Kraft 2001 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

26

Reported operating companies income, which is defined as

operating income before general corporate expenses and

amortization of goodwill and other intangible assets, was affected

by the following unusual items during 2001 and 2000:

• Sale of Food Factory and Integration Costs: During 2001,

the Company recorded pre-tax charges of $53 million for site

reconfigurations and other consolidation programs in the United

States. In addition, the Company recorded a pre-tax charge of

$29 million related to the sale of a North American food factory.

These pre-tax charges, which aggregate $82 million, were

included in marketing, administration and research costs in the

consolidated statement of earnings for the following segments:

Cheese, Meals and Enhancers, $63 million; Biscuits, Snacks and

Confectionery, $2 million; Beverages, Desserts and Cereals, $12

million; and Oscar Mayer and Pizza, $5 million.

• Sale of French Confectionery Business: During 2000, the

Company sold a French confectionery business (“French

Confectionery Sale”) for proceeds of $251 million on which a

pre-tax gain of $139 million was recorded. The pre-tax gain is

included in the Europe, Middle East and Africa segment’s

marketing, administration and research costs in the consolidated

statement of earnings.

The operating companies income comparison was also affected by

approximately $40 million of operating income from the previously

mentioned CDC sales.

Reported operating companies income increased $1,280 million

(26.9%) over 2000, due primarily to the acquisition of Nabisco.

On a pro forma basis, operating companies income increased

$500 million (8.9%), driven by volume growth, productivity

savings and Nabisco synergies, partially offset by unfavorable

currency movements.

Currency movements have decreased operating revenues by

$522 million and operating companies income by $60 million from

2000. Decreases in operating revenues and operating companies

income are due to the strength of the U.S. dollar against the euro,

Canadian dollar and certain Asian and Latin American currencies.

Although the Company cannot predict future movements in

currency exchange rates, the strength of the U.S. dollar, primarily

against the euro and Asian currencies, if sustained during 2002,

could continue to have an unfavorable impact on operating

revenues and operating companies income comparisons.

Reported interest and other debt expense, net, increased $840

million in 2001. This increase was due primarily to notes issued to

Philip Morris in the fourth quarter of 2000 to finance the acquisition

of Nabisco. On a pro forma basis, interest and other debt expense,

net, decreased $213 million in 2001 from $1,348 million in 2000.

This decrease in pro forma interest expense is due to the use of

free cash flow to repay debt and ongoing efforts to externally

refinance debt payable to Philip Morris in the current low interest

rate environment.

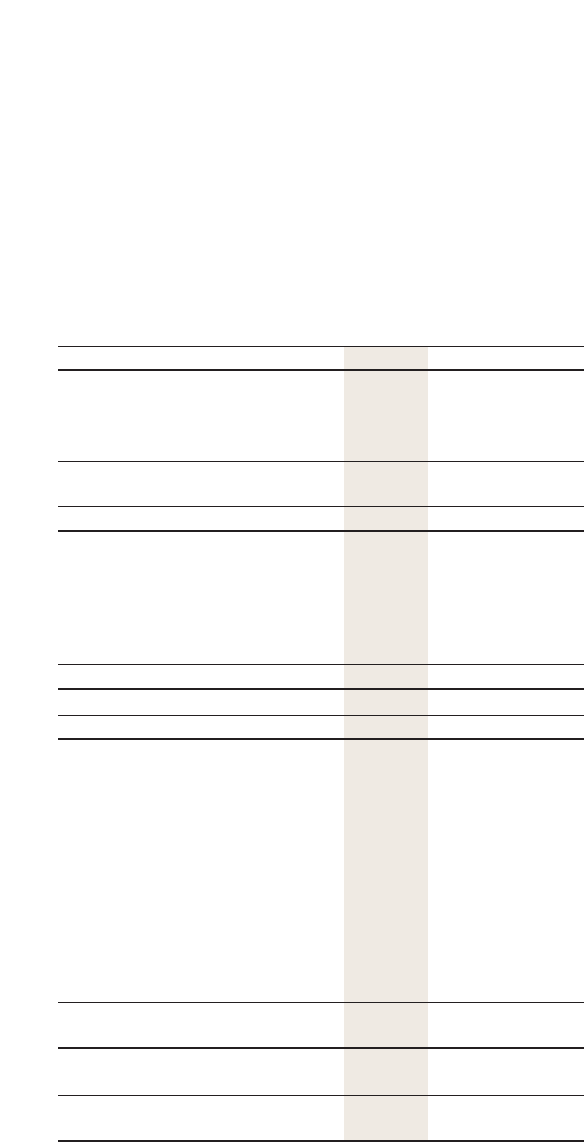

The following is a reconciliation of reported operating results to

underlying and pro forma operating results:

(in millions)

Year Ended December 31, 2001 2000 1999

Reported volume (in pounds) 17,392 13,130 12,817

Volume of businesses sold (18) (82) (176)

Estimated impact of century

date change 55 (55)

Underlying volume (in pounds) 17,374 13,103 12,586

Nabisco volume 3,852

Pro forma volume (in pounds) 17,374 16,955

Reported operating revenues $33,875 $26,532 $26,797

Operating revenues of

businesses sold (4) (162) (373)

Estimated impact of century

date change 97 (97)

Underlying operating revenues 33,871 26,467 $26,327

Nabisco operating revenues 7,566

Pro forma operating revenues $33,871 $34,033

Reported operating

companies income $ 6,035 $ 4,755 $ 4,253

Operating companies income of

businesses sold (1) (39) (64)

Estimated impact of century

date change 40 (40)

Loss on the sale of a North American

food factory and integration costs 82

Separation programs 157

Gain on sale of a French

confectionery business (139)

Underlying operating

companies income 6,116 4,617 $ 4,306

Nabisco operating

companies income 999

Pro forma operating

companies income $ 6,116 $ 5,616

2001 compared with 2000

Reported volume for 2001 increased 4,262 million pounds (32.5%)

over 2000, due primarily to the acquisition of Nabisco. Pro forma

volume increased 2.5% over 2000. Excluding the 53rd week of

shipments in 2000, volume increased 3.7%, reflecting new product

introductions and volume gains in developing markets.

Reported operating revenues for 2001 increased $7,343 million

(27.7%) over 2000, due primarily to the acquisition of Nabisco.

Pro forma operating revenues decreased slightly from 2000, due

primarily to the 53rd week of sales in 2000, the adverse effect of

currency exchange rates and lower sales prices on coffee products

(driven by commodity-related price declines), partially offset by the

favorable impact of volume growth.