Kraft 2001 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

31

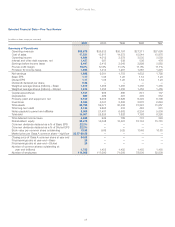

Kraft Foods International (continued)

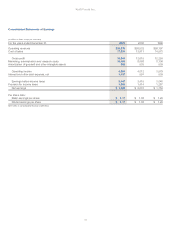

(in millions)

Year Ended December 31, 2001 2000 1999

Reported operating

companies income:

Europe, Middle East and Africa $ 861 $1,019 $ 895

Latin America and Asia Pacific 378 189 168

Total reported operating

companies income 1,239 1,208 1,063

Gain on sale of a French

confectionery business:

Europe, Middle East and Africa (139)

Operating companies income of

businesses sold:

Europe, Middle East and Africa (32) (52)

Latin America and Asia Pacific (1) (3) (4)

Estimated impact of century

date change:

Europe, Middle East and Africa 8(8)

Latin America and Asia Pacific 5(5)

Underlying operating

companies income 1,238 1,047 $ 994

Nabisco operating companies income:

Europe, Middle East and Africa 1

Latin America and Asia Pacific 93

Pro forma operating

companies income $1,238 $1,141

2001 compared with 2000

KFI’s reported volume for 2001 increased 34.4% over 2000, due

primarily to the acquisition of Nabisco. On a pro forma basis,

volume for 2001 increased 3.5% over 2000. Excluding the 53rd

week of shipments in 2000, volume increased 4.7%, benefiting from

gains across most consumer sectors and driven by continued

growth in the developing markets of Central and Eastern Europe,

Latin America and Asia Pacific.

During 2001, reported operating revenues increased $698 million

(8.6%) over 2000, due primarily to the acquisition of Nabisco ($1.2

billion) and the shift in CDC revenues ($26 million), partially offset by

unfavorable currency movements ($460 million) and the revenues

of divested businesses ($148 million). On a pro forma basis,

operating revenues decreased 4.0%, primarily reflecting unfavorable

currency movements.

Reported operating companies income for 2001 increased $31

million (2.6%) over 2000, due primarily to the acquisition of Nabisco

($128 million), lower marketing, administration and research costs

($119 million) and the shift in CDC income ($13 million), partially

offset by the gain on the French Confectionery Sale in 2000 ($139

million), unfavorable currency movements ($51 million) and income

of divested businesses ($34 million). On a pro forma basis, which

does not include the French Confectionery Sale in 2000, operating

companies income increased 8.5%.

The following discusses operating results within each of KFI’s

reportable segments.

Europe, Middle East and Africa: Reported and pro forma

volume for 2001 decreased slightly from 2000, due primarily to

the 53rd week of shipments in 2000. Excluding the 53rd week of

shipments in 2000, volume increased 1.3%, due primarily to volume

gains in the developing markets of Central and Eastern Europe and

growth in many Western European markets, partially offset by lower

volume in Germany, reflecting increased price competition and

trade inventory reductions, and lower canned meats volume in Italy.

In beverages, volume increased in both coffee and refreshment

beverages. Coffee volume grew in many markets, driven by new

product introductions and recent acquisitions in Romania, Morocco

and Bulgaria. In Germany, coffee volume increased despite trade

inventory reductions. Refreshment beverages volume increased,

driven by higher sales to the Middle East. Snacks volume

increased, driven by confectionery and salty snacks, particularly in

Central and Eastern Europe. Snacks volume in Germany was lower

due to increased price competition and trade inventory reductions.

Cheese volume increased due primarily to Philadelphia cream

cheese growth across the region, partially offset by lower volume

in Germany. In convenient meals and grocery, volume declined as

lower canned meats volume in Italy and a decline in grocery

volume in Germany were partially offset by higher shipments of

lunch combinations and pourable dressings in the United Kingdom.

Reported operating revenues for 2001 decreased $485 million

(7.1%) from 2000, due primarily to unfavorable currency movements

($251 million), revenues from divested businesses ($131 million),

lower pricing ($123 million, primarily commodity-driven coffee price

decreases) and lower volume/mix ($69 million), partially offset by

the acquisition of Nabisco ($46 million), the 2001 acquisitions of

coffee businesses in Romania, Morocco and Bulgaria ($29 million)

and the shift in CDC revenues ($14 million). On a pro forma basis,

operating revenues decreased 6.1%, reflecting unfavorable currency

movements and commodity-related coffee price decreases.

Reported operating companies income for 2001 decreased $158

million (15.5%) from 2000, due primarily to the gain on the French

Confectionery Sale in 2000 ($139 million), unfavorable currency

movements ($19 million), income from divested businesses ($32

million), lower volume/mix ($12 million) and unfavorable margins

($16 million), partially offset by lower marketing, administration and

research costs ($50 million) and the shift in CDC income. On a pro

forma basis, operating companies income increased 0.5%.

Latin America and Asia Pacific: Reported volume for 2001

increased more than 100% from 2000, due primarily to the

acquisition of Nabisco. On a pro forma basis, volume for 2001

increased 9.6% over 2000. Excluding the 53rd week of shipments

in 2000, volume increased 9.9%, due to gains across most

consumer sectors. Beverages volume increased, due primarily to

growth in refreshment beverages in Latin America and Asia Pacific,

and coffee in Asia Pacific. Cheese volume increased due primarily

to cream cheese and process cheese. Grocery volume was higher,

due primarily to new product introductions. Snacks volume

increased, driven primarily by new biscuit product introductions