Kraft 2001 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

33

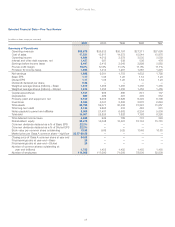

Reported operating companies income increased $21 million

(12.5%) over 1999, due primarily to higher volume/mix ($43 million)

and higher pricing ($14 million), partially offset by higher marketing,

administration and research costs ($20 million) and the shift in CDC

income ($10 million). On an underlying basis, operating companies

income increased 20.1%.

Financial Review

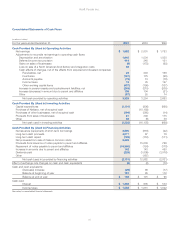

Net Cash Provided by Operating Activities

Net cash provided by operating activities was $3.3 billion in 2001

and 2000, while $2.7 billion was provided by operating activities

in 1999. The increase in 2000 operating cash flows over 1999

primarily reflected increased net earnings of $248 million and

reduced levels of receivables and inventories of $318 million, which

included the shift in working capital attributable to the CDC.

Net Cash Used in Investing Activities

During 2001, 2000 and 1999, net cash used in investing activities

was $1.2 billion, $16.1 billion and $669 million, respectively. The

increase in 2000 primarily reflects the cash used for the acquisition

of Nabisco.

Capital expenditures, which were funded by operating activities,

were $1.1 billion, $906 million and $860 million in 2001, 2000 and

1999, respectively. The capital expenditures were primarily to

modernize the manufacturing facilities, lower cost of production

and expand production capacity for growing product lines. The

additional expenditures in 2001 were due primarily to the

acquisition of Nabisco. Capital expenditures are expected to be

approximately $1.2 billion in 2002 and are expected to be funded

from operations.

During 2001, the Company purchased coffee businesses in

Romania, Morocco and Bulgaria and also acquired confectionery

businesses in Russia and Poland. The total cost of these and other

smaller acquisitions was $194 million.

During 2000, the Company purchased Boca Burger, Inc. and

Balance Bar Co. The total cost of these and other smaller

acquisitions was $365 million.

Net Cash Used in Financing Activities

During 2001, net cash of $2.1 billion was used in financing activities,

compared with $13.0 billion provided by financing activities

during 2000. During 2001, financing activities included net debt

repayments of $2.0 billion, excluding debt repayments made with

IPO proceeds. The net proceeds from the IPO were used to repay

debt to Philip Morris and, as a result, had no impact on financing

cash flows. In 2000, the Company’s financing activities provided

cash, as additional borrowings to finance the acquisition of

Nabisco exceeded the cash used to pay dividends. During 1999,

net cash of $2.0 billion was used in financing activities.

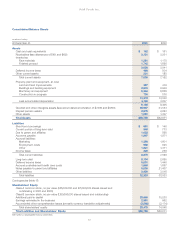

Debt and Liquidity

The SEC recently issued Financial Reporting Release No. 61, which

sets forth the views of the SEC regarding enhanced disclosures

relating to liquidity and capital resources. The information provided

below about the Company’s debt, credit facilities, guarantees and

future commitments is included here to facilitate a review of the

Company’s liquidity.

Debt: The Company’s total debt, including intercompany accounts

payable to Philip Morris, was $16.0 billion at December 31, 2001,

and $25.8 billion at December 31, 2000. The decrease was due

primarily to the repayment of $8.4 billion of long-term notes payable

to Philip Morris with the net proceeds from the IPO.

During 2001, the Company refinanced $2.6 billion, representing the

remaining portion of an $11.0 billion long-term note payable to Philip

Morris, with the proceeds from short-term borrowings. In addition,

the Company refinanced long-term, fixed-rate Swiss franc notes

payable to Philip Morris with short-term Swiss franc borrowings

from Philip Morris at variable interest rates.

During 2001, in anticipation of a public bond offering, the Company

converted its $4.0 billion, 7.40% note payable to Philip Morris,

originally maturing in December 2002, into a 3.56125% note

payable to Philip Morris maturing in November 2001. On November

2, 2001, the Company completed a $4.0 billion public global bond

offering at a weighted average interest rate of 5.48%, the net

proceeds of which were used to repay the 3.56125% short-term

note payable to Philip Morris.

As discussed in Notes 3, 7 and 8 to the consolidated financial

statements, the Company’s total debt of $16.0 billion at December

31, 2001 is due to be repaid as follows: in 2002, $4.9 billion; in

2003-2004, $0.5 billion; in 2005-2006, $2.0 billion; and thereafter,

$8.6 billion. Debt obligations due to be repaid in 2002 will be

satisfied with a combination of short-term borrowings, refinancing

transactions in the debt markets and operating cash flows. The

Company’s debt-to-equity ratio was 0.68 at December 31, 2001

and 1.84 at December 31, 2000.

Credit Ratings: The Company’s credit ratings by Moody’s at

December 31, 2001 were “P-1” in the commercial paper market and

“A2” for long-term debt obligations. The Company’s credit ratings

by Standard & Poor’s at December 31, 2001 were “A-1” in the

commercial paper market, and “A-” for long-term debt obligations.

The Company’s credit ratings by Fitch Rating Services at

December 31, 2001 were “F-1” in the commercial paper market and

“A” for long-term debt obligations. Changes in the Company’s credit

ratings, although none are currently anticipated, could result in

corresponding changes in the Company’s borrowing costs.

However, none of the Company’s debt agreements require

accelerated repayment in the event of a decrease in credit ratings.

Credit Facilities: In July 2001, reflecting the Company’s reduced

requirements for credit facilities following the IPO, Philip Morris

terminated an existing $9.0 billion 364-day revolving credit

agreement that could have been transferred to the Company. Upon