Kraft 2001 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

23

fair value are recognized in earnings when the related hedged items

are recorded in earnings. During 2001, the Company recognized

deferred losses of $15 million in earnings, which offset the impact

of gains on the related hedged items. In Note 16 of the notes to

consolidated financial statements, the Company has included a

detailed discussion of the types of exposures that it periodically

hedges, as well as a summary of the various instruments which it

utilizes. The Company does not use derivative financial instruments

for speculative purposes.

Employee Benefit Plans: The Company and its subsidiaries

provide a range of benefits to their employees and retired

employees, including pensions, postretirement health care

benefits and postemployment benefits (primarily severance). The

Company records annual amounts relating to these plans based

on calculations specified by U.S. GAAP, which include various

actuarial assumptions, such as discount rates, assumed rates of

return, compensation increases, turnover rates and health care

cost trend rates. The Company reviews its actuarial assumptions

on an annual basis and makes modifications to the assumptions

based on current rates and trends when it is deemed appropriate

to do so. As required by U.S. GAAP, the effect of the modifications

is generally recorded or amortized over future periods. The

Company believes that the assumptions utilized in recording its

obligations under its plans, which are presented in Note 14 to the

consolidated financial statements, are reasonable based on its

experience and advice from its actuaries.

Related Party Transactions: As discussed in Note 3 to the

Company’s consolidated financial statements, Philip Morris and

certain of its affiliates provide the Company with various services,

including planning, legal, treasury, accounting and financial

services, auditing, insurance, human resources, office of the

secretary, corporate affairs, information technology and tax

services. Billings for these services were $339 million in 2001,

$248 million in 2000 and $165 million in 1999. The increases reflect

information services and financial services that were previously

performed by the Company, but are now provided by Philip Morris

at approximately the same cost. Although the value of services

provided by Philip Morris cannot be quantified on a stand-alone

basis, management believes that the billings are reasonable based

on the level of support provided by Philip Morris, and that the

charges reflect all services provided.

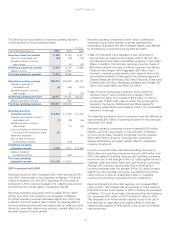

The Company also has long-term notes payable to Philip Morris of

$5.0 billion at December 31, 2001 and $21.4 billion at December 31,

2000. A significant portion of the amount outstanding at December

31, 2000 related to borrowings for the acquisition of Nabisco. The

decrease from 2000 to 2001 reflects the repayment of borrowings

with proceeds from the IPO, a public global bond offering and

short-term borrowings. The interest rates on the debt with Philip

Morris were established at market rates available to Philip Morris

at the time of issuance for similar debt with matching maturities.

However, the $5.0 billion remaining long-term note payable to Philip

Morris has no prepayment penalty, and the Company may repay

some or all of the note with the proceeds from external debt

offerings in the current low interest rate environment.

In addition, the accounts of the Company are included in the

consolidated federal income tax return of Philip Morris. To the

extent that foreign tax credits, capital losses and other credits

generated by the Company, which cannot be utilized on a stand-

alone basis, are utilized in Philip Morris’ consolidated federal income

tax return, the benefit is recognized in the Company’s calculation

of its provision for income taxes. The Company’s provisions for

income taxes for the years ended December 31, 2001, 2000 and

1999 were lower than provisions calculated on a stand-alone basis

by $185 million, $139 million and $107 million, respectively.

The preparation of all financial statements includes the use of

estimates and assumptions that affect a number of amounts

included in the Company’s financial statements, including, among

other things, employee benefit costs and related disclosures,

inventories under the last-in-first-out (“LIFO”) method, marketing

costs (advertising, consumer incentives and trade promotions),

environmental costs and income taxes. The Company bases its

estimates on historical experience and other assumptions which it

believes are reasonable. If actual amounts are ultimately different

from previous estimates, the revisions are included in the

Company’s results for the period in which the actual amounts

become known. Historically, the aggregate differences, if any,

between the Company’s estimates and actual amounts in any year

have not had a significant impact on the Company’s consolidated

financial statements.

Business Environment

The Company is subject to fluctuating commodity costs, currency

movements and competitive challenges in various product

categories and markets, including a trend toward increasing

consolidation in the retail trade and consequent inventory reductions

and changing consumer preferences. Certain competitors may have

different profit objectives and some international competitors may

be less susceptible to currency exchange rates. To confront these

challenges, the Company continues to take steps to build the value

of its brands and improve its food business portfolio with new

products and marketing initiatives.

Fluctuations in commodity costs can cause retail price volatility,

intensify price competition and influence consumer and trade

buying patterns. KFNA’s and KFI’s businesses are subject to

fluctuating commodity costs, including dairy, coffee bean and

cocoa costs. Dairy commodity costs on average have been higher

in 2001 than those seen in 2000. Cocoa bean prices have also

been higher, while coffee bean prices have been lower than in

2000. During the latter part of 2000 and into 2001, energy costs

rose in response to higher prices charged for oil and natural gas.

However, this increase in energy costs did not have a material

adverse effect on the operating results of the Company.