JetBlue Airlines 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At December 31, 2010, 60 of the 160 aircraft we operated were leased under operating leases, with

remaining lease term expiration dates ranging from 2011 to 2026. We had one additional aircraft under an

operating lease at December 31, 2010, which was not yet placed in service. As of December 31, 2010, five of

our aircraft lease terms were scheduled to expire within 18 months, including one EMBRAER 190 aircraft in

2011 and four Airbus A320 in 2012. Five of the 61 aircraft operating leases have variable rate rent payments

based on LIBOR. Leases for 53 of our aircraft can generally be renewed at rates based on fair market value at

the end of the lease term for one or two years. We have purchase options in 45 of our aircraft leases at the

end of the lease term at fair market value and a one-time option during the term at fixed amounts that were

expected to approximate fair market value at lease inception.

We executed a supplement to our Terminal 5 lease with the Port Authority of New York and New Jersey,

or PANYNJ, which was effective in December 2010. Under this supplement, we will lease the 19.35 acre

portion of JFK known as Terminal 6, which is adjacent to our current facility at Terminal 5. We are

responsible for the demolishing, and related activities, of the existing Terminal 6 passenger terminal buildings,

the costs of which will be reimbursed by the PANYNJ. We intend to use Terminal 6 primarily for maintaining,

deicing, and parking aircraft during the term. As part of the lease supplement, we have committed to ground

rental payments for Terminal 6 over the five year term, which are non-cancelable and included in the table

below.

In March 2010, we announced we will be combining our Darien, CT and Forest Hills, NY corporate

offices and relocating to a new corporate headquarters in Long Island City, NY. In September 2010, we

executed a lease for our new corporate headquarters in Long Island City for a 12 year term. Rental payments

begin in 2012 and are included in the table below.

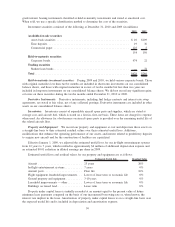

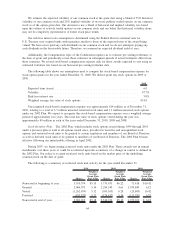

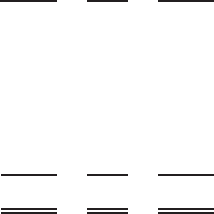

Future minimum lease payments under noncancelable operating leases, including those described above,

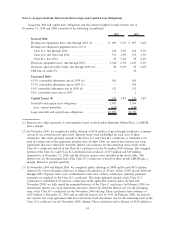

with initial or remaining terms in excess of one year at December 31, 2010, are as follows (in millions):

Aircraft Other Total

2011............................................ $ 160 $ 54 $ 214

2012............................................ 141 50 191

2013............................................ 119 45 164

2014............................................ 128 37 165

2015............................................ 137 33 170

Thereafter ........................................ 473 378 851

Total minimum operating lease payments................. $1,158 $597 $1,755

We have entered into sale-leaseback arrangements with a third party lender for 45 of our operating

aircraft, including one executed in 2008, in which there were no material deferred gains recorded. The sale-

leasebacks occurred simultaneously with the delivery of the related aircraft to us from their manufacturers.

Each sale-leaseback transaction was structured with a separate trust set up by the third party lender, the assets

of which consist of the one aircraft initially transferred to it following the sale by us and the subsequent lease

arrangement with us. Because of their limited capitalization and the potential need for additional financial

support, these trusts are variable interest entities as defined in the Consolidations topic of the Codification and

must be considered for consolidation in our financial statements. Our assessment of each trust considers both

quantitative and qualitative factors, including whether we have the power to direct the activities and to what

extent we participate in the sharing of benefits and losses of the trusts. JetBlue does not retain any equity

interests in any of these trusts and our obligations to them are limited to the fixed rental payments we are

required to make to them, which were approximately $1.10 billion as of December 31, 2010 and are reflected

in the future minimum lease payments in the table above. Our only interest in these entities are the purchase

options to acquire the aircraft as specified above. Since there are no other arrangements (either implicit or

explicit) between us and the individual trusts that would result in our absorbing additional variability from the

trusts, we concluded that we are not the primary beneficiary of these trusts. We account for these leases as

operating leases, following the appropriate lease guidance as required by the Leases topic in the Codification.

60