MasterCard 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 MasterCard annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MasterCard

Annual Report

2014

A SHARED JOURNEY

Table of contents

-

Page 1

A SHARED JOURNEY MasterCard Annual Report 2014 -

Page 2

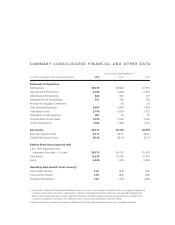

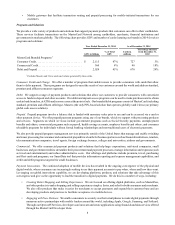

... Tax Expense Net Income Basic Earnings per Share Diluted Earnings per Share Balance Sheet Data (at period end) Cash, Cash Equivalents and Investment Securities - Current Total Assets Equity Operating Data Growth (local currency) Gross Dollar Volume1 Cross-border Volume Processed Transactions2 13% 16... -

Page 3

... by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No The aggregate market value of the registrant's Class A common stock, par value $0.0001 per share, held by non-affiliates (using the New York Stock Exchange closing price as of June 30, 2014, the... -

Page 4

... Data ...Changes in and Disagreements With Accountants on Accounting and Financial Disclosure...Controls and Procedures ...Other Information ...PART III Directors, Executive Officers and Corporate Governance...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management... -

Page 5

... interchange fees and surcharging); regulation related to our participation in the payments industry; existing regulation leading to new regulation in other jurisdictions or of other products; preferential or protective government actions; potential or incurred liability and limitations on business... -

Page 6

...technology company in the global payments industry that connects consumers, financial institutions, merchants, governments and businesses worldwide, enabling them to use electronic forms of payment instead of cash and checks. As the operator of what we believe is the world's fastest payments network... -

Page 7

...open standard for tokenization, which helps protect sensitive cardholder information for digital transactions, significantly reducing fraud and delivering benefits to both issuers and merchants. Among the products we launched in this area in 2014 is MasterCard SafetyNetâ„¢, which provides protection... -

Page 8

... of the purchase, net of a discount (referred to as the "merchant discount" rate, as further described below), to the merchant. Interchange Fees. Interchange fees represent a sharing of a portion of payments system costs among the issuers and acquirers participating in our four-party payments system... -

Page 9

... credit risk arising from the potential financial failure of any principal customers of MasterCard, Maestro and Cirrus, and affiliate debit licensees. Principal customers participate directly in MasterCard programs and are responsible for the settlement and other activities of their sponsored... -

Page 10

...These services facilitate transactions on the MasterCard Network among cardholders, merchants, financial institutions and governments in markets globally. The following chart provides GDV and number of cards featuring our brands in 2014 for select programs and solutions: Year Ended December 31, 2014... -

Page 11

... code; services assisting customers, merchants and third-party service providers in protecting commercial sites from hacker intrusions and subsequent account data compromises; a suite of fraud detection and management products and services; and services protecting issuers from attacks that can... -

Page 12

...consulting and research, fraud products and services, loyalty and rewards solutions, program management services and a variety of other payment-related products and services. Rebates and incentives (contra-revenue). Rebates and incentives are provided to certain MasterCard customers and are recorded... -

Page 13

... In addition, a number of our customers issue American Express and/or Discover-branded payment cards in a manner consistent with a four-party system. We continue to face intense competitive pressure on the prices we charge our issuers and acquirers, and we seek to enter into business agreements with... -

Page 14

... of the U.S. merchant class litigation, we have modified our no-surcharge rules to permit U.S. merchants to surcharge credit cards, subject to certain limitations. Data Protection and Information Security. Aspects of our operations or business are subject to privacy and data protection laws in the... -

Page 15

...Reports The Company's internet address is www.mastercard.com. From time to time, we may use our website as a channel of distribution of material company information. Financial and other material information is routinely posted and accessible on the investor relations section of our corporate website... -

Page 16

.... While not directly regulating network fees, the rules make clear that network fees cannot be used to circumvent the interchange fee restrictions. The regulations require debit and prepaid cards to be enabled with two unaffiliated payments networks. Moreover, an issuer or payments network may not... -

Page 17

..., merchants filed class action or individual suits against MasterCard, Visa and their customers alleging that our interchange fees and acceptance rules violate federal antitrust laws. The settlement of these claims has received final court approval, which is being appealed. In Canada, a number of... -

Page 18

... aspects of our business such as fraud monitoring and the development of information-based products and solutions. In addition, these regulations may increase the costs to our customers of issuing payment products, which may, in turn, decrease the number of our cards and other payment devices that... -

Page 19

...subject to new regulations relating to its payment, clearing and settlement activities, which could address areas such as risk management policies and procedures; collateral requirements; participant default policies and procedures; the ability to complete timely clearing and settlement of financial... -

Page 20

... business models. For example, operators of end-to-end payments systems tend to have greater control over consumer and merchant customer service than operators of four-party payments systems such as ours, in which we must typically rely on our issuing and acquiring financial institution customers... -

Page 21

... and results of operations. In order to increase transaction volumes, enter new markets and expand our card base, we seek to enter into business agreements with customers through which we offer incentives, pricing discounts and other support to customers that issue and promote our products. In... -

Page 22

... relationships with our issuers and acquirers and their further relationships with cardholders and merchants to support our programs and services. We do not issue cards or other payment devices, extend credit to cardholders or determine the interest rates or other fees charged to cardholders using... -

Page 23

...border) transactions conducted using MasterCard, Maestro and Cirrus cards are authorized, cleared and settled by our customers or other processors. Because we do not provide domestic processing services in these countries and do not, as described above, have direct relationships with cardholders, we... -

Page 24

... MasterCard, Maestro and Cirrus-branded cards and generate a significant amount of revenue from cross-border volume fees and transaction processing fees. Revenue from processing crossborder and currency conversion transactions for our customers fluctuates with cross-border travel and our customers... -

Page 25

..., proprietary and other information (including account data information) or data security compromises. Such events could also cause service interruptions, malfunctions or other failures in the physical infrastructure or operations systems that support our businesses and customers (such as the... -

Page 26

... external agents hacking the merchants' or third-party processors' systems and installing malware to compromise the confidentiality and integrity of those systems. Further data security breaches may subject us to reputational damage and/or lawsuits involving payment cards carrying our brands. While... -

Page 27

...) may divert management's time and resources from our core business and disrupt our operations. Moreover, we may spend time and money on acquisitions or projects that do not meet our expectations or increase our revenue. To the extent we pay the purchase price of any acquisition in cash, it would... -

Page 28

...of December 31, 2014, MasterCard and its subsidiaries owned or leased 160 commercial properties. We own our corporate headquarters, a 472,600 square foot building located in Purchase, New York. There is no outstanding debt on this building. Our principal technology and operations center is a 528,000... -

Page 29

... our Board of Directors after taking into account various factors, including our financial condition, operating results, available cash and current and anticipated cash needs. Issuer Purchases of Equity Securities On December 10, 2013, the Company's Board of Directors approved a new share repurchase... -

Page 30

...purchased under the December 2013 Share Repurchase Program and the December 2014 Share Repurchase Program is as of the end of the period. Item 6. Selected Financial Data The statement of operations data presented below for the years ended December 31, 2014, 2013 and 2012, and the balance sheet data... -

Page 31

... between periods. MasterCard's management uses these non-GAAP financial measures to, among other things, evaluate its ongoing operations in relation to historical results, for internal planning and forecasting purposes and in the calculation of performance-based compensation. More specifically... -

Page 32

... Factors - Business Risks" in Part I, Item 1A of this Report related to a failure or breach of our security systems or infrastructure as a result of cyberattacks. Impact of Foreign Currency Rates Our overall operating results can be impacted by changes in foreign currency exchange rates, especially... -

Page 33

... 2012. In addition, changes in foreign currency exchange rates directly impact the calculation of gross dollar volume ("GDV") and gross euro volume ("GEV"), which are used in the calculation of our domestic assessments, cross-border volume fees and volume related rebates and incentives. In most non... -

Page 34

... and rewards solutions fees are charged to issuers for benefits provided directly to consumers with MasterCard-branded cards, such as insurance, assistance for lost cards, locating ATMs and rewards programs. Program management services provided to prepaid card issuers consist of foreign exchange... -

Page 35

..., 2014, 2013 and 2012 were as follows: For the Years Ended December 31, 2014 2013 1 Percent Increase (Decrease) 1 2012 2014 2013 (in millions, except percentages) Domestic assessments ...$ Cross-border volume fees ...Transaction processing fees ...Other revenues ...Gross revenue ...Rebates and... -

Page 36

...2014 and 2013: For the Years Ended December 31, Volume 2014 2013 2 Foreign Currency 1 2014 2013 2 Other 2014 2013 3 2 3 Total 2014 2013 2 Domestic assessments ...Cross-border volume fees...Transaction processing fees ...Other revenues ...Rebates and incentives ...Net revenue ...** Not applicable... -

Page 37

... our industry and brand. Professional fees increased in both 2014 and 2013, primarily due to higher third-party service expenses. Data processing and telecommunication expense consists of expenses to support our global payments network infrastructure, expenses to operate and maintain our computer... -

Page 38

... as of December 31, 2013 related to the timing of MasterCard's administration of the short-term reduction in default credit interchange from U.S. issuers, which expired in April 2014. During 2014, MasterCard executed settlement agreements with a number of opt-out merchants and no adjustments to the... -

Page 39

... cash required to meet these needs through operations. The following table summarizes the cash, cash equivalents, time deposits and investment securities balances and credit available to the Company at December 31: 2014 Years Ended December 31, 2013 2012 (in billions) Cash, cash equivalents, time... -

Page 40

... in March 2014. Net cash used in financing activities for the year ended December 31, 2013 was primarily related to the repurchase of the Company's Class A common stock and dividend payments to our stockholders. The table below shows a summary of the balance sheet data at December 31: 2014 2013 (in... -

Page 41

... Board of Directors after taking into account various factors, including our financial condition, operating results, available cash and current and anticipated cash needs. The following table summarizes the annual, per share dividends paid in the years reflected: Years Ended December 31, 2014 2013... -

Page 42

... financial statements included in Part II, Item 8 of this Report for further discussion. 2 Amounts primarily relate to sponsorships to promote the MasterCard brand. Future cash payments that will become due to our customers under agreements which provide pricing rebates on our standard fees... -

Page 43

...Accounting Estimates The application of U.S. GAAP requires the Company to make estimates and assumptions about certain items and future events that directly affect the Company's reported financial condition. We have established detailed policies and control procedures to provide reasonable assurance... -

Page 44

...2014 related to the hedging program. A 100 basis point adverse change in interest rates would not have a material impact on the Company's financial assets or liabilities at December 31, 2014 and 2013. In addition, there was no material equity price risk at December 31, 2014 or 2013. Foreign Exchange... -

Page 45

... or more settlement failures by the Company's customers. This credit facility has variable rates, which are applied to the borrowing based on terms and conditions set forth in the agreement. See Note 12 (Debt) to the consolidated financial statements in Part II, Item 8 of this Report for additional... -

Page 46

... 31, 2014 and 2013 and for the years ended December 31, 2014, 2013 and 2012 Management's Report on Internal Control Over Financial Reporting...Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheet ...Consolidated Statement of Operations ...Consolidated Statement of... -

Page 47

... Act of 2002, management has assessed the effectiveness of MasterCard's internal control over financial reporting as of December 31, 2014. In making its assessment, management has utilized the criteria set forth in Internal Control - Integrated Framework (2013) issued by the Committee of... -

Page 48

...] REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of MasterCard Incorporated: In our opinion, the consolidated financial statements listed in the accompanying index present fairly, in all material respects, the financial position of MasterCard... -

Page 49

MASTERCARD INCORPORATED CONSOLIDATED BALANCE SHEET December 31, 2014 2013 (in millions, except share data) ASSETS Cash and cash equivalents...$ Restricted cash for litigation settlement ...Investment securities available-for-sale, at fair value...Accounts receivable ...Settlement due from ... -

Page 50

MASTERCARD INCORPORATED CONSOLIDATED STATEMENT OF OPERATIONS For the Years Ended December 31, 2014 2013 (in millions, except per share data) 2012 Net Revenue...$ Operating Expenses General and administrative...Advertising and marketing ...Depreciation and amortization ...Provision for litigation ... -

Page 51

MASTERCARD INCORPORATED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME For the Years Ended December 31, 2014 2013 (in millions) 2012 Net Income...$ Other comprehensive income (loss): Foreign currency translation adjustments ...Defined benefit pension and postretirement plans ...Income tax effect... -

Page 52

...), net of tax ...Cash dividends declared on Class A and Class B common stock, $0.29 per share ...Purchases of treasury stock...Share-based payments ...Conversion of Class B to Class A common stock...Balance at December 31, 2013 . . Net income ...Activity related to noncontrolling interests ...Other... -

Page 53

MASTERCARD INCORPORATED CONSOLIDATED STATEMENT OF CASH FLOWS For the Years Ended December 31, 2014 2013 (in millions) 2012 Operating Activities Net income ...$ Adjustments to reconcile net income to net cash provided by operating activities: Amortization of customer and merchant incentives...... -

Page 54

...of payment solutions and services through a family of well-known brands, including MasterCard, Maestro and Cirrus. The Company also provides value-added offerings such as loyalty and reward programs, information services and consulting. The Company's network is designed to ensure safety and security... -

Page 55

... Company or at the time the rebate or incentive is earned by the customer. Rebates and incentives are calculated based upon estimated performance and the terms of the related business agreements. In addition, MasterCard may make payments to a customer directly related to entering into an agreement... -

Page 56

... operations. Restrictions may include legally restricted deposits, contracts entered into with others, or the Company's statements of intention with regard to particular deposits. In December 2012, the Company made a payment into a qualified cash settlement fund related to its U.S. merchant class... -

Page 57

... 31, 2014 and 2013. Settlement due from/due to customers - The Company operates systems for clearing and settling payment transactions among MasterCard customers. Net settlements are generally cleared daily among customers through settlement cash accounts by wire transfer or other bank clearing... -

Page 58

... expenses on the consolidated statement of operations. Where a non-U.S. currency is the functional currency, translation from that functional currency to U.S. dollars is performed for balance sheet accounts using current exchange rates in effect at the balance sheet date and for revenue... -

Page 59

...adopted the revised accounting guidance effective January 1, 2014. This new accounting guidance did not have a material impact on the Company's consolidated financial statements. Foreign currency - In March 2013, the FASB issued clarifying accounting guidance on the release of cumulative translation... -

Page 60

MASTERCARD INCORPORATED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Note 4. Supplemental Cash Flows The following table includes supplemental cash flow disclosures for each of the years ended December 31: 2014 2013 (in millions) 2012 Cash paid for income taxes, net of refunds ...$ Cash... -

Page 61

... liquid nature. These instruments include cash and cash equivalents, restricted cash, accounts receivable, settlement due from customers, restricted security deposits held for customers, time deposits, prepaid expenses, accounts payable, settlement due to customers and accrued expenses. In addition... -

Page 62

MASTERCARD INCORPORATED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Settlement and Other Guarantee Liabilities The Company estimates the fair value of its settlement and other guarantees using the market pricing approach which applies market assumptions for relevant though not directly ... -

Page 63

... income generated from cash, cash equivalents and investment securities availablefor-sale. Note 6. Prepaid Expenses and Other Assets Prepaid expenses and other current assets consisted of the following at December 31: 2014 (in millions) 2013 Customer and merchant incentives...$ Prepaid income taxes... -

Page 64

... 2013 Beginning balance...Goodwill acquired during the year ...Foreign currency translation ...Other ...Ending balance ... $ 1,122 $ 525 (106) (19) 1,522 $ $ 1,092 - 30 - 1,122 The Company had no accumulated impairment losses for goodwill at December 31, 2014 or 2013. Based on annual impairment... -

Page 65

... 31, 2014 for the years ending December 31: (in millions) 2015 ...2016 ...2017 ...2018 ...2019 and thereafter ... $ 216 159 92 26 43 $ Note 10. Accrued Expenses and Accrued Litigation Accrued expenses consisted of the following at December 31: 2014 (in millions) 2013 536 Customer and merchant... -

Page 66

...years ended December 31, 2014 and 2013. The Company also recognized corresponding effects in accumulated other comprehensive income and deferred taxes. The Company also has an unfunded non-qualified supplemental executive retirement plan (the "Non-qualified Plan") that provides certain key employees... -

Page 67

... the Plans' funded status, key assumptions and amounts recognized in the Company's consolidated balance sheet at December 31: Pension Plans 2014 2013 Postretirement Plans 2014 2013 (in millions, except percentages) Change in benefit obligation Benefit obligation at beginning of year ...$ Service... -

Page 68

... of the years ended December 31: Pension Plans 2014 2013 2012 (in millions) 2014 Postretirement Plans 2013 2012 Service cost ...Interest cost ...Expected return on plan assets ...Settlement loss ...Amortization of actuarial loss ...Amortization of prior service credit...Net periodic benefit cost... -

Page 69

... for the years ended December 31: Pension Plans 2014 2013 2012 2014 Postretirement Plans 2013 2012 Discount rate ...Expected return on plan assets ...Rate of compensation increase: Qualified Plan ...Non-qualified Plan...International pension plans ...Postretirement Plans ...* Not applicable 3.80... -

Page 70

... to the Qualified Plan in 2014, 2013 and 2012. The Company is not required to contribute to the Qualified Plan in 2015 and does not intend to make a contribution in 2015. The international defined benefit pension plans are subject to statutory regulations for funding and the Company estimates it... -

Page 71

... Plans Benefit Payments Expected Subsidy Receipts Net Benefit Payments Pension Plans (in millions) 2015 ...2016 ...2017 ...2018 ...2019 ...2020 - 2024 ... $ 27 21 20 27 19 80 $ 4 4 4 4 4 24 $ - - - - - 1 $ 4 4 4 4 4 23 Savings Plans Substantially all of the Company's U.S. employees... -

Page 72

...MasterCard was in compliance in all material respects with the covenants of the Credit Facility at December 31, 2014 and 2013. The majority of Credit Facility lenders are customers or affiliates of customers of MasterCard. On August 2, 2012, the Company filed a universal shelf registration statement... -

Page 73

... TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Ownership and Governance Structure Equity ownership and voting power of the Company's shares were allocated as follows as of December 31: 2014 Equity Ownership General Voting Power Equity Ownership 2013 General Voting Power Public Investors (Class... -

Page 74

... the Company's share repurchase authorizations of its Class A common stock through December 31, 2014, as well as historical purchases: Authorization Dates December 2014 December 2013 February 2013 June 2012 April 2011 Total (in millions, except average price data) Board authorization ...Dollar... -

Page 75

... The risk-free rate of return was based on the U.S. Treasury yield curve in effect on the date of grant. In 2014 and 2013, the expected term and the expected volatility were based on historical MasterCard information. In 2012, the Company utilized the simplified method for calculating the expected... -

Page 76

..., 2014... 5,330 1,353 (2,240) (211) 4,232 4,077 $ $ $ $ $ $ 38 76 25 52 56 55 1.2 1.2 $ $ 364 351 The fair value of each RSU is the closing stock price on the New York Stock Exchange of the Company's Class A common stock on the date of grant, adjusted for the exclusion of dividend equivalents... -

Page 77

...against an annually predetermined return on equity goal, with an average return on equity per year over the three-year period commencing on January 1 of the grant year. The initial fair value of each PSU is the closing price on the New York Stock Exchange of the Company's Class A common stock on the... -

Page 78

... 2012 (the "Director Plan"). The Director Plan provides for awards of Deferred Stock Units ("DSUs") to each director of the Company who is not a current employee of the Company. The following table includes additional share-based payment information for each of the years ended December 31: 2014 2013... -

Page 79

MASTERCARD INCORPORATED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) Note 17. Income Taxes The total income tax provision for the years ended December 31 is comprised of the following components: 2014 2013 (in millions) 2012 Current Federal ...State and local ...Foreign...Deferred ... -

Page 80

MASTERCARD INCORPORATED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (Continued) During the fourth quarter of 2014, the Company implemented an initiative to better align its legal entity and tax structure with its operational footprint outside of the U.S. This initiative resulted in a one-time ... -

Page 81

...in such foreign jurisdictions and the ability under tax law in these jurisdictions to utilize net operating losses following a change in control. A reconciliation of the beginning and ending balance for the Company's unrecognized tax benefits for the years ended December 31, is as follows: 2014 2013... -

Page 82

... competition law claims under state law. The complaints allege, among other things, that MasterCard, Visa, and certain financial institutions conspired to set the price of interchange fees, enacted point of sale acceptance rules (including the no surcharge rule) in violation of antitrust laws and... -

Page 83

..., in the qualified cash settlement fund classified as restricted cash on its balance sheet. The class settlement agreement provided for a return to the defendants of a portion of the class cash settlement fund, based upon the percentage of purchase volume represented by the opt-out merchants. This... -

Page 84

...has opened proceedings to investigate: (1) MasterCard's interregional interchange fees that apply when a card issued outside the EEA is used at a merchant location in the EEA, (2) central acquiring rules, which apply when a merchant uses the services of an acquirer established in another country and... -

Page 85

...objectors' request to appeal that ruling. ATM Non-Discrimination Rule Surcharge Complaints In October 2011, a trade association of independent Automated Teller Machine ("ATM") operators and 13 independent ATM operators filed a complaint styled as a class action lawsuit in the U.S. District Court for... -

Page 86

...These risk management procedures include interaction with the bank regulators of countries in which it operates, requiring customers to make adjustments to settlement processes, and requiring collateral from customers. MasterCard requires certain customers that are not in compliance with the Company... -

Page 87

... and supportive of the other. Accordingly, all significant operating decisions are based upon analysis of MasterCard at the consolidated level. Revenue by geographic market is based on the location of the Company's customer that issued the card, as well as the location of the merchant acquirer where... -

Page 88

... CONSOLIDATED FINANCIAL STATEMENTS - (Continued) MasterCard did not have any one customer that generated greater than 10% of net revenue in 2014, 2013 or 2012. The following table reflects the geographical location of the Company's property, plant and equipment, net, as of December 31: 2014 2013 (in... -

Page 89

MASTERCARD INCORPORATED SUMMARY OF QUARTERLY DATA (Unaudited) 2014 Quarter Ended March 31 June 30 September 30 December 31 2014 Total (in millions, except per share data) Net revenue ...$ Operating income ...Net income ...Basic earnings per share ...$ Basic weighted-average shares outstanding ...... -

Page 90

... in Part II, Item 8. PricewaterhouseCoopers LLP, an independent registered public accounting firm, has audited the consolidated financial statements included in this Annual Report on Form 10-K and, as part of their audit, has issued their report, included herein, on the effectiveness of our internal... -

Page 91

...Annual Meeting of Stockholders to be held on June 9, 2015 (the "Proxy Statement"). The aforementioned information in the Proxy Statement is incorporated by reference into this Report. Item 11. Executive Compensation The information required by this Item with respect to executive officer and director... -

Page 92

...has duly caused this Annual Report on Form 10-K to be signed on its behalf by the undersigned, thereunto duly authorized. MASTERCARD INCORPORATED (Registrant) Date: February 13, 2015 By: /s/ AJAY BANGA Ajay Banga President and Chief Executive Officer (Principal Executive Officer) Pursuant to the... -

Page 93

...13, 2015 By: /s/ MERIT E. JANOW Merit E. Janow Director Date: February 13, 2015 By: /s/ NANCY J. KARCH Nancy J. Karch Director Date: February 13, 2015 By: /s/ MARC OLIVIÉ Marc Olivié Director Date: February 13, 2015 By: /s/ RIMA QURESHI Rima Qureshi Director Date: February 13, 2015 By... -

Page 94

...MasterCard Incorporated, the several lenders from time to time parties thereto, Citibank, N.A., as managing administrative agent, and JPMorgan Chase Bank, N.A. as administrative agent (incorporated by reference to Exhibit 10.1 to the Company's Current Report on Form 8-K filed November 21, 2012 (File... -

Page 95

... between MasterCard UK Management Services Limited and Ann Cairns, dated July 6, 2011 (incorporated by reference to Exhibit 10.8.2 to the Company's Annual Report on Form 10-K filed February 16, 2012 (File No. 001-32877)). MasterCard International Incorporated Supplemental Executive Retirement Plan... -

Page 96

... Report on Form 10-Q filed August 8, 2003 (File No. 000-50250)). Stipulation and Agreement of Settlement, dated July 20, 2006, between MasterCard Incorporated, the several defendants and the plaintiffs in the consolidated federal class action lawsuit titled In re Foreign Currency Conversion Fee... -

Page 97

... Service Association and MasterCard's customer banks that are parties thereto (incorporated by reference to Exhibit 10.2 to the Company's Quarterly Report on Form 10-Q filed October 30, 2014 (File No. 001-32877)). MasterCard Settlement and Judgment Sharing Agreement, dated as of February 7, 2011... -

Page 98

** Exhibit omits certain information that has been filed separately with the U.S. Securities and Exchange Commission and has been granted confidential treatment. The agreements and other documents filed as exhibits to this report are not intended to provide factual information or other disclosure ... -

Page 99

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 100

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 101

... on and other investor information. Tuesday, June 9, 8:30 a.m., at MasterCard Corporate Headquarters, 2000 Purchase Street, Purchase, New York. Investor Relations 1.914.249.4565 [email protected] Stock Listing and Symbol New York Stock Exchange Symbol: MA Transfer Agent Stockholder... -

Page 102

... and Public Affairs Columbia University Nancy J. Karch 2 (Chair), 3 Director Emeritus McKinsey & Company (1) Human Resources and Compensation Committee (2) Nominating and Corporate Governance Committee (3) Audit Committee (4) Vice Chairman in the Ofï¬ce of the CEO and advisor to the Executive...