Kraft 2001 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

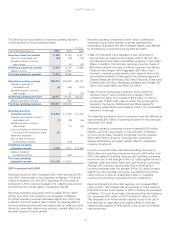

Cheese, Meals and Enhancers – Volume grew 0.9%, as growth in Meals and

Enhancers and in Canada more than offset declines in Cheese and Food Service,

due in part to exiting non -branded businesses. Operating companies income

increased 5.1%.

Oscar Mayer and Pizza – Volume was up 2.3% on gains from our processed meats,

meat alternatives and pizza businesses. Operating companies income was up 5.4%.

Kraft Foods International:

Europe, Middle East and Africa – Volume increased 1.3%, as strong growth in Central

and Eastern Europe and gains in numerous Western European markets were partially

offset by declines in Germany and Italy. Operating companies income increased 0.5%.

Latin America and Asia Pacific – Volume increased a strong 9.9%, led by broad-based

growth in snacks, beverages, cheese and grocery products. Operating companies

income increased 32.7%.

Overall, the earnings growth we delivered was once again among the industry’s best.

But as good a year as it was, we’re not satisfied. Looking ahead, we will continue to

build both the bottom and top lines with five enduring strategies:

Accelerate growth of core brands – To drive growth, we’re leveraging one of the industry’s

most powerful portfolios of brands to address the marketplace’s most compelling trends.

We’re focusing new-product innovation on four high-growth consumer needs: snacking,

beverages, convenient meals and health & wellness. We’re capturing a greater share

of the fastest-growing distribution channels, including supercenters, convenience stores,

mass merchandisers, drug stores, club stores and food away from home. And we’re

developing customized products and marketing programs to reach rapidly expanding

demographic segments such as the African-American and Hispanic populations

in the U.S.

Drive global category leadership – Managed effectively, category leadership is

a compelling advantage. With our large number of leading brands, we’re able

to capture a strong share of each category’s growth, giving us the resources to

reinvest in marketing and innovation and keep us well positioned for future growth.

We build category strength with our worldwide councils of category experts, who

share best practices, fast-adapt product ideas, and optimize productivity and

sourcing in our global biscuits, cheese, coffee, confectionery and refreshment

beverages businesses.

We are intent on driving growth in developing markets. More than 80% of the world’s

population lives in developing markets, yet only 9% of Kraft’s revenues are sourced

there. Our rapid expansion in these markets will continue by broadening our brand

portfolio in current categories, bringing new categories to current geographies,

expanding to new geographies and building distribution in all geographies where

we operate.

Optimize our portfolio – With the integration of Nabisco, our reported revenues increased

28%, giving us a leading global position in snack foods. We will continue to acquire

high-potential businesses to jump-start us in new fast-growing categories or countries

and give us greater scale in existing ones. We also will divest slower-growth or lower-

margin businesses that no longer constitute a strategic fit.

Drive world-class productivity, quality and service – Strong cost management funds

our future, helping us deliver top-tier growth and profitability. Using a continuously

replenished, three-year pipeline of ideas, our productivity programs now yield annual

Our Strategies

Accelerate growth of core brands

Drive global category leadership

Optimize our portfolio

Drive world-class productivity,

quality and service

Build employee and organizational

excellence