Kraft 2001 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

47

Note 6. Inventories:

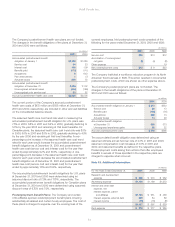

The cost of approximately 54% and 56% of inventories in 2001 and

2000, respectively, was determined using the LIFO method. The

stated LIFO amounts of inventories were approximately $150 million

and $171 million higher than the current cost of inventories at

December 31, 2001 and 2000, respectively.

Note 7. Short-Term Borrowings and

Borrowing Arrangements:

At December 31, 2001, the Company had short-term borrowings

of $2,681 million, consisting principally of commercial paper

borrowings with an average year-end interest rate of 1.9%. Of this

amount, the Company reclassified $2.0 billion of the commercial

paper borrowings to long-term debt based upon its intent and

ability to refinance these borrowings. At December 31, 2000, the

Company had short-term borrowings of $146 million with an

average year-end interest rate of 9.2%.

The fair values of the Company’s short-term borrowings at

December 31, 2001 and 2000, based upon current market interest

rates, approximate the amounts disclosed above.

During 2001, the Company entered into agreements for a $2.0

billion 5-year revolving credit facility maturing in July 2006 and a

$4.0 billion 364-day revolving credit facility maturing in July 2002.

The Company intends to use these credit facilities to support

commercial paper borrowings, the proceeds of which will be used

for general corporate purposes. These facilities require the

maintenance of a minimum net worth. None of these facilities were

drawn at December 31, 2001. In addition, the Company maintains

credit lines with a number of lending institutions amounting to

approximately $768 million. The Company maintains these credit

lines primarily to meet the short-term working capital needs of its

international businesses.

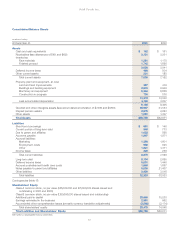

Note 8. Long-Term Debt:

At December 31, 2001 and 2000, the Company’s long-term debt

consisted of the following:

(in millions)

2001 2000

Short-term borrowings, reclassified as

long-term debt $2,000 $

—

Notes, 4.63% to 7.55% (average effective

rate 5.95%), due through 2035 6,229 2,751

Debentures, 7.00% to 8.50% (average effective

rate 10.14%), $315 million face amount,

due through 2017 258 401

Foreign currency obligations 136 173

Other 51 83

8,674 3,408

Less current portion of long-term debt (540) (713)

$8,134 $2,695

Aggregate maturities of long-term debt, excluding short-term

borrowings reclassified as long-term debt, are as follows:

(in millions)

2002 $ 540

2003 378

2004 85

2005 730

2006 1,252

2007-2011 2,593

Thereafter 1,153

Based on market quotes, where available, or interest rates currently

available to the Company for issuance of debt with similar terms

and remaining maturities, the aggregate fair value of the Company’s

long-term debt, including the current portion of long-term debt,

at December 31, 2001 and 2000 was $8,679 million and $3,459

million, respectively.

Note 9. Capital Stock:

The Company’s articles of incorporation authorize 3.0 billion shares

of Class A common stock, 2.0 billion shares of Class B common

stock and 500 million shares of preferred stock. At December 31,

2001, there were 555 million Class A common shares and 1.18

billion Class B common shares issued and outstanding, of which

Philip Morris holds 275 million Class A common shares and all of

the Class B common shares. There are no preferred shares issued

and outstanding. Class A common shares are entitled to one vote

each while Class B common shares are entitled to ten votes each.

Therefore, Philip Morris holds 97.7% of the combined voting power

of the Company’s outstanding common stock. At December 31,

2001, 75,949,530 shares of common stock were reserved for stock

options and other stock awards.

Note 10. Stock Plans:

The Company’s Board of Directors has adopted the 2001 Kraft

Performance Incentive Plan (the “Plan”), which was established

concurrently with the IPO. Under the Plan, the Company may grant

stock options, stock appreciation rights, restricted stock, reload

options and other awards based on the Company’s Class A

common stock, as well as performance-based annual and long-

term incentive awards. Up to 75 million shares of the Company’s

Class A common stock may be issued under the Plan. The

Company’s Board of Directors granted options for 21,029,777

shares of Class A common stock concurrent with the closing

date of the IPO (June 13, 2001) at an exercise price equal to the

IPO price of $31.00 per share. A portion of the shares granted

(18,904,637) becomes exercisable on January 31, 2003, and will

expire ten years from the date of the grant. The remainder of the

shares granted (2,125,140) may become exercisable on a schedule

based on total shareholder return for the Company’s Class A

common stock during the three years following the date of the

grant, or will become exercisable five years from the date of

the grant. These options will also expire ten years from the date