Kraft 2001 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

51

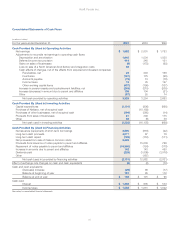

Geographic data for operating revenues, total assets and long-lived

assets (which consist of all non-current assets, other than goodwill

and other intangible assets and prepaid pension assets) were

as follows:

(in millions)

For the Years Ended December 31, 2001 2000 1999

Operating revenues:

United States $23,078 $16,910 $16,540

Europe 6,062 6,642 7,500

Other 4,735 2,980 2,757

Total operating revenues $33,875 $26,532 $26,797

(in millions)

At December 31, 2001 2000 1999

Total assets:

United States $43,889 $40,454 $19,429

Europe 7,366 7,630 8,292

Other 4,543 3,987 2,615

Total assets $55,798 $52,071 $30,336

Long-lived assets:

United States $ 6,750 $ 6,684 $ 3,904

Europe 2,136 2,116 2,021

Other 1,274 1,912 971

Total long-lived assets $10,160 $10,712 $ 6,896

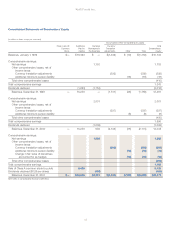

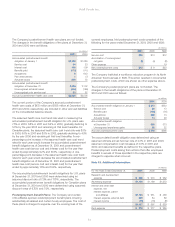

Note 14. Benefit Plans:

The Company and its subsidiaries sponsor noncontributory defined

benefit pension plans covering substantially all U.S. employees.

Pension coverage for employees of the Company’s non-U.S.

subsidiaries is provided, to the extent deemed appropriate, through

separate plans, many of which are governed by local statutory

requirements. In addition, the Company’s U.S. and Canadian

subsidiaries provide health care and other benefits to substantially

all retired employees. Health care benefits for retirees outside the

United States and Canada are generally covered through local

government plans.

Pension Plans: Net pension (income) cost consisted of the

following for the years ended December 31, 2001, 2000 and 1999:

(in millions) U.S. Plans Non-U.S. Plans

2001 2000 1999 2001 2000 1999

Service cost $ 107 $69 $76 $45 $37 $40

Interest cost 339 213 212 112 98 100

Expected return on

plan assets (648) (523) (511) (126) (103) (97)

Amortization:

Net gain on adoption

of SFAS No. 87 (11) (11) (1) (1)

Unrecognized net

(gain) loss from

experience

differences (21) (36) (15) (1) (1) 2

Prior service cost 876544

Settlements (12) (34) (41)

Net pension

(income) cost $(227) $(315) $(284) $35 $34 $48

In 2001 and 2000, retiring employees elected lump-sum payments,

resulting in settlement gains of $12 million and $34 million,

respectively. During 2001, the Company announced that it was

offering a voluntary early retirement program to certain eligible

salaried employees in the United States. The program is expected

to eliminate approximately 750 employees and will result in a pre-

tax charge of approximately $140 million upon final employee

acceptance in the first quarter of 2002. During 1999, the Company

instituted an early retirement and workforce reduction program that

resulted in settlement gains, net of additional termination benefits of

$41 million.