Kraft 2001 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

55

Credit exposure and credit risk: The Company is exposed to

credit loss in the event of nonperformance by counterparties.

However, the Company does not anticipate nonperformance and

such exposure was not material at December 31, 2001.

Fair value: The aggregate fair value, based on market quotes, of

the Company’s third-party debt at December 31, 2001 was $9,360

million as compared with its carrying value of $9,355 million.

The aggregate fair value of the Company’s third-party debt at

December 31, 2000 was $3,605 million as compared with its

carrying value of $3,554 million. Based on interest rates available

to the Company for issuances of debt with similar terms and

remaining maturities, the aggregate fair value and carrying value of

the Company’s long-term notes payable to Philip Morris and its

affiliates were $5,325 million and $5,000 million, respectively, at

December 31, 2001 and $21,357 million and $21,407 million,

respectively, at December 31, 2000.

See Notes 3, 7 and 8 for additional disclosures of fair value for

short-term borrowings and long-term debt.

Note 17. Contingencies:

The Company and its subsidiaries are parties to a variety of legal

proceedings arising out of the normal course of business, including

a few cases in which substantial amounts of damages are sought.

The Company believes that it has valid defenses and is vigorously

defending the litigation pending against it. While the results of

litigation cannot be predicted with certainty, management believes

that the final outcome of these proceedings will not have a material

adverse effect on the Company’s consolidated financial position or

results of operations.

Prior to the effectiveness of the registration statement covering the

shares of the Company’s Class A common stock being sold in the

IPO, some of the underwriters of the IPO provided written copies of

a “pre-marketing feedback” form to certain potential purchasers

of the Company’s Class A common stock. The feedback form

was for internal use only and was designed to elicit orally certain

information from designated accounts as part of designing strategy

in connection with the IPO. This form may have constituted a

prospectus that did not meet the requirements of the Securities Act

of 1933.

If the distribution of this form by the underwriters did constitute a

violation of the Securities Act of 1933, persons who received this

form, directly or indirectly, and who purchased the Company’s

Class A common stock in the IPO may have the right, for a period

of one year from the date of the violation, to obtain recovery of

the consideration paid in connection with their purchase of the

Company’s Class A common stock or, if they had already sold the

stock, attempt to recover losses resulting from their purchase of

the Class A common stock. The Company cannot determine

the amount of Class A common stock that was purchased by

recipients of the “pre-marketing feedback” form. However, the

Company does not believe that any attempts to rescind these

purchases or to recover these losses will have a material adverse

effect on its consolidated financial position or results of operations.

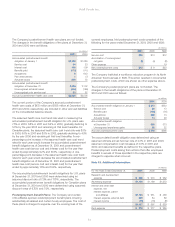

Note 18. Quarterly Financial Data (Unaudited):

(in millions, except per share data) 2001 Quarters

First Second Third Fourth

Operating revenues $8,367 $8,692 $8,056 $8,760

Gross profit $4,100 $4,300 $3,832 $4,112

Net earnings $ 326 $ 505 $ 503 $ 548

Weighted average shares

for diluted EPS 1,455 1,510 1,735 1,736

Per share data:

Basic EPS $ 0.22 $ 0.33 $ 0.29 $ 0.32

Diluted EPS $ 0.22 $ 0.33 $ 0.29 $ 0.32

Dividends declared $ 0.13 $ 0.13

Market price—high $32.00 $34.81 $35.57

—low $29.50 $30.00 $31.50

(in millions, except per share data) 2000 Quarters

First Second Third Fourth

Operating revenues $6,460 $6,974 $6,215 $6,883

Gross profit $3,079 $3,417 $2,958 $3,161

Net earnings $ 470 $ 568 $ 548 $ 415

Weighted average shares

for diluted EPS 1,455 1,455 1,455 1,455

Per share data:

Basic EPS $ 0.32 $ 0.39 $ 0.38 $ 0.29

Diluted EPS $ 0.32 $ 0.39 $ 0.38 $ 0.29

Basic and diluted EPS are computed independently for each of the periods presented.

Accordingly, the sum of the quarterly EPS amounts may not agree to the total year.

On June 13, 2001, the Company completed an IPO by issuing 280

million shares of its Class A common stock.

During the third quarter of 2000, the Company recorded a pre-tax

gain of $139 million on the sale of a French confectionery business.

The principal stock exchange, on which the Company’s Class A common stock is listed, is the New York Stock Exchange. At January 31,

2002, there were approximately 1,500 holders of record of the Company’s Class A common stock.