JetBlue Airlines 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

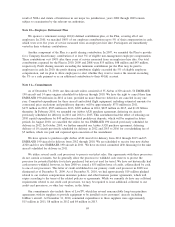

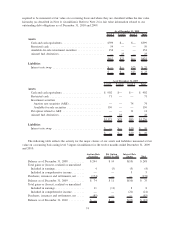

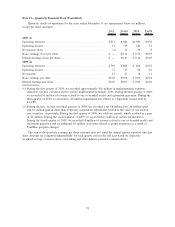

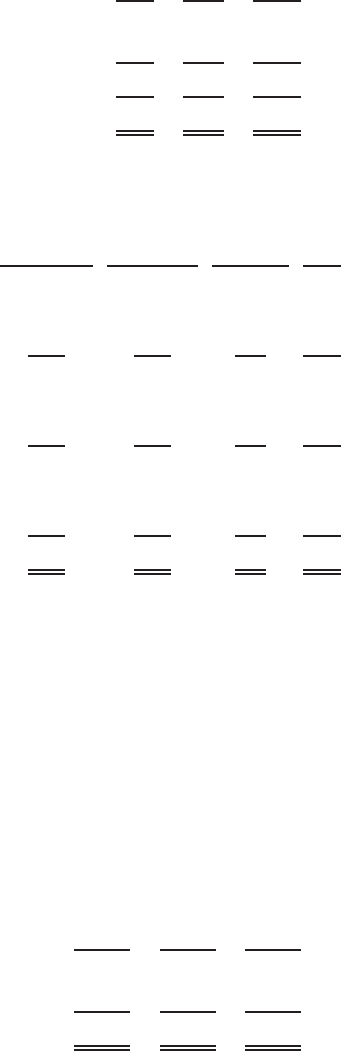

Note 15—Comprehensive Income (Loss)

Comprehensive income (loss) includes changes in fair value of our aircraft fuel derivatives and interest

rate swap agreements, which qualify for hedge accounting. The differences between net income (loss) and

comprehensive income (loss) for the years ended December 31, are as follows (in millions):

2010 2009 2008

Net income (loss) ............................................ $97 $ 61 $ (84)

Gain (loss) on derivative instruments (net of $7, $54, and $68 of taxes) .... (11) 85 (103)

Total other comprehensive income (loss) ......................... (11) 85 (103)

Comprehensive income (loss) .................................. $86 $146 $(187)

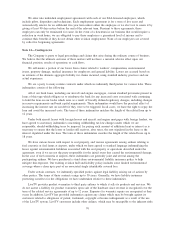

A rollforward of the amounts included in accumulated other comprehensive income (loss), net of taxes

for the years ended December 31, 2008, 2009, and 2010 is as follows (in millions):

Aircraft Fuel

Derivatives

Interest Rate

Swaps

Investment

Securities Total

Beginning accumulated gains (losses), at December 31, 2007 ... $19 $— $— $19

Reclassifications into earnings .......................... (31) — 8 (23)

Change in fair value .................................. (65) (7) (8) (80)

Balance of accumulated gains (losses), at December 31, 2008 . . . (77) (7) — (84)

Reclassifications into earnings .......................... 72 3 — 75

Change in fair value .................................. 12 (2) — 10

Balance of accumulated gains (losses), at December 31, 2009 ... 7 (6) — 1

Reclassifications into earnings .......................... 3 5 — 8

Change in fair value .................................. (6) (13) — (19)

Ending accumulated gains (losses), at December 31, 2010 ...... $ 4 $(14) $— $(10)

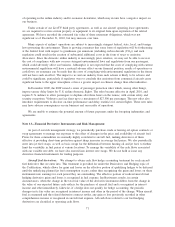

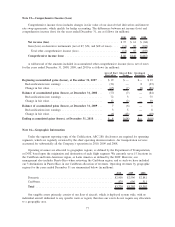

Note 16—Geographic Information

Under the segment reporting topic of the Codification, ASC 280, disclosures are required for operating

segments, which are regularly reviewed by the chief operating decision makers. Air transportation services

accounted for substantially all the Company’s operations in 2010, 2009 and 2008.

Operating revenues are allocated to geographic regions, as defined by the Department of Transportation,

or DOT, based upon the origination and destination of each flight segment. We currently serve 15 locations in

the Caribbean and Latin American region, or Latin America as defined by the DOT. However, our

management also includes Puerto Rico when reviewing the Caribbean region, and as such we have included

our 3 destinations in Puerto Rico in our Caribbean allocation of revenues. Operating revenues by geographic

regions for the years ended December 31 are summarized below (in millions):

2010 2009 2008

Domestic .............................................. $2,900 $2,596 $2,881

Caribbean .............................................. 879 696 511

Total ................................................. $3,779 $3,292 $3,392

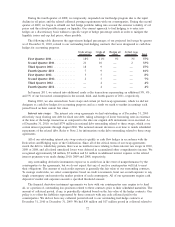

Our tangible assets primarily consist of our fleet of aircraft, which is deployed system wide, with no

individual aircraft dedicated to any specific route or region; therefore our assets do not require any allocation

to a geographic area.

77