Kraft 2001 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

52

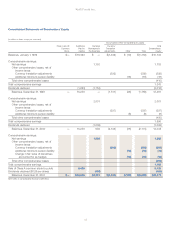

The changes in benefit obligations and plan assets, as well as the

funded status of the Company’s pension plans at December 31,

2001 and 2000, were as follows:

(in millions) U.S. Plans Non-U.S. Plans

2001 2000 2001 2000

Benefit obligation at

January 1 $4,327 $2,766 $1,915 $1,740

Service cost 107 69 45 37

Interest cost 339 213 112 98

Benefits paid (403) (258) (108) (94)

Acquisitions 71 1,463 (22) 236

Settlements 14 11

Actuarial losses 500 51 22 91

Currency 18 (205)

Other 912 39 12

Benefit obligation at

December 31 4,964 4,327 2,021 1,915

Fair value of plan assets at

January 1 7,039 6,282 1,589 1,314

Actual return on plan assets (386) (215) (227) 103

Contributions 37 33 63 32

Benefits paid (394) (278) (76) (64)

Acquisitions (45) 1,226 (41) 265

Currency 18 (121)

Actuarial gains (losses) 108 (9) 360

Fair value of plan assets at

December 31 6,359 7,039 1,329 1,589

Excess (deficit) of plan assets

versus benefit obligations at

December 31 1,395 2,712 (692) (326)

Unrecognized actuarial

losses (gains) 756 (691) 226 (42)

Unrecognized prior

service cost 56 54 49 27

Unrecognized net transition

obligation (1) 7 7

Net prepaid pension

asset (liability) $2,206 $2,075 $ (410) $ (334)

The combined U.S. and non-U.S. pension plans resulted in a net

prepaid asset of $1,796 million and $1,741 million at December 31,

2001 and 2000, respectively. These amounts were recognized in

the Company’s consolidated balance sheets at December 31, 2001

and 2000 as prepaid pension assets of $2,675 million and $2,623

million, respectively, for those plans in which plan assets exceeded

their accumulated benefit obligations and as other liabilities of

$879 million and $882 million at December 31, 2001 and 2000,

respectively, for plans in which the accumulated benefit obligations

exceeded their plan assets.

At December 31, 2001 and 2000, certain of the Company’s U.S.

plans were unfunded, with projected benefit and accumulated

benefit obligations of $213 million and $164 million, respectively, in

2001 and $156 million and $97 million, respectively, in 2000. For

certain non-U.S. plans, which have accumulated benefit obligations

in excess of plan assets, the projected benefit obligation,

accumulated benefit obligation and fair value of plan assets were

$1,165 million, $1,073 million and $416 million, respectively, as of

December 31, 2001 and $639 million, $596 million and $49 million,

respectively, as of December 31, 2000.

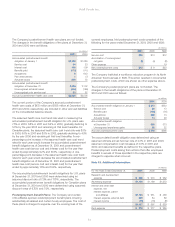

The following weighted-average assumptions were used to

determine the Company’s obligations under the plans:

U.S. Plans Non-U.S. Plans

2001 2000 2001 2000

Discount rate 7.00% 7.75% 5.80% 5.88%

Expected rate of return on

plan assets 9.00 9.00 8.49 8.51

Rate of compensation increase 4.50 4.50 3.36 3.55

The Company and certain of its subsidiaries sponsor employee

savings plans, to which the Company contributes. These plans

cover certain salaried, non-union and union employees. The

Company’s contributions and costs are determined by the

matching of employee contributions, as defined by the plans.

Amounts charged to expense for defined contribution plans totaled

$63 million, $43 million and $41 million in 2001, 2000 and 1999,

respectively.

Postretirement Benefit Plans: Net postretirement health care

costs consisted of the following for the years ended December 31,

2001, 2000 and 1999:

(in millions)

2001 2000 1999

Service cost $34 $23 $27

Interest cost 168 109 101

Amortization:

Unrecognized net loss from

experience differences 523

Unrecognized prior service cost (8) (8) (7)

Other expense 21

Net postretirement health

care costs $199 $126 $145

During 1999, the Company instituted early retirement and workforce

reduction programs that resulted in curtailment losses of $21 million.