Kraft 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

30

Reported operating companies income increased $187 million

(11.3%) over 1999 due to higher margins ($254 million, driven by

lower commodity-related and manufacturing costs), higher

volume/mix ($67 million) and the 1999 separation charge ($71

million), partially offset by higher marketing, administration and

research costs ($171 million, the majority of which related to higher

marketing expenses) and the shift in CDC income ($30 million).

Marketing expense increased as the Company increased price

promotions on cheese products during 2000 in the United States

during a period of intense competition that resulted from low

cheese commodity costs. On an underlying basis, operating

companies income increased 8.8%.

Biscuits, Snacks and Confectionery: Reported volume in 2000

increased 14.9% over 1999, reflecting the continued success of

two-compartment snacks and the introduction of new intense mint

and chocolate products.

Reported operating revenues increased $64 million (24.2%) over

1999, due primarily to higher volume/mix. Reported operating

companies income increased $27 million (37.0%) over 1999, due

primarily to higher volume/mix ($45 million) and the 1999 separation

charge, partially offset by higher marketing, administration and

research costs ($24 million). On an underlying basis, operating

companies income increased 36.5%.

Beverages, Desserts and Cereals: Reported volume in 2000

increased 8.1% from 1999. Beverages volume grew on the strength

of ready-to-drink beverages, reflecting new product introductions,

and higher coffee shipments due to growth in Starbucks grocery

coffee. Volume also grew in frozen whipped toppings, due in part

to the introduction of new products. These increases were partially

offset by lower volume in ready-to-eat cereals, due to aggressive

competitive activity, and lower volume in dry packaged desserts,

reflecting lower promotions. On an underlying basis, volume

increased 9.5%, of which 0.6 percentage points related to the

acquisition of Balance Bar Co.

Reported operating revenues increased $192 million (3.8%) over

1999, due primarily to higher volume/mix ($126 million) and the

acquisition of Balance Bar Co. ($113 million), partially offset by the

shift in CDC revenues ($44 million).

Reported operating companies income increased $81 million (8.0%)

over 1999, due primarily to higher volume/mix ($50 million), the

1999 separation charges ($46 million), higher margins ($20 million,

due primarily to lower commodity costs) and the acquisition of

Balance Bar Co., partially offset by higher marketing, administration

and research costs ($29 million, the majority of which related to

higher marketing expenses), and the shift in CDC income ($14

million). On an underlying basis, operating companies income

increased 4.7%.

Oscar Mayer and Pizza: Reported volume in 2000 increased

5.2% from 1999. Volume grew in pizza, reflecting the continued

success of rising crust pizza and new product introductions.

Volume growth also reflected the introduction of new lunch

combination varieties, the acquisition of Boca Burger, Inc. and

gains in hot dogs and cold cuts. On an underlying basis, volume

increased 5.9%, of which approximately 0.8 percentage points

related to the acquisition of Boca Burger, Inc.

Reported operating revenues increased $263 million (8.2%) over

1999, due primarily to higher volume/mix ($168 million), higher

pricing ($82 million) and the acquisition of Boca Burger, Inc. ($35

million), partially offset by the shift in CDC revenues ($24 million).

Reported operating companies income increased $62 million

(13.8%) over 1999, due primarily to higher volume/mix ($78 million),

higher margins ($43 million) and the 1999 separation charge ($38

million), partially offset by higher marketing, administration and

research costs ($86 million, the majority of which related to higher

marketing expenses) and the shift in CDC income ($8 million). On

an underlying basis, operating companies income increased 6.6%.

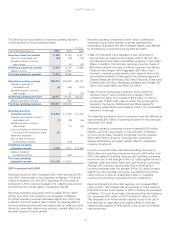

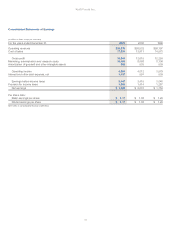

Kraft Foods International

(in millions)

Year Ended December 31, 2001 2000 1999

Reported volume (in pounds):

Europe, Middle East and Africa 2,826 2,829 2,816

Latin America and Asia Pacific 2,057 803 764

Total reported volume (in pounds) 4,883 3,632 3,580

Volume of businesses sold:

Europe, Middle East and Africa (1) (40) (93)

Latin America and Asia Pacific (17) (37) (70)

Estimated impact of century

date change:

Europe, Middle East and Africa 7(7)

Latin America and Asia Pacific 7(7)

Underlying volume (in pounds) 4,865 3,569 3,403

Nabisco volume:

Europe, Middle East and Africa 44

Latin America and Asia Pacific 1,089

Pro forma volume (in pounds) 4,865 4,702

Reported operating revenues:

Europe, Middle East and Africa $6,339 $6,824 $7,676

Latin America and Asia Pacific 2,430 1,247 1,224

Total reported operating revenues 8,769 8,071 8,900

Operating revenues of

businesses sold:

Europe, Middle East and Africa (131) (294)

Latin America and Asia Pacific (4) (21) (54)

Estimated impact of century

date change:

Europe, Middle East and Africa 14 (14)

Latin America and Asia Pacific 12 (12)

Underlying operating revenues 8,765 7,945 $8,526

Nabisco operating revenues:

Europe, Middle East and Africa 47

Latin America and Asia Pacific 1,140

Pro forma operating revenues $8,765 $9,132