JetBlue Airlines 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We record impairment losses on long-lived assets used in operations when events and circumstances

indicate that the assets may be impaired and the undiscounted future cash flows estimated to be generated by

the assets are less than the assets’ net book value. If impairment occurs, the loss is measured by comparing

the fair value of the asset to its carrying amount. Impairment losses are recorded in depreciation and

amortization expense. In 2008, we recorded an impairment loss of $8 million related to the write-off of our

temporary terminal facility at JFK.

In 2009, we sold two aircraft, which resulted in gains totaling $1 million. In 2008, we sold nine aircraft,

which resulted in gains totaling $23 million. The gains on our sales of aircraft are included in other operating

expenses.

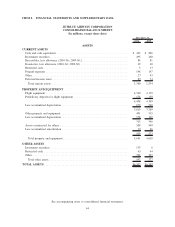

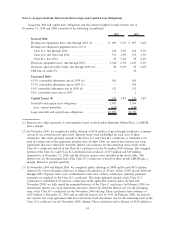

Software: We capitalize certain costs related to the acquisition and development of computer software.

We amortize these costs using the straight-line method over the estimated useful life of the software, which is

generally between five and ten years. The net book value of computer software, which is included in other

assets on our consolidated balance sheets, was $46 million and $30 million at December 31, 2010 and 2009,

respectively. Amortization expense related to computer software was $13 million, $14 million and $8 million

for the years ended December 31, 2010, 2009 and 2008, respectively. Amortization expense related to

computer software is expected to be approximately $9 million in 2011, $8 million in 2012, $7 million in 2013,

$6 million in 2014, and $5 million in 2015.

Intangible Assets: Intangible assets consist of acquired take-off and landing slots at certain domestic

slot-controlled airports. We record these assets at cost and amortize them on a straight-line basis over their

expected useful lives. As of December 31, 2010, the cost and accumulated amortization of intangible assets

recorded was not material, and are included in other long term assets in our consolidated balance sheet. We

periodically evaluate these intangible assets for impairment; however we have not recorded any impairment

losses to date through December 31, 2010.

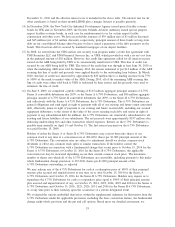

Intangible assets also include an indefinite lived asset related to an air-to-ground spectrum license

acquired by LiveTV in 2006 at a public auction from the Federal Communications Commission for

approximately $7 million. In September 2010, we determined this spectrum license had been impaired as

further discussed in Note 14, which resulted in a loss of approximately $5 million being recorded in other

operating expenses during 2010, with approximately $2 million remaining in other long term assets related to

this license as of December 31, 2010.

Passenger Revenues: Passenger revenue is recognized, net of the taxes that we are required to collect

from our customers, including federal transportation taxes, security taxes and airport facility charges, when the

transportation is provided or after the ticket or customer credit (issued upon payment of a change fee) expires.

Tickets sold but not yet recognized as revenue and unexpired credits are included in air traffic liability.

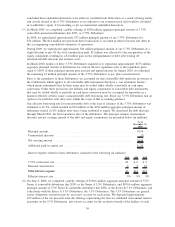

Loyalty Program: We account for our customer loyalty program, TrueBlue, by recording a liability for

the estimated incremental cost of providing transportation for outstanding points earned from JetBlue

purchases that we expect to be redeemed. We adjust this liability, which is included in air traffic liability,

based on points earned and redeemed, changes in the estimated incremental costs associated with providing

travel and changes in the TrueBlue program.

Points in TrueBlue are also sold to participating companies, including credit card and car rental

companies. These sales are accounted for as multiple-element arrangements, with one element representing the

travel that will ultimately be provided when the points are redeemed and the other consisting of marketing

related activities that we conduct with the participating company. The fair value of the transportation portion

of these point sales is deferred and recognized as passenger revenue when transportation is provided. The

marketing portion, which is the excess of the total sales proceeds over the estimated fair value of the

transportation to be provided, is recognized in other revenue when the points are sold.

TrueBlue points not redeemed are recognized as revenue when they expire. The terms of expiration of

points under our original loyalty program were modified with the launch of a new version of TrueBlue in

2009. We recorded $15 million and $13 million in revenue for point expirations in 2009 and 2010,

respectively.

51