Kraft 2001 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

35

Commodities: The Company is exposed to price risk related to

forecasted purchases of certain commodities used as raw

materials by the Company’s businesses. Accordingly, the Company

uses commodity forward contracts, as cash flow hedges, primarily

for coffee, cocoa, milk, cheese and wheat. Commodity futures and

options are also used to hedge the price of certain commodities,

including milk, coffee, cocoa, wheat, corn, sugar and soybean.

At December 31, 2001 and 2000, the Company had net long

commodity positions of $589 million and $617 million, respectively.

Interest Rates: The Company uses interest rate swaps to hedge

the fair value of an insignificant portion of its long-term debt. The

differential to be paid or received is accrued and recognized as

interest expense. If an interest rate swap agreement is terminated

prior to maturity, the realized gain or loss is recognized over the

remaining life of the agreement if the hedged amount remains

outstanding, or immediately if the underlying hedged exposure does

not remain outstanding. If the underlying exposure is terminated

prior to the maturity of the interest rate swap, the unrealized gain or

loss on the related interest rate swap is recognized in earnings

currently. At December 31, 2001, the aggregate notional principal

amount of those agreements, which converted fixed-rate debt to

variable-rate debt, was $102 million. Aggregate maturities at

December 31, 2001 were $29 million in 2003 and $73 million in

2004. During the year ended December 31, 2001, there was no

ineffectiveness relating to these fair value hedges.

Value at Risk: The Company uses a value at risk (“VAR”)

computation to estimate the potential one-day loss in the fair value

of its interest rate-sensitive financial instruments and to estimate

the potential one-day loss in pre-tax earnings of its foreign currency

and commodity price-sensitive derivative financial instruments.

The VAR computation includes the Company’s debt; short-term

investments; foreign currency forwards, swaps and options; and

commodity futures, forwards and options. Anticipated transactions,

foreign currency trade payables and receivables, and net

investments in foreign subsidiaries, which the foregoing instruments

are intended to hedge, were excluded from the computation.

The VAR estimates were made assuming normal market

conditions, using a 95% confidence interval. The Company used

a “variance/co-variance” model to determine the observed

interrelationships between movements in interest rates and various

currencies. These interrelationships were determined by observing

interest rate and forward currency rate movements over the

preceding quarter for the calculation of VAR amounts at December

31, 2001 and 2000, and over each of the four preceding quarters

for the calculation of average VAR amounts during each year. The

values of foreign currency and commodity options do not change

on a one-to-one basis with the underlying currency or commodity,

and were valued accordingly in the VAR computation.

The estimated potential one-day loss in fair value of the Company’s

interest rate-sensitive instruments, primarily debt, under normal

market conditions and the estimated potential one-day loss in pre-

tax earnings from foreign currency and commodity instruments

under normal market conditions, as calculated in the VAR model,

were as follows:

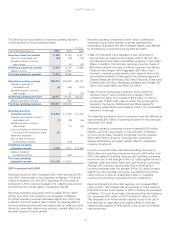

Pre-Tax Earnings Impact

(in millions) At 12/31/01 Average High Low

Instruments sensitive to:

Foreign currency rates $ 2 $6 $13 $2

Commodity prices 57115

Fair Value Impact

(in millions) At 12/31/01 Average High Low

Instruments sensitive to:

Interest rates $122 $79 $122 $56

Pre-Tax Earnings Impact

(in millions) At 12/31/00 Average High Low

Instruments sensitive to:

Foreign currency rates $ 20 $20 $ 24 $15

Commodity prices 98 97

Fair Value Impact

(in millions) At 12/31/00 Average High Low

Instruments sensitive to:

Interest rates $166 $83 $166 $39