Kraft 2001 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

32

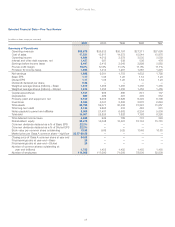

and geographic expansion, partially offset by lower volume in

Argentina, due to economic weakness. Continued erosion of the

economic climate in Argentina may negatively affect volume and

income growth in the Latin America and Asia Pacific segment

during 2002.

During 2001, reported operating revenues increased $1,183 million

(94.9%) over 2000, due primarily to the acquisition of Nabisco,

partially offset by unfavorable currency movements. On a pro forma

basis, operating revenues increased 2.0%.

Reported operating companies income for 2001 increased $189

million (100.0%) over 2000, due primarily to the acquisition of

Nabisco ($128 million), lower marketing, administration and

research costs ($69 million), higher margins ($14 million) and the

shift in CDC income, partially offset by unfavorable currency

movements ($32 million). On a pro forma basis, operating

companies income increased 32.7%, due primarily to productivity

savings and Nabisco synergies.

2000 compared with 1999

KFI’s reported volume for 2000 increased 1.5% over 1999, due

primarily to volume increases in both the Europe, Middle East &

Africa and Latin America & Asia Pacific segments. On an underlying

basis, volume increased 4.9%, including the impact of the 53rd

week of shipments in 2000.

Reported operating revenues for 2000 decreased $829 million

(9.3%) from 1999, due primarily to unfavorable currency movements

($887 million), the shift in CDC revenues ($52 million), lower pricing

($30 million, due primarily to commodity-driven coffee price

decreases) and the impact of divestitures ($196 million), partially

offset by higher volume/mix ($291 million). On an underlying basis,

operating revenues decreased 6.8%.

Reported operating companies income for 2000 increased by $145

million (13.6%) to $1.2 billion, due primarily to higher volume/mix

($147 million), the gain on the French Confectionery Sale ($139

million) and higher margins ($84 million, primarily relating to lower

commodity costs), partially offset by unfavorable currency

movements ($96 million), higher marketing, administration and

research costs ($78 million), the shift in CDC income ($26 million)

and the impact of divested businesses. On an underlying basis,

operating companies income increased 5.3%.

The following discusses operating results within each of KFI’s

reportable segments.

Europe, Middle East and Africa: Reported volume for 2000

increased 0.5% over 1999, while underlying volume increased 2.9%

over 1999, with growth in all product categories. In beverages,

coffee volume benefited from growth in the developing markets

of Central and Eastern Europe and in the established markets

of Sweden, Austria, Italy and the United Kingdom. Volume in

refreshment beverages grew in Central and Eastern Europe, driven

by the expansion of powdered soft drinks. Volume growth in

snacks reflected double-digit gains in salty snacks on expansion

into Central and Eastern Europe, as well as new confectionery

product launches and line extensions. Cheese volume grew on

the strength of Philadelphia cream cheese, reflecting successful

marketing programs across Europe and a re-launch in the Middle

East. Volume also grew for process cheese in Italy and Spain. In

convenient meals, volume grew on the successful launch of new

lunch combination varieties in the United Kingdom and line

extensions of packaged dinners in Germany and Belgium. Volume

grew in grocery, reflecting gains in spoonable dressings, benefiting

from effective marketing programs in Italy and new product

launches in Spain.

Reported operating revenues decreased $852 million (11.1%) from

1999, due primarily to unfavorable currency movements ($830

million), lower pricing ($60 million, due primarily to commodity-

driven coffee price decreases), the shift in CDC revenues ($28

million) and the impact of divestitures ($163 million), partially offset

by higher volume/mix ($186 million). On an underlying basis,

operating revenues decreased 9.0%.

Reported operating companies income increased $124 million

(13.9%) over 1999, due primarily to the gain on the French

Confectionery Sale ($139 million), higher volume/mix ($104 million)

and higher margins ($70 million, due primarily to lower coffee

commodity costs), partially offset by unfavorable currency

movements ($97 million), higher marketing, administration and

research costs ($58 million), the shift in CDC income ($16 million)

and the impact of divestitures ($20 million). On an underlying basis,

operating companies income increased 2.5%.

Latin America and Asia Pacific: Reported volume for 2000

increased 5.1% over 1999. On an underlying basis, volume in 2000

increased 12.5% over 1999, led by strong growth in Brazil, Australia,

China, the Philippines, Indonesia, Japan and Korea and higher

exports to the Caribbean. Beverages volume grew due to

increased coffee volume in the Caribbean and China. Refreshment

beverages volume increased, benefiting from new flavors in Brazil,

marketing programs in China and the Philippines, and expansion

into Thailand. Snacks volume gains were driven by confectionery

volume growth in Asia Pacific, reflecting new product launches in

Indonesia, China and the Philippines. In Latin America, volume

benefited from the launch of new chocolate products in Brazil.

Cheese volume grew, driven by marketing and promotion of

Philadelphia cream cheese in Australia and Japan, as well as gains

in process cheese in the Philippines and Indonesia. Convenient

meals volume grew, led by exports of macaroni & cheese dinners

to Asian markets. Grocery volume grew on higher shipments of

yeast spread in Australia and increased shipments of gelatins and

cereals to Asia.

Reported operating revenues increased $23 million (1.9%) over

1999, due primarily to higher volume/mix ($105 million) and higher

pricing ($30 million), partially offset by unfavorable currency

movements ($57 million), the shift in CDC revenues ($24 million)

and the impact of divestitures ($33 million). On an underlying basis,

operating revenues increased 6.9%.