Kraft 2001 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

34

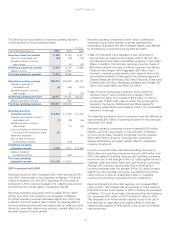

termination of this facility, the Company entered into agreements

for a $2.0 billion 5-year revolving credit facility expiring in July 2006

and a $4.0 billion 364-day revolving credit facility expiring in July

2002. Including these revolving credit facilities, the Company’s total

credit facilities were $6.8 billion at December 31, 2001, of which

approximately $6.5 billion were undrawn at December 31, 2001.

Certain of these credit facilities are used to support commercial

paper borrowings, the proceeds of which will be used for general

corporate purposes. A portion of the facilities is used to meet the

short-term working capital needs of the Company’s international

businesses. Certain of the credit facilities require the maintenance

of a minimum net worth, as defined, of $18.2 billion, which the

Company exceeded at December 31, 2001. The Company does

not currently anticipate any difficulty in continuing to exceed this

covenant requirement. The foregoing revolving credit facilities do

not include any other covenants that could require an acceleration

of maturity or the posting of collateral. The five-year revolving credit

facility enables the Company to reclassify short-term debt on a

long-term basis. At December 31, 2001, $2.0 billion of commercial

paper borrowings that the Company intends to refinance were

reclassified as long-term debt. The Company expects to continue

to refinance long-term and short-term debt from time to time. The

nature and amount of the Company’s long-term and short-term

debt and the proportionate amount of each can be expected to

vary as a result of future business requirements, market conditions

and other factors.

Guarantees and Commitments: At December 31, 2001, the

Company was contingently liable for guarantees and commitments

of $41 million. These include surety bonds related to dairy

commodity purchases and guarantees related to letters of credit.

Guarantees do not have, and are not expected to have, a

significant impact on the Company’s liquidity. The Company’s

consolidated rent expense for 2001 was $372 million. Accordingly,

the Company does not consider its lease commitments to be a

significant determinant of the Company’s liquidity.

The Company believes that its cash from operations, existing credit

facilities and access to global capital markets will provide sufficient

liquidity to meet its working capital needs, planned capital

expenditures and payment of its anticipated quarterly dividends.

Dividends

Dividends paid in 2001 and 2000 were $225 million and $1.0 billion,

respectively. The dividends paid in 2000 reflect dividends to Philip

Morris. During 2001, the Company declared two regular quarterly

dividends of $0.13 per share on its Class A and Class B common

stock. The present annualized dividend rate is $0.52 per common

share. The declaration of dividends is subject to the discretion of

the Company’s board of directors and will depend on various

factors, including the Company’s net earnings, financial condition,

cash requirements, future prospects and other factors deemed

relevant by the Company’s board of directors.

Market Risk

The Company operates internationally, with manufacturing and

sales facilities in various locations around the world, and utilizes

certain financial instruments to manage its foreign currency and

commodity exposures, which primarily relate to forecasted

transactions and interest rate exposures. Derivative financial

instruments are used by the Company, principally to reduce

exposures to market risks resulting from fluctuations in foreign

exchange rates, commodity prices and interest rates by creating

offsetting exposures. The Company is not a party to leveraged

derivatives. For a derivative to qualify as a hedge at inception and

throughout the hedged period, the Company formally documents

the nature and relationships between the hedging instruments and

hedged items, as well as its risk-management objectives, strategies

for undertaking the various hedge transactions and method of

assessing hedge effectiveness. Additionally, for hedges of

forecasted transactions, the significant characteristics and

expected terms of a forecasted transaction must be specifically

identified, and it must be probable that each forecasted transaction

will occur. Financial instruments qualifying for hedge accounting

must maintain a specified level of effectiveness between the

hedging instrument and the item being hedged, both at inception

and throughout the hedged period. The Company does not use

derivative financial instruments for speculative purposes.

Substantially all of the Company’s derivative financial instruments

are effective as hedges under the new accounting standard.

Accordingly, the Company recorded deferred losses of $18 million

in accumulated other comprehensive losses. This reflects the initial

adoption of the accounting pronouncement and a decrease in the

fair value of derivatives during the year of $33 million, partially offset

by deferred losses transferred to earnings of $15 million. The fair

value of all derivative financial instruments has been calculated

based on active market quotes.

Foreign Exchange Rates: The Company uses forward foreign

exchange contracts and foreign currency options to mitigate its

exposure to changes in foreign currency exchange rates from third-

party and intercompany forecasted transactions. The primary

currencies to which the Company is exposed include the euro and

Canadian dollar. At December 31, 2001 and 2000, the Company

had option and forward foreign exchange contracts with aggregate

notional amounts of $431 million and $237 million, respectively, for

the purchase or sale of foreign currencies.