JetBlue Airlines 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating Revenues. Operating revenues decreased 3%, or $100 million, primarily due to a 4% decrease

in passenger revenues. The $126 million decrease in passenger revenues was attributable to a 4% decrease in

yield over 2008 and a 0.7 point decrease in load factor on relatively flat capacity, offset by increases in fees

from our Even More Legroom optional upgrade product, which we introduced in mid-2008.

Other revenues increased 8%, or $26 million, primarily due to higher excess baggage revenue of

$18 million resulting from the introduction of the second checked bag fee in June 2008 and increased rates for

these and other ancillary services during 2009. Other revenue also increased due to additional LiveTV third-

party revenues as a result of additional third party aircraft installations, and higher concession revenues from

our new terminal at JFK, partially offset by a reduction in charter revenue.

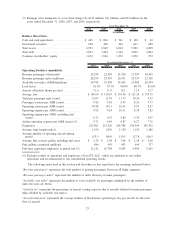

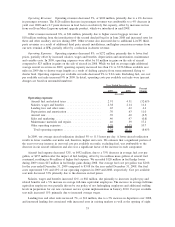

Operating Expenses. Operating expenses decreased 8%, or $272 million, primarily due to lower fuel

prices, partially offset by increased salaries, wages and benefits, depreciation and amortization, maintenance

and variable costs. In 2009, operating expenses were offset by $1 million in gains on the sale of aircraft

compared to $23 million in gains on the sale of aircraft in 2008. While we had on average eight additional

average aircraft in service in 2009, operating capacity increased less than 1% to 32.56 billion available seat

miles in 2009 due to shorter stage lengths as a result of shifting capacity from transcontinental flying to

shorter haul. Operating expenses per available seat mile decreased 9% to 9.24 cents. Excluding fuel, our cost

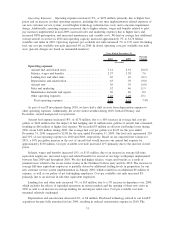

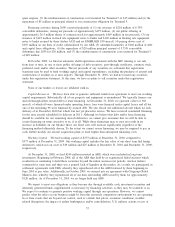

per available seat mile increased 9% in 2009. In detail, operating costs per available seat mile were (percent

changes are based on unrounded numbers):

2009 2008

Percent

Change

Year Ended December 31,

(in cents)

Operating expenses:

Aircraft fuel and related taxes ...................... 2.91 4.31 (32.6)%

Salaries, wages and benefits ....................... 2.38 2.14 11.4

Landing fees and other rents ....................... .65 .62 6.4

Depreciation and amortization ...................... .70 .63 11.0

Aircraft rent ................................... .39 .40 (2.5)

Sales and marketing ............................. .46 .47 (0.8)

Maintenance materials and repairs ................... .46 .39 17.2

Other operating expenses.......................... 1.29 1.15 10.7

Total operating expenses ........................ 9.24 10.11 (8.6)%

In 2009, our average aircraft utilization declined 5% to 11.5 hours per day. A lower aircraft utilization

results in fewer available seat miles and, therefore, higher unit costs. We estimate that a significant portion of

the year-over-year increase in our total cost per available seat mile, excluding fuel, was attributable to the

decrease in our aircraft utilization and also was a significant factor of the increase in each component.

Aircraft fuel expense decreased 32%, or $452 million, due to a 33% decrease in average fuel cost per

gallon, or $457 million after the impact of fuel hedging, offset by two million more gallons of aircraft fuel

consumed, resulting in $6 million of higher fuel expense. We recorded $120 million in fuel hedge losses

during 2009 versus $47 million in fuel hedge gains during 2008. Our average fuel cost per gallon was $2.08

for the year ended December 31, 2009 compared to $3.08 for the year ended December 31, 2008. Our fuel

costs represented 31% and 43% of our operating expenses in 2009 and 2008, respectively. Cost per available

seat mile decreased 33% primarily due to the decrease in fuel prices.

Salaries, wages and benefits increased 12%, or $82 million, due primarily to increases in pilot pay and

related benefits and a 5% increase in average full-time equivalent employees. The increase in average full-time

equivalent employees was partially driven by our policy of not furloughing employees and additional staffing

levels in preparation for our new customer service system implementation in January 2010. Cost per available

seat mile increased 11% primarily due to increased average wages.

Landing fees and other rents increased 7%, or $14 million, due to a 5% increase in departures over 2008,

and increased landing fees associated with increased rates in existing markets as well as the opening of eight

33