Kraft 2001 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

45

While it is not possible to quantify with certainty the potential

impact of actions regarding environmental remediation and

compliance efforts that the Company may undertake in the future,

in the opinion of management, environmental remediation and

compliance costs, before taking into account any recoveries

from third parties, will not have a material adverse effect on the

Company’s consolidated financial position, results of operations

or cash flows.

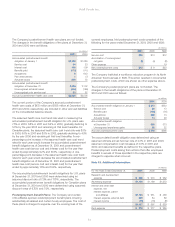

Note 3. Related Party Transactions:

Philip Morris and certain of its affiliates provide the Company with

various services, including planning, legal, treasury, accounting,

auditing, insurance, human resources, office of the secretary,

corporate affairs, information technology and tax services. In 2001,

the Company entered into a formal agreement with Philip Morris

providing for a continuation of these services, the cost of which

increased $91 million as Philip Morris provided information

technology and financial services, all of which were previously

performed by the Company at approximately the same cost.

Billings for these services, which were based on the cost to Philip

Morris to provide such services, were $339 million, $248 million

and $165 million for the years ended December 31, 2001, 2000 and

1999, respectively. These costs were paid to Philip Morris monthly.

Although the cost of these services cannot be quantified on a

stand-alone basis, management believes that the billings are

reasonable based on the level of support provided by Philip Morris

and its affiliates, and that they reflect all services provided. The

effects of these transactions are included in operating cash flows

in the Company’s consolidated statements of cash flows.

In addition, the Company’s daily net cash or overdraft position is

transferred to Philip Morris or a European subsidiary of Philip

Morris. The Company pays or receives interest based upon the

applicable commercial paper rate, or the London Interbank Offered

Rate, on the net amount payable to, or receivable from, Philip

Morris or its European subsidiary.

The Company also has long-term notes payable to its parent, Philip

Morris, and its affiliates as follows:

(in millions)

At December 31, 2001 2000

Notes payable in 2009, interest at 7.00% $5,000 $ 5,000

Notes payable in 2002, interest at 7.75% 11,000

Notes payable in 2002, interest at 7.40% 4,000

Swiss franc notes payable in 2008, interest

at 4.58% 715

Swiss franc notes payable in 2006, interest

at 3.58% 692

$5,000 $21,407

The two notes maturing in 2002 were related to the financing for

the acquisition of Nabisco and were at market interest rates

available to Philip Morris for debt with matching maturities.

During 2001, the Company used the IPO proceeds, net of the

underwriting discount and expenses, of $8.4 billion to retire a

portion of the $11.0 billion long-term note payable to Philip Morris.

The remainder of this note was repaid with the proceeds from

commercial paper borrowings. The Company repaid the $4.0 billion

note primarily with the net proceeds from a $4.0 billion public global

bond offering. The Company also refinanced the two long-term

Swiss franc notes payable to Philip Morris with short-term Swiss

franc borrowings from Philip Morris at variable interest rates. The

short-term Swiss franc borrowings are included in due to parent

and affiliates on the Company’s consolidated balance sheet as of

December 31, 2001.

Based on interest rates available to the Company for issuances of

debt with similar terms and remaining maturities, the aggregate fair

values of the Company’s long-term notes payable to Philip Morris

and its affiliates at December 31, 2001 and 2000 were $5,325

million and $21,357 million, respectively. The fair values of the

Company’s current amounts due to parent and affiliates

approximate carrying amounts.

Note 4. Divestitures:

During 2001, the Company sold several small food businesses. The

aggregate proceeds received in these transactions were $21 million,

on which the Company recorded a pre-tax gain of $8 million.

During 2000, the Company sold a French confectionery business

for proceeds of $251 million, on which a pre-tax gain of $139 million

was recorded. Several small international and domestic food

businesses were also sold in 2000. The aggregate proceeds

received in these transactions were $300 million, on which the

Company recorded pre-tax gains of $172 million.

During 1999, the Company sold several small international and

domestic food businesses. The aggregate proceeds received in

these transactions were $175 million, on which the Company

recorded pre-tax gains of $62 million.

The operating results of the businesses sold were not material to

the Company’s consolidated operating results in any of the periods

presented. Pre-tax gains on these divestitures were included in

marketing, administration and research costs on the Company’s

consolidated statements of earnings.