MasterCard 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

62

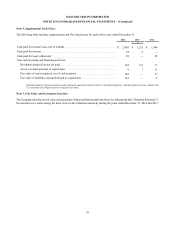

Certain customer and merchant business agreements provide incentives upon entering into the agreement. Customer and merchant

incentives represent payments made or amounts to be paid to customers and merchants under business agreements. Amounts to

be paid for these incentives and the related liability were included in accrued expenses and other liabilities. Costs directly related

to entering into such an agreement are generally deferred and amortized over the life of the agreement.

Prepaid income taxes primarily consists of taxes paid relating to the deferred charge resulting from the reorganization of our legal

entity and tax structure to better align with our business footprint of our non-U.S. operations.

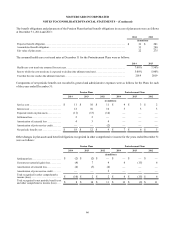

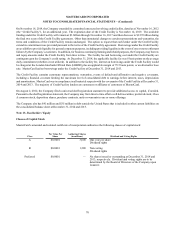

Note 7. Property, Plant and Equipment

Property, plant and equipment consisted of the following at December 31:

2014 2013

(in millions)

Building and land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 510 $ 451

Equipment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 398 344

Furniture and fixtures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53 48

Leasehold improvements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91 77

Property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,052 920

Less: accumulated depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (437) (394)

Property, plant and equipment, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 615 $ 526

As of December 31, 2014 and 2013, capital leases of $29 million and $30 million, respectively, were included in equipment.

Accumulated amortization of these capital leases was $17 million and $21 million as of December 31, 2014 and 2013, respectively.

Depreciation and amortization expense for the above property, plant and equipment was $107 million, $92 million and $84 million

for the years ended December 31, 2014, 2013 and 2012, respectively.

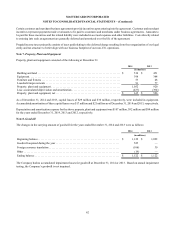

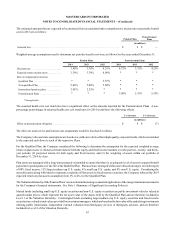

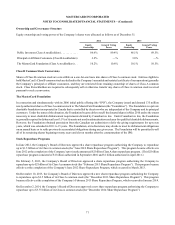

Note 8. Goodwill

The changes in the carrying amount of goodwill for the years ended December 31, 2014 and 2013 were as follows:

2014 2013

(in millions)

Beginning balance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,122 $ 1,092

Goodwill acquired during the year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 525 —

Foreign currency translation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (106) 30

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (19) —

Ending balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,522 $ 1,122

The Company had no accumulated impairment losses for goodwill at December 31, 2014 or 2013. Based on annual impairment

testing, the Company’s goodwill is not impaired.