Kraft 2001 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

49

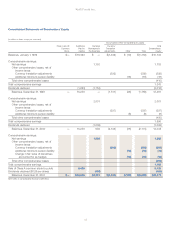

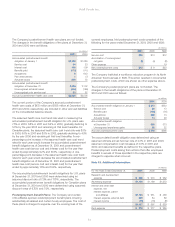

Note 12. Pre-tax Earnings and Provision for Income Taxes:

Pre-tax earnings and provision for income taxes consisted of the

following for the years ended December 31, 2001, 2000 and 1999:

(in millions)

2001 2000 1999

Pre-tax earnings:

United States $2,282 $2,188 $1,990

Outside United States 1,165 1,227 1,050

Total pre-tax earnings $3,447 $3,415 $3,040

Provision for income taxes:

United States federal:

Current $ 594 $ 572 $ 543

Deferred 299 218 164

893 790 707

State and local 112 120 144

Total United States 1,005 910 851

Outside United States:

Current 445 477 449

Deferred 115 27 (13)

Total outside United States 560 504 436

Total provision for income taxes $1,565 $1,414 $1,287

At December 31, 2001, applicable United States federal income

taxes and foreign withholding taxes have not been provided on

approximately $1.5 billion of accumulated earnings of foreign

subsidiaries that are expected to be permanently reinvested. The

Company is unable to provide a meaningful estimate of additional

deferred taxes that would have been provided were these earnings

not considered permanently reinvested.

The effective income tax rate on pre-tax earnings differed from the

U.S. federal statutory rate for the following reasons for the years

ended December 31, 2001, 2000 and 1999:

2001 2000 1999

U.S. federal statutory rate 35.0% 35.0% 35.0%

Increase (decrease) resulting from:

State and local income taxes,

net of federal tax benefit 2.0 2.2 3.0

Goodwill amortization 9.4 5.2 5.9

Other (1.0) (1.0) (1.6)

Effective tax rate 45.4% 41.4% 42.3%

The tax effects of temporary differences that gave rise to deferred

income tax assets and liabilities consisted of the following at

December 31, 2001 and 2000:

(in millions)

2001 2000

Deferred income tax assets:

Accrued postretirement and

postemployment benefits $ 774 $ 789

Other 737 539

Total deferred income tax assets 1,511 1,328

Deferred income tax liabilities:

Trade names (3,847)

Property, plant and equipment (1,379) (1,527)

Prepaid pension costs (850) (743)

Total deferred income tax liabilities (6,076) (2,270)

Net deferred income tax liabilities $(4,565) $ (942)

Note 13. Segment Reporting:

The Company manufactures and markets packaged retail food

products, consisting principally of beverages, cheese, snacks,

convenient meals and various packaged grocery products through

its North American and international food businesses. Reportable

segments for the North American businesses are organized and

managed principally by product category. The North American food

segments are Cheese, Meals and Enhancers; Biscuits, Snacks and

Confectionery; Beverages, Desserts and Cereals; and Oscar Mayer

and Pizza. Kraft Foods North America’s food service business

within the United States and its businesses in Canada and Mexico

are managed through the Cheese, Meals and Enhancers segment.

International operations are organized and managed by geographic

location. The international food segments are Europe, Middle East

and Africa; and Latin America and Asia Pacific.

The Company’s management reviews operating companies

income to evaluate segment performance and allocate resources.

Operating companies income excludes general corporate expenses

and amortization of goodwill. Interest and other debt expense,

net, and provision for income taxes are centrally managed and,

accordingly, such items are not presented by segment since they

are excluded from the measure of segment profitability reviewed by

management. The Company’s assets, which are principally in the

United States and Europe, are managed geographically. The

accounting policies of the segments are the same as those

described in the Summary of Significant Accounting Policies.