Kraft 2001 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

36

This VAR computation is a risk analysis tool designed to statistically

estimate the maximum probable daily loss from adverse movements

in interest rates, foreign currency rates and commodity prices

under normal market conditions. The computation does not purport

to represent actual losses in fair value or earnings to be incurred

by the Company, nor does it consider the effect of favorable

changes in market rates. The Company cannot predict actual future

movements in such market rates and does not present these VAR

results to be indicative of future movements in such market rates

or to be representative of any actual impact that future changes

in market rates may have on its future results of operations or

financial position.

New Accounting Standards

Effective January 1, 2001, the Company adopted Statement of

Financial Accounting Standards (“SFAS”) No. 133, “Accounting for

Derivative Instruments and Hedging Activities,” and its related

amendment, SFAS No. 138, “Accounting for Certain Derivative

Instruments and Certain Hedging Activities” (collectively referred

to as “SFAS No. 133”). These standards require that all derivative

financial instruments be recorded on the consolidated balance

sheets at their fair value as either assets or liabilities. Changes in

the fair value of derivatives are recorded each period in earnings or

accumulated other comprehensive losses, depending on whether

a derivative is designated and effective as part of a hedge

transaction and, if it is, the type of hedge transaction. Gains and

losses on derivative instruments reported in accumulated other

comprehensive losses are included in earnings in the periods in

which earnings are affected by the hedged item. As of January 1,

2001, the adoption of these new standards did not have a material

effect on net earnings (less than $1 million) or accumulated other

comprehensive losses (less than $1 million).

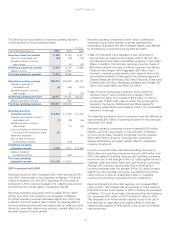

The Emerging Issues Task Force (“EITF”) issued EITF Issue

No. 00-14, “Accounting for Certain Sales Incentives” and EITF

Issue No. 00-25, “Vendor Income Statement Characterization of

Consideration Paid to a Reseller of the Vendor’s Products.” As a

result, certain items previously included in marketing, administration

and research costs on the consolidated statement of earnings will

either be recorded as a reduction of operating revenues or as an

increase in cost of sales. These EITF Issues will be effective in the

first quarter of 2002. The Company estimates that adoption of

EITF Issues No. 00-14 and No. 00-25 will result in a reduction of

operating revenues in 2001, 2000 and 1999 of approximately

$4.6 billion, $3.6 billion and $3.4 billion, respectively. Marketing,

administration and research costs will decline in 2001, 2000 and

1999 by approximately $4.7 billion, $3.7 billion and $3.4 billion,

respectively, while cost of sales will increase by an insignificant

amount. The adoption of these EITF Issues will have no impact

on net earnings or basic and diluted EPS.

During 2001, the Financial Accounting Standards Board (“FASB”)

issued SFAS No. 141, “Business Combinations” and SFAS No. 142,

“Goodwill and Other Intangible Assets.” Effective January 1, 2002,

the Company will no longer be required to amortize indefinite life

goodwill and intangible assets as a charge to earnings. In addition,

the Company will be required to conduct an annual review of

goodwill and other intangible assets for potential impairment. The

Company estimates that net earnings and diluted earnings per

share would have been approximately $2,839 million and $1.76,

respectively, for the year ended December 31, 2001; $2,531 million

and $1.74, respectively, for the year ended December 31, 2000; and

$2,287 million and $1.57, respectively, for the year ended December

31, 1999, had the provisions of the new standards been applied in

those years. The Company does not currently anticipate having

to record a charge to earnings for the potential impairment of

goodwill or other intangible assets as a result of adoption of these

new standards.

In October 2001, the FASB issued SFAS No. 144, “Accounting for

the Impairment or Disposal of Long-Lived Assets,” which replaces

SFAS No. 121, “Accounting for the Impairment of Long-Lived Assets

and Long-Lived Assets to be Disposed Of.” SFAS No. 144 provides

updated guidance concerning the recognition and measurement of

an impairment loss for certain types of long-lived assets, expands

the scope of a discontinued operation to include a component of

an entity and eliminates the current exemption to consolidation

when control over a subsidiary is likely to be temporary. SFAS

No. 144 is effective for the Company on January 1, 2002. The

Company does not expect the adoption of SFAS No. 144 to have

a material impact on the Company’s 2002 financial statements.

Contingencies

See Note 17 to the consolidated financial statements for a

discussion of contingencies.