Kraft 2001 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

43

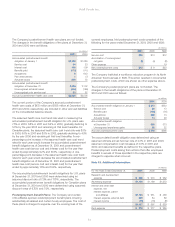

Note 1. Background and Basis of Presentation:

Background: Kraft Foods Inc. (“Kraft”) was incorporated in 2000

in the Commonwealth of Virginia. Following Kraft’s formation, Philip

Morris Companies Inc. (“Philip Morris”) transferred to Kraft its

ownership interest in Kraft Foods North America, Inc., a Delaware

corporation, through a capital contribution. In addition, during

2000, Philip Morris transferred management responsibility for its

food businesses in Latin America to Kraft Foods North America,

Inc. and its wholly-owned subsidiary, Kraft Foods International, Inc.

Kraft, together with its subsidiaries (collectively referred to as the

“Company”), is engaged in the manufacture and sale of retail

packaged foods in the United States, Canada, Europe, Latin

America and Asia Pacific.

On December 11, 2000, the Company acquired all of the

outstanding shares of Nabisco Holdings Corp. (“Nabisco”) for

$55 per share in cash. See Note 5, Acquisitions, for a complete

discussion of this transaction.

Prior to June 13, 2001, the Company was a wholly-owned

subsidiary of Philip Morris. On June 13, 2001, the Company

completed an initial public offering (“IPO”) of 280,000,000 shares of

its Class A common stock at a price of $31.00 per share. The IPO

proceeds, net of the underwriting discount and expenses, of $8.4

billion were used to retire a portion of an $11.0 billion long-term note

payable to Philip Morris incurred in connection with the acquisition

of Nabisco. After the IPO, Philip Morris owns approximately 83.9%

of the outstanding shares of the Company’s capital stock through

its ownership of 49.5% of the Company’s Class A common

stock and 100% of the Company’s Class B common stock. The

Company’s Class A common stock has one vote per share while

the Company’s Class B common stock has ten votes per share.

Therefore, Philip Morris holds 97.7% of the combined voting power

of the Company’s outstanding common stock.

Basis of presentation: The consolidated financial statements

include the Company and its subsidiaries. The preparation of

financial statements in conformity with accounting principles

generally accepted in the United States of America requires

management to make estimates and assumptions that affect

the reported amounts of assets and liabilities, the disclosure of

contingent assets and liabilities at the dates of the financial

statements and the reported amounts of operating revenues and

expenses during the reporting periods. Actual results could differ

from those estimates. The Company’s operating subsidiaries report

year-end results as of the Saturday closest to December 31 each

year. This resulted in fifty-three weeks of operating results in the

Company’s consolidated statement of earnings for the year ended

December 31, 2000.

Certain prior years’ amounts have been reclassified to conform with

the current year’s presentation.

Note 2. Summary of Significant Accounting Policies:

Cash and cash equivalents: Cash equivalents include demand

deposits with banks and all highly liquid investments with original

maturities of three months or less.

Inventories: Inventories are stated at the lower of cost or market.

The last-in, first-out (“LIFO”) method is used to cost substantially

all domestic inventories. The cost of other inventories is principally

determined by the average cost method.

Impairment of long-lived assets: The Company reviews long-

lived assets, including intangible assets, for impairment whenever

events or changes in business circumstances indicate that the

carrying amount of the assets may not be fully recoverable. The

Company performs undiscounted operating cash flow analyses to

determine if an impairment exists. If an impairment is determined to

exist, any related impairment loss is calculated based on fair value.

Impairment losses on assets to be disposed of, if any, are based

on the estimated proceeds to be received, less costs of disposal.

In October 2001, the Financial Accounting Standards Board

(“FASB”) issued Statement of Financial Accounting Standards

(“SFAS”) No. 144, “Accounting for the Impairment or Disposal of

Long-Lived Assets,” which replaces SFAS No. 121, “Accounting

for the Impairment of Long-Lived Assets and Long-Lived Assets

to be Disposed Of.” SFAS No. 144 provides updated guidance

concerning the recognition and measurement of an impairment

loss for certain types of long-lived assets, expands the scope of a

discontinued operation to include a component of an entity and

eliminates the current exemption to consolidation when control

over a subsidiary is likely to be temporary. SFAS No. 144 is effective

for the Company on January 1, 2002. The Company does not

expect the adoption of SFAS No. 144 to have a material impact

on the Company’s 2002 financial statements.

Depreciation, amortization and goodwill valuation: Property,

plant and equipment are stated at historical cost and depreciated

by the straight-line method over the lives of the assets. Machinery

and equipment are depreciated over periods ranging from 3 to

20 years and buildings and building improvements over periods

up to 40 years. Goodwill and other intangible assets substantially

comprise brand names purchased through acquisitions.

In consideration of the long histories of these brands, goodwill

and other intangible assets associated with them are amortized

on the straight-line method over 40 years.

Notes to Consolidated Financial Statements