Kraft 2001 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Yes, we’re big. But we’ve never lost touch with the source of our success: the ability

to listen with a creative ear...the imagination to meet people’s needs with innovative

food ideas…a commitment to trust we will not compromise.

And as we’ve grown, we’ve kept the best of local while capturing all the advantages

of global scale – and done it with teamwork, discipline and speed. For those who

invest in us, our goal is simple: consistent, top-tier performance.

Perhaps no other year in our history has embodied all this quite like 2001.

It was a transformational year for Kraft Foods.

We integrated Nabisco and Kraft with great success, building new growth opportunities

and gaining more than $100 million in synergy savings.

We completed an initial public offering of 16.1% of Kraft’s outstanding shares, raising

$8.4 billion in net proceeds used to retire debt associated with the Nabisco acquisition.

We began paying dividends at an annual rate of 52 cents per share and produced

a total return for shareholders of 10.6% for the 28 weeks Kraft shares traded in 2001.

New products generated more than $1.1 billion in revenues.

Our volume grew 11% in developing markets around the world.

We made five acquisitions to drive future growth.

More than 12 million consumers visited our websites each month for ideas and information.

Productivity savings for the year met our target of 3.5% of cost of goods sold.

We grew worldwide volume 3.7%, in line with our stated goal of 3% - 4% growth.

We generated a strong $3.3 billion in operating cash flow.

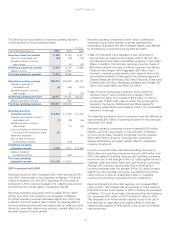

And once again we delivered on our promise of top-tier financial results, with operating

companies income up 8.9% to $6.1 billion, net earnings up 19.9% to $2.1 billion and

diluted earnings per share up 19.8% to $1.21.

Our results were strong across the company.

All six of our business segments increased volume and operating companies income

for the year.

Kraft Foods North America:

Beverages, Desserts and Cereals – Volume was up 9.3%, powered by double-digit

gains in our ready-to-drink beverage business, which more than offset softness in

Desserts and Cereals. Operating companies income for the segment increased 7.0%.

Biscuits, Snacks and Confectionery – Volume increased 1.6%, led by strong growth

in our core cookies and crackers businesses. Operating companies income was up

24.6%, benefiting from volume growth and synergy gains.

Fellow Shareholders:

Our Mission

To Be the Undisputed Global

Food Leader

Consumers... First Choice

Customers... Indispensable Partner

Alliances... Most Desired Partner

Employees... Employer of Choice

Communities... Responsible Citizen

Investors... Top-Tier Performer

19

•

•

•

•

•

•

•

•

•

•

•

Note: All amounts discussed in this letter are on a pro forma basis. In addition, the volume comparisons

are also adjusted to reflect a 52-week fiscal year 2000.