Kraft 2001 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

53

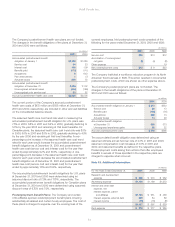

The Company’s postretirement health care plans are not funded.

The changes in the benefit obligations of the plans at December 31,

2001 and 2000 were as follows:

(in millions)

2001 2000

Accumulated postretirement benefit

obligation at January 1 $2,102 $1,380

Service cost 34 23

Interest cost 168 109

Benefits paid (172) (111)

Acquisitions 8633

Plan amendments 1(7)

Actuarial losses 295 75

Accumulated postretirement benefit

obligation at December 31 2,436 2,102

Unrecognized actuarial losses (464) (159)

Unrecognized prior service cost 53 62

Accrued postretirement health care costs $2,025 $2,005

The current portion of the Company’s accrued postretirement

health care costs of $172 million and $138 million at December 31,

2001 and 2000, respectively, are included in other accrued liabilities

on the consolidated balance sheets.

The assumed health care cost trend rate used in measuring the

accumulated postretirement benefit obligation for U.S. plans was

7.5% in 2000, 6.8% in 2001 and 6.2% in 2002, gradually declining to

5.0% by the year 2005 and remaining at that level thereafter. For

Canadian plans, the assumed health care cost trend rate was 8.0%

in 2000, 9.0% in 2001 and 8.0% in 2002, gradually declining to 4.0%

by the year 2006 and remaining at that level thereafter. A one-

percentage-point increase in the assumed health care cost trend

rates for each year would increase the accumulated postretirement

benefit obligation as of December 31, 2001 and postretirement

health care cost (service cost and interest cost) for the year then

ended by approximately 9.2% and 12.9%, respectively. A one-

percentage-point decrease in the assumed health care cost trend

rates for each year would decrease the accumulated postretirement

benefit obligation as of December 31, 2001 and postretirement

health care cost (service cost and interest cost) for the year then

ended by approximately 7.6% and 10.4%, respectively.

The accumulated postretirement benefit obligations for U.S. plans

at December 31, 2001 and 2000 were determined using an

assumed discount rate of 7.0% and 7.75%, respectively. The

accumulated postretirement benefit obligations for Canadian plans

at December 31, 2001 and 2000 were determined using assumed

discount rates of 6.75% and 7.0%, respectively.

Postemployment Benefit Plans: The Company and certain

of its affiliates sponsor postemployment benefit plans covering

substantially all salaried and certain hourly employees. The cost of

these plans is charged to expense over the working lives of the

covered employees. Net postemployment costs consisted of the

following for the years ended December 31, 2001, 2000 and 1999:

(in millions)

2001 2000 1999

Service cost $20 $13 $12

Amortization of unrecognized

net gains (8) (4) (8)

Other expense 19

Net postemployment costs $12 $ 9 $23

The Company instituted a workforce reduction program in its North

American food business in 1999. This action resulted in incremental

postemployment costs, which are shown as other expense above.

The Company’s postemployment plans are not funded. The

changes in the benefit obligations of the plans at December 31,

2001 and 2000 were as follows:

(in millions)

2001 2000

Accumulated benefit obligation at January 1 $ 373 $333

Service cost 20 13

Benefits paid (156) (76)

Acquisitions 269 74

Actuarial losses 14 29

Accumulated benefit obligation

at December 31 520 373

Unrecognized experience gains 52 22

Accrued postemployment costs $ 572 $395

The accumulated benefit obligation was determined using an

assumed ultimate annual turnover rate of 0.3% in 2001 and 2000,

assumed compensation cost increases of 4.5% in 2001 and

2000, and assumed benefits as defined in the respective plans.

Postemployment costs arising from actions that offer employees

benefits in excess of those specified in the respective plans are

charged to expense when incurred.

Note 15. Additional Information:

(in millions)

For the Years Ended December 31, 2001 2000 1999

Research and development

expense $ 358 $ 270 $ 262

Advertising expense $1,190 $1,198 $1,272

Interest and other debt

expense, net:

Interest expense, parent

and affiliates $1,103 $ 531 $ 458

Interest expense, external debt 349 84 89

Interest income (15) (18) (8)

$1,437 $ 597 $ 539

Rent expense $ 372 $ 277 $ 285