Kraft 2001 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

25

Separation Programs: In October 2001, the Company announced

that it was offering a voluntary retirement program to certain

salaried employees in the United States. The program is expected

to terminate approximately 750 employees and will result in an

estimated pre-tax charge of approximately $140 million upon final

employee acceptance in the first quarter of 2002. This pre-tax

charge is part of the previously discussed $200 million to $300

million in pre-tax charges related to the integration of Nabisco.

During 1999, KFNA offered voluntary retirement incentive or

separation programs to certain eligible hourly and salaried

employees in the United States. Employees electing to terminate

employment under the terms of these programs were entitled to

enhanced retirement or severance benefits. Approximately 1,100

hourly and salaried employees accepted the benefits offered by

these programs and elected to retire or terminate. As a result, the

Company recorded a pre-tax charge of $157 million in 1999. This

charge was included in marketing, administration and research

costs in the consolidated statements of earnings for the following

segments: Cheese, Meals and Enhancers, $71 million; Oscar

Mayer and Pizza, $38 million; Biscuits, Snacks and Confectionery,

$2 million; and Beverages, Desserts and Cereals, $46 million.

Payments of pension and postretirement benefits are made in

accordance with the terms of the applicable benefit plans.

Severance benefits, which were paid over a period of time,

commenced upon dates of termination, which ranged from April

1999 to March 2000. The program and related payments were

completed during 2000. Salary and related benefit costs of

employees prior to their retirement or termination date were

expensed as incurred.

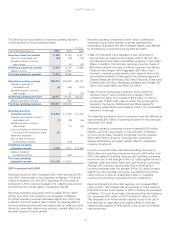

Consolidated Operating Results

The acquisition of Nabisco and subsequent IPO were significant

events that affect the comparability of earnings. In order to isolate

the financial effects of these events, and to provide a more

meaningful comparison of the Company’s results of operations, the

following tables and the subsequent discussion of the Company’s

consolidated operating results refer to results on a reported,

underlying and pro forma basis. Reported results include the

operating results of Nabisco in 2001, but not in 2000 and 1999.

Reported results also reflect average shares of common stock

outstanding during 2001, and reflect an average of 1.455 billion

shares outstanding during 2000 and 1999. Underlying results

include the operating results of Nabisco in 2001, but not in 2000

and 1999, and adjust for certain unusual items as detailed on

the tables, such as results from operations divested since the

beginning of 1999. Pro forma results assume the Company owned

Nabisco for all of 2000. In addition, pro forma results reflect

common shares outstanding of 1.735 billion based on the

assumption that shares issued immediately following the IPO were

outstanding during 2001 and 2000, and that, effective January 1,

2000, the net proceeds of the IPO were used to retire a portion of

a long-term note payable used to finance the Nabisco acquisition.

Pro forma results also adjust for certain unusual items as detailed

on the tables, such as the results from operations divested since

the beginning of 2000.

Consolidated Operating Results

(in millions)

Year Ended December 31, 2001 2000 1999

Reported volume (in pounds):

Kraft Foods North America

Cheese, Meals and Enhancers 5,219 4,820 4,874

Biscuits, Snacks and Confectionery 2,350 54 47

Beverages, Desserts and Cereals 3,421 3,117 2,883

Oscar Mayer and Pizza 1,519 1,507 1,433

Total Kraft Foods North America 12,509 9,498 9,237

Kraft Foods International

Europe, Middle East and Africa 2,826 2,829 2,816

Latin America and Asia Pacific 2,057 803 764

Total Kraft Foods International 4,883 3,632 3,580

Total reported volume 17,392 13,130 12,817

Reported operating revenues:

Kraft Foods North America

Cheese, Meals and Enhancers $10,256 $ 9,405 $ 9,360

Biscuits, Snacks and Confectionery 5,917 329 265

Beverages, Desserts and Cereals 5,370 5,266 5,074

Oscar Mayer and Pizza 3,563 3,461 3,198

Total Kraft Foods North America 25,106 18,461 17,897

Kraft Foods International

Europe, Middle East and Africa 6,339 6,824 7,676

Latin America and Asia Pacific 2,430 1,247 1,224

Total Kraft Foods International 8,769 8,071 8,900

Total reported operating

revenues $33,875 $26,532 $26,797

Reported operating

companies income:

Kraft Foods North America

Cheese, Meals and Enhancers $ 2,099 $ 1,845 $ 1,658

Biscuits, Snacks and Confectionery 966 100 73

Beverages, Desserts and Cereals 1,192 1,090 1,009

Oscar Mayer and Pizza 539 512 450

Total Kraft Foods North America 4,796 3,547 3,190

Kraft Foods International

Europe, Middle East and Africa 861 1,019 895

Latin America and Asia Pacific 378 189 168

Total Kraft Foods International 1,239 1,208 1,063

Total reported operating

companies income $ 6,035 $ 4,755 $ 4,253