deposits and investment securities balances

and credit available to the Company at December 31:

Years Ended December 31,

2014 2013 2012

(in billions)

Cash, cash equivalents, time deposits and available-for-sale investment securities 1. . . $ 6.4 $ 6.3 $ 5.0

Unused line of credit 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.0 3.0 3.0

1 Includes $70 million of time deposits included in prepaid expenses and other current assets at December 31,2014. Excludes restricted cash related to

the U.S. merchant class litigation settlement of $540 million and $723 million at December 31, 2014 and December 31, 2013, respectively.

2 The Company did not use any funds from the line of credit during the periods presented, except for business continuity planning and related purposes.

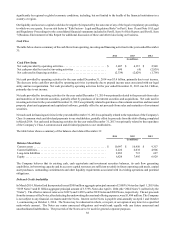

Cash, cash equivalents, time deposits and available-for-sale investment securities held by our foreign subsidiaries (i.e., any entities

where earnings would be subject to U.S. tax upon repatriation) was $2.6 billion and $3.6 billion at December 31, 2014 and 2013,

respectively, or 42% and 57% of our total cash, cash equivalents and available-for-sale investment securities as of such dates. The

decrease in cash, cash equivalents, time deposits and available-for-sale investment securities held by our foreign subsidiaries

during 2014 was primarily driven by prepaid tax in Belgium as well as a repatriation of foreign earnings in conjunction with a

reorganization undertaken to better align our tax and legal entity structure with our business footprint outside of the U.S. The

reorganization occurred in the fourth quarter of 2014. It is our present intention to permanently reinvest the undistributed earnings

associated with our foreign subsidiaries as of December 31, 2014 outside of the United States (as disclosed in Note 17 (Income

Taxes) to the consolidated financial statements included in Part II, Item 8 of this Report), and our current plans do not require

repatriation of these earnings. If these earnings are needed for U.S operations or can no longer be permanently reinvested outside

of the United States, the Company would be subject to U.S. tax upon repatriation.

Our liquidity and access to capital could be negatively impacted by global credit market conditions. The Company guarantees

the settlement of many MasterCard, Cirrus and Maestro-branded transactions between our issuers and acquirers. See Note 19

(Settlement and Other Risk Management) to the consolidated financial statements in Part II, Item 8 of this Report for a description

of these guarantees. Historically, payments under these guarantees have not been significant; however, historical trends may not

be an indication of the future. The risk of loss on these guarantees is specific to individual customers, but may also be driven