MasterCard 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MASTERCARD INCORPORATED

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

77

Note 17. Income Taxes

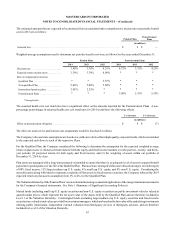

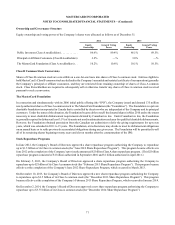

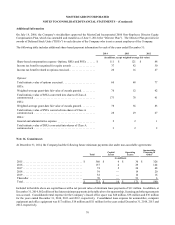

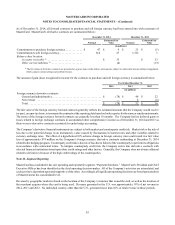

The total income tax provision for the years ended December 31 is comprised of the following components:

2014 2013 2012

(in millions)

Current

Federal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 977 $ 1,010 $ 524

State and local . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47 33 24

Foreign. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 528 456 390

1,552 1,499 938

Deferred

Federal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (81) (100) 248

State and local . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3) (4) 7

Foreign. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6) (11) (19)

(90) (115) 236

Income tax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,462 $ 1,384 $ 1,174

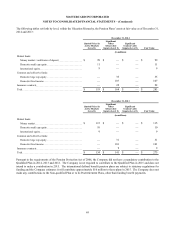

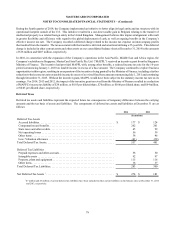

The domestic and foreign components of income before income taxes for the years ended December 31 are as follows:

2014 2013 2012

(in millions)

United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,378 $ 2,741 $ 2,508

Foreign. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,701 1,759 1,425

Income before income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5,079 $ 4,500 $ 3,933

MasterCard has not provided for U.S. federal income and foreign withholding taxes on approximately $3.3 billion of undistributed

earnings from non-U.S. subsidiaries as of December 31, 2014 because such earnings are intended to be reinvested indefinitely

outside of the United States. If these earnings were distributed, foreign tax credits may become available under current law to

reduce the resulting U.S. income tax liability. However, it is not practicable to determine the amount of the tax and credits.

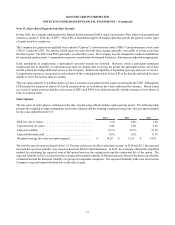

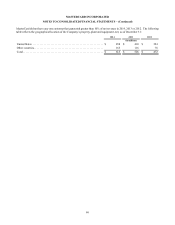

The provision for income taxes differs from the amount of income tax determined by applying the U.S. federal statutory income

tax rate of 35% to pretax income for the years ended December 31, as a result of the following:

2014 2013 2012

Amount Percent Amount Percent Amount Percent

(in millions, except percentages)

Income before income taxes . . . . . . . . . . . . . . . $ 5,079 $ 4,500 $ 3,933

Federal statutory tax . . . . . . . . . . . . . . . . . . . . . 1,778 35.0 % 1,575 35.0 % 1,376 35.0 %

State tax effect, net of federal benefit . . . . . . . . 29 0.6 % 19 0.4 % 23 0.6 %

Foreign tax effect. . . . . . . . . . . . . . . . . . . . . . . . (108) (2.1)% (208) (4.6)% (175) (4.4)%

Foreign repatriation . . . . . . . . . . . . . . . . . . . . . . (177) (3.5)% (14) (0.3)% (27) (0.7)%

Other, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (60) (1.2)% 12 0.3 % (23) (0.6)%

Income tax expense . . . . . . . . . . . . . . . . . . . . . . $ 1,462 28.8 % $ 1,384 30.8 % $ 1,174 29.9 %

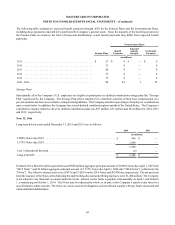

Effective Income Tax Rate

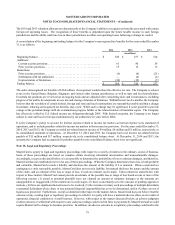

The effective income tax rates for the years ended December 31, 2014, 2013 and 2012 were 28.8%, 30.8% and 29.9%, respectively.

The effective tax rate for 2014 was lower than the effective tax rate for 2013 primarily due to the recognition of a larger repatriation

benefit and an increase in the Company’s domestic production activity deduction in the U.S. related to the Company’s authorization

revenue, partially offset by an unfavorable mix of taxable earnings in 2014. The effective tax rate for 2013 was higher than the

effective tax rate for 2012 primarily due to the recognition of a discrete benefit relating to additional export incentives in 2012 and

a lower benefit related to foreign repatriations in 2013, which was partially offset by a more favorable mix of taxable earnings in

2013.