Kraft 2001 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2001 Kraft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Kraft Foods Inc.

44

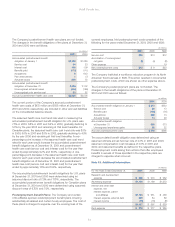

During 2001, the FASB issued SFAS No. 141, “Business

Combinations” and SFAS No. 142, “Goodwill and Other Intangible

Assets.” Effective January 1, 2002, the Company will no longer be

required to amortize indefinite life goodwill and intangible assets as

a charge to earnings. In addition, the Company will be required to

conduct an annual review of goodwill and other intangible assets

for potential impairment. The Company estimates that net

earnings and diluted earnings per share (“EPS”) would have been

approximately $2,839 million and $1.76, respectively, for the year

ended December 31, 2001; $2,531 million and $1.74, respectively, for

the year ended December 31, 2000; and $2,287 million and $1.57,

respectively, for the year ended December 31, 1999, had the

provisions of the new standards been applied in those years. The

Company does not currently anticipate having to record a charge

to earnings for the potential impairment of goodwill or other

intangible assets as a result of adoption of these new standards.

Marketing costs: The Company promotes its products with

significant marketing activities, including advertising, consumer

incentives and trade promotions. Advertising costs are expensed

as incurred. Consumer incentive and trade promotion activities are

recorded as expense based on amounts estimated as being due to

customers and consumers at the end of a period, based principally

on the Company’s historical utilization and redemption rates.

Revenue recognition: The Company recognizes operating

revenue upon shipment of goods when title and risk of loss pass to

customers. The Company classifies shipping and handling costs

as part of cost of sales.

The Emerging Issues Task Force (“EITF”) issued EITF Issue

No. 00-14, “Accounting for Certain Sales Incentives” and EITF

Issue No. 00-25, “Vendor Income Statement Characterization of

Consideration Paid to a Reseller of the Vendor’s Products.” As a

result, certain items previously included in marketing, administration

and research costs on the consolidated statement of earnings will

either be recorded as a reduction of operating revenues or as an

increase in cost of sales. These EITF Issues will be effective in the

first quarter of 2002. The Company estimates that adoption of

EITF Issues No. 00-14 and No. 00-25 will result in a reduction of

operating revenues in 2001, 2000 and 1999 of approximately

$4.6 billion, $3.6 billion and $3.4 billion, respectively. Marketing,

administration and research costs will decline in 2001, 2000 and

1999 by approximately $4.7 billion, $3.7 billion and $3.4 billion,

respectively, while cost of sales will increase by an insignificant

amount. The adoption of these EITF Issues will have no impact

on net earnings or basic and diluted EPS.

Hedging instruments: Effective January 1, 2001, the Company

adopted SFAS No. 133, “Accounting for Derivative Instruments and

Hedging Activities,” and its related amendment, SFAS No. 138,

“Accounting for Certain Derivative Instruments and Certain Hedging

Activities” (collectively referred to as “SFAS No. 133”). These

standards require that all derivative financial instruments be

recorded on the consolidated balance sheets at their fair value as

either assets or liabilities. Changes in the fair value of derivatives

are recorded each period in earnings or accumulated other

comprehensive losses, depending on whether a derivative is

designated and effective as part of a hedge transaction and, if it

is, the type of hedge transaction. Gains and losses on derivative

instruments reported in accumulated other comprehensive losses

are included in earnings in the periods in which earnings are

affected by the hedged item. As of January 1, 2001, the adoption

of these new standards did not have a material effect on net

earnings (less than $1 million) or accumulated other comprehensive

losses (less than $1 million).

Stock-based compensation: The Company accounts for

employee stock compensation plans in accordance with the

intrinsic value-based method permitted by SFAS No. 123,

“Accounting for Stock-Based Compensation,” which does not

result in compensation cost.

Income taxes: The Company accounts for income taxes in

accordance with SFAS No. 109, “Accounting for Income Taxes.” The

accounts of the Company are included in the consolidated federal

income tax return of Philip Morris. Income taxes are generally

computed on a separate company basis. To the extent that foreign

tax credits, capital losses and other credits generated by the

Company, which cannot be utilized on a separate company basis,

are utilized in Philip Morris’ consolidated federal income tax return,

the benefit is recognized in the calculation of the Company’s

provision for income taxes. The Company’s provisions for income

taxes included in the consolidated statements of earnings for the

years ended December 31, 2001, 2000 and 1999 were lower than

provisions calculated on a separate return basis by $185 million,

$139 million and $107 million, respectively. The Company makes

payments to, or is reimbursed by, Philip Morris for the tax effects

resulting from its inclusion in Philip Morris’ consolidated federal

income tax return.

Software costs: The Company capitalizes certain computer

software and software development costs incurred in connection

with developing or obtaining computer software for internal use.

Capitalized software costs, which are not significant, are amortized

on a straight-line basis over the estimated useful lives of the

software, which do not exceed five years.

Foreign currency translation: The Company translates the

results of operations of its foreign subsidiaries using average

exchange rates during each period, whereas balance sheet

accounts are translated using exchange rates at the end of each

period. Currency translation adjustments are recorded as a

component of shareholders’ equity. Transaction gains and losses

for all periods presented were not significant.

Environmental costs: The Company is subject to laws and

regulations relating to the protection of the environment. The

Company provides for expenses associated with environmental

remediation obligations when such amounts are probable and can

be reasonably estimated. Such accruals are adjusted as new

information develops or circumstances change.