JetBlue Airlines 2010 Annual Report Download - page 66

Download and view the complete annual report

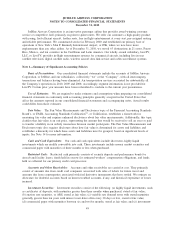

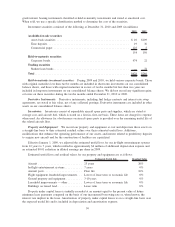

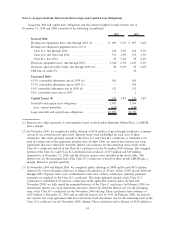

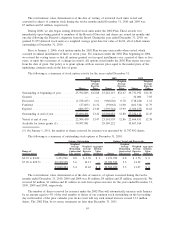

Please find page 66 of the 2010 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.series of the 5.5% Debentures. The total net proceeds of the offering were approximately $165 million,

after deducting underwriting fees and other transaction related expenses as well as the $32 million escrow

deposit. Interest on the 5.5% Debentures is payable semi-annually on April 15 and October 15.

Holders of the Series A 5.5% Debentures may convert them into shares of our common stock at any time

at a conversion rate of 220.6288 shares per $1,000 principal amount of Series A 5.5% Debenture. Holders

of the Series B 5.5% Debentures may convert them into shares of our common stock at any time at a

conversion rate of 225.2252 shares per $1,000 principal amount of Series B 5.5% Debenture. The

conversion rates are subject to adjustment should we declare common stock dividends or effect any

common stock splits or similar transactions. If the holders convert the 5.5% Debentures in connection with

any fundamental corporate change that occurs prior to October 15, 2013 for the Series A 5.5% Debentures

or October 15, 2015 for the Series B 5.5% Debentures, the applicable conversion rate may be increased

depending upon our then current common stock price. The maximum number of shares of common stock

into which all of the 5.5% Debentures are convertible, including pursuant to this make-whole fundamental

change provision, is 54.4 million shares. Holders who convert their 5.5% Debentures prior to April 15,

2011 will receive, in addition to the number of shares of our common stock calculated at the applicable

conversion rate, a cash payment from the escrow account for the 5.5% Debentures of the series converted

equal to the sum of the remaining interest payments that would have been due on or before April 15, 2011

in respect of the converted 5.5% Debentures.

We may redeem any of the 5.5% Debentures for cash at a redemption price of 100% of their principal

amount, plus accrued and unpaid interest at any time on or after October 15, 2013 for the Series A

5.5% Debentures and October 15, 2015 for the Series B 5.5% Debentures. Holders may require us to

repurchase the 5.5% Debentures for cash at a repurchase price equal to 100% of their principal amount

plus accrued and unpaid interest, if any, on October 15, 2013, 2018, 2023, 2028, and 2033 for the

Series A 5.5% Debentures and October 15, 2015, 2020, 2025, 2030, and 2035 for the Series B

5.5% Debentures; or at any time prior to their maturity upon the occurrence of a specified designated

event.

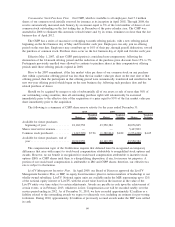

On June 4, 2008, in conjunction with the public offering of the 5.5% Debentures described above, we also

entered into a share lending agreement with Morgan Stanley & Co. Incorporated, an affiliate of the

underwriter of the offering, or the share borrower, pursuant to which we loaned the share borrower

approximately 44.9 million shares of our common stock. Under the share lending agreement, the share

borrower is required to return the borrowed shares when the debentures are no longer outstanding. We did

not receive any proceeds from the sale of the borrowed shares by the share borrower, but we did receive a

nominal lending fee of $0.01 per share from the share borrower for the use of borrowed shares.

We evaluated the various embedded derivatives within the supplemental indenture for bifurcation from the

5.5% Debentures under the applicable provisions of the Codification. Based upon our detailed assessment,

we concluded these embedded derivatives were either (i) excluded from bifurcation as a result of being

clearly and closely related to the 5.5% Debentures or are indexed to our common stock and would be

classified in stockholders’ equity if freestanding or (ii) the fair value of the embedded derivatives was

determined to be immaterial.

The net proceeds from our public offering of the 5.5% Debentures described above were used for the

repurchase of substantially all of our $175 million principal amount of 3.5% convertible notes due 2033,

issued in July 2003, which became subject to repurchase at the holders’ option on July 15, 2008.

During 2008, approximately $76 million principal amount of the 5.5% Debentures were voluntarily

converted by holders. As a result, we issued 16.9 million shares of our common stock. Cash payments

from the escrow accounts related to these conversions were $11 million and borrowed shares equivalent to

the number of shares of our common stock issued upon these conversions were returned to us pursuant to

the share lending agreement described above. During 2009, approximately $3 million principal amount of

the 5.5% Debentures were voluntarily converted by holders into approximately 0.6 million shares of our

common stock. The borrower returned 10.0 million shares to us in September 2009, almost all of which

were voluntarily returned shares in excess of converted shares, pursuant to the share lending agreement. At

December 31, 2010, the remaining principal balance was $123 million, which is currently convertible into

57